Ripple Effects of Token Unlocks to the scheduled release of tokens that were previously restricted by vesting periods, lockups, or smart contract conditions. Projects typically design their token distribution to release only a fraction of the total supply at launch, preserving the remainder for stakeholders who contribute to the project’s development, investment, or long-term growth. These stakeholders often include core team members, early investors, ecosystem partners, and the broader community participating in staking or incentivized programs.

Teams implement vesting schedules not only to prevent earlyRipple Effects of Token Unlocks dumping but also to ensure long-term alignment between insiders and the market. When team members cannot immediately sell their allocations, it demonstrates a commitment to building real value over time. Similarly, early investors are often subject to lockups that discourage short-term speculation and encourage strategic participation in the project’s evolution. As a result, token unlocks are not random events; they are deliberate mechanisms designed to support a stable environment for both development and investment.

How Token Unlocks Influence Price Action in the Altcoin Arena

Ripple Effects of Token Unlocks When new supply enters circulation, the immediate effect is often a shift in market dynamics. An increase in supply without a corresponding rise in demand can lead to downward price pressure. This is why many traders monitor unlock schedules closely, as these events frequently coincide with heightened volatility. In some cases, prices begin to decline even before the unlock occurs, simply because traders anticipate potential selling from recipients of the newly Ripple Effects of Token Unlocks .Liquidity plays a crucial role in determining how dramatic the price reaction will be. Tokens with high liquidity and deep order books, often supported by strong market maker activity, can absorb the impact of unlocks more smoothly.

In contrast, low-liquidity altcoins experience sharper movements because even moderate selling can create significant downward pressure. The relationship between unlock size, liquidity availability, and daily trading volume often determines whether the event causes a mild correction or a sudden price crash.However, it is important to note that not all Ripple Effects of Token Unlocks lead to negative outcomes. In cases where the project is gaining adoption, unveiling new products, or maintaining strong community engagement, increased supply may be met with healthy demand. Sometimes, unlocks can even stimulate positive movement by providing tokens needed for liquidity pools, ecosystem expansion, or strategic partnerships.

Market Sentiment, Investor Psychology, and the Narrative of Token Unlocks

In the altcoin arena, where emotional trading often overshadows logic, token Ripple Effects of Token Unlocks hold significant psychological power. Many traders react instinctively to the idea of increased supply, fearing that early holders or insiders may take profits and leave the project vulnerable. This fear can spread quickly through social media discussions, fueling FUD, or fear, uncertainty, and doubt. When sentiment becomes negative, traders often exit positions prematurely, triggering additional selling pressure.Yet token unlocks are not inherently negative. The market often reacts based on narrative rather than reality. When a project communicates transparently about its unlock schedule and demonstrates responsible token management,

the broader community may interpret unlocks as signs of growth and maturity. For example, if team members continue holding their tokens even after they become liquid, investors may view this as an expression of long-term confidence. Similarly, if a project uses unlocked tokens to support development or deepen liquidity, the unlock may be seen as beneficial rather than threatening.Investor psychology plays a profound role in shaping how the market absorbs these events. Traders who understand the context behind unlocks are less likely to panic and more likely to identify real opportunities amid temporary volatility. In many cases, the emotional reaction surrounding the event has a greater impact on price than the unlock itself.

Tokenomics Design and the Role of Unlock Structure

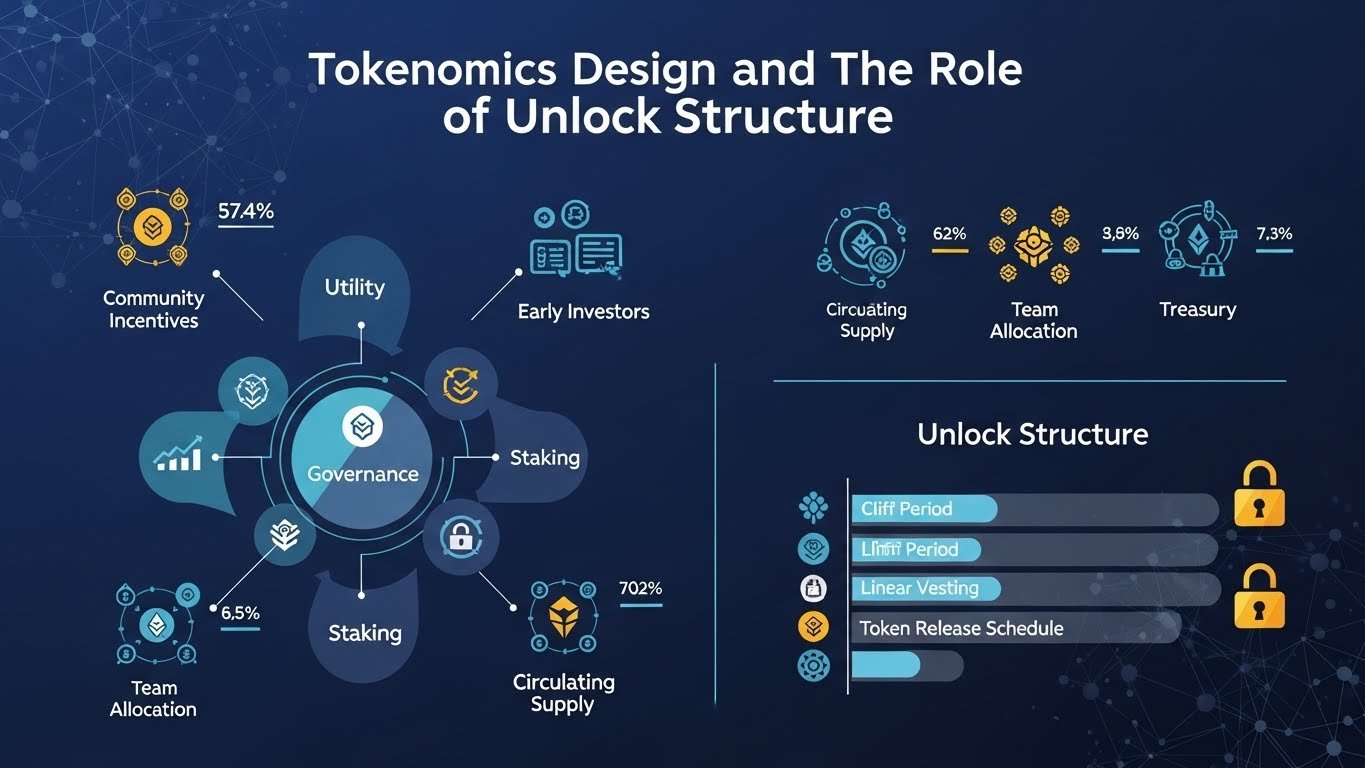

Token Ripple Effects of Token Unlocks are only one component of a project’s broader tokenomics design. The allocation of tokens across team members, investors, community rewards, and ecosystem development determines how the project balances short-term activity with long-term sustainability. A project that concentrates too much supply in the hands of insiders risks repeated periods of selling pressure that undermine market confidence. In contrast, a well-distributed token model fosters fairness, stability, and ongoing engagement from new and existing holders.

The structure of Ripple Effects of Token Unlocks also plays a crucial role. Many projects implement linear vesting models, where tokens are released gradually over time. This approach minimizes sudden shocks to the market and allows traders to adapt to new supply conditions more easily. Others employ cliff unlocks, where large amounts of tokens become available all at once after an initial waiting period. Cliff events can create intense volatility because they introduce significant uncertainty about how recipients will behave once they receive their tokens.Long-term investors often prefer projects with transparent, predictable, and evenly paced unlock schedules because these models reduce the risk of abrupt price movements. Clarity and fairness in tokenomics contribute to a healthier and more resilient market environment, giving investors greater confidence in their long-term participation.

Strategies Traders Use to Navigate Token Unlock Events

Experienced traders treat token Ripple Effects of Token Unlocksas important catalysts that can influence both short-term opportunities and long-term positioning. Rather than reacting emotionally, they study unlock calendars, estimate the potential impact on supply, and examine historical patterns for similar events. When the unlock represents a large percentage of the circulating supply or is scheduled during a period of weak market sentiment, traders may choose to reduce exposure to manage risk. Conversely, when unlocks occur during strong bullish periods or coincide with major project developments, traders may anticipate renewed interest and favorable price action.

Some traders observe that Ripple Effects of Token Unlocks -related dips can create opportunities for re-accumulation once the initial selling subsides. This approach requires patience and careful analysis of post-unlock market behavior. Others focus on liquidity conditions and prefer to enter or exit positions when trading volume is supportive enough to minimize slippage. The key to navigating token unlocks effectively lies in understanding both the mechanics of supply release and the emotional reactions that often accompany these events.

Long-Term Perspective: How Unlocks Reflect Project Strength or Weakness

While traders often view token Ripple Effects of Token Unlocks through a short-term lens, long-term investors interpret them as indicators of a project’s internal structure and commitment to sustainability. Unlock schedules reveal how the project plans to grow its ecosystem, fund development, and reward contributors over time. When vesting periods are thoughtfully designed and strategically aligned with roadmap milestones, they demonstrate a project’s dedication to building real utility and value.

Long-term investors also analyze whether team members retain their tokens after vesting periods. Continued holding may indicate genuine belief in the project’s future, whereas rapid selling can raise concerns about the team’s confidence or intentions. In addition, investors look closely at how the project uses newly unlocked tokens. Tokens directed toward partnerships, liquidity provisioning, or ecosystem expansion tend to strengthen a project’s foundation, while tokens distributed without clear justification may undermine trust.

Ultimately, the broader market context influences how unlocks are interpreted. In bullish environments, unlocks may be absorbed quickly with minimal negative impact. In bearish markets, even small unlocks can trigger heightened anxiety and exaggerated price moves. A long-term view allows investors to evaluate unlock events within the larger cycle rather than reacting to short-term noise.

Transparency, Communication, and Reputation: The Soft Power of Token Unlocks

Beyond supply mechanics and price effects, token Ripple Effects of Token Unlocks carry a powerful reputational component. A project’s willingness to communicate openly about upcoming unlocks significantly influences how investors perceive the team’s professionalism and integrity. Projects that clearly publish vesting schedules, provide regular reminders, and explain the purpose behind unlocks tend to foster stronger trust.

The opposite is also true. When unlocks occur without prior notice, or when information about token distribution is difficult to find, investors may question the transparency of the project. Negative experiences surrounding Ripple Effects of Token Unlocks events can create long-lasting skepticism that affects future adoption and investment interest.The crypto market, particularly the altcoin sector, has a long memory. Projects that manage unlocks responsibly often maintain stronger reputations, while those associated with sudden dumps or opaque practices struggle to regain investor confidence. Trust, once lost, is difficult to rebuild, which is why communication about tokenomics and unlock schedules is essential.

Conclusion

Token Ripple Effects of Token Unlocks are far more than isolated events; they are structural components of the altcoin ecosystem that influence everything from price action and liquidity to investor psychology and project reputation. Understanding token unlocks equips traders and investors with a powerful tool for evaluating risk, timing market entries, and assessing the long-term viability of crypto projects.By analyzing the percentage of tokens entering circulation, the identity of the recipients, the broader tokenomics design, and the project’s communication strategy,

market participants can form a more informed perspective on how Ripple Effects of Token Unlocks may impact the token’s trajectory. In a landscape where volatility is the norm and narratives shift rapidly, awareness of token unlock dynamics enhances both short-term decision-making and long-term conviction.Token unlocks will continue to shape the altcoin arena, influencing investor behavior and project development for years to come. Approaching them with clarity, discipline, and strategic insight transforms these potentially disruptive events into opportunities for growth and deeper understanding of the crypto market.

FAQs

Q: Do token unlocks always lead to a price drop?

Token unlocks hamesha price girawat ka sabab nahi bante. Unka asar liquidity, Ripple Effects of Token Unlocks size, market sentiment, aur recipients ke selling behavior par depend karta hai. Kuch cases mein, market strong ho to unlocks ka price par bohot kam negative impact hota hai.

Q: How can I track upcoming token unlock events?

Aksar projects apne official tokenomics documents, whitepapers, aur websites par vesting schedules share karte hain. Kuch third-party analytics platforms bhi token unlock calendars maintain karte hain. Hamesha official sources se cross-check karna behtar hota hai.

Q: Why do projects use token lockups for teams and investors?

Token lockups long-term alignment ke liye hote hain. Yeh ensure karte hain ke team members aur early investors launch ke turant baad selling na karein. Iss se market stability barqarar rehti hai aur project ki growth ko sustainable foundation milta hai.

Q: What is the difference between linear vesting and cliff unlocks?

Linear vesting tokens ko dheere dheere release karta hai, jisse market par supply pressure evenly distribute hota hai. Cliff Ripple Effects of Token Unlocks aik specific date par bohot large amount ek hi dafa release kar dete hain, jo zyada volatility aur uncertainty create kar sakte hain.

Q: How should traders respond to large upcoming unlocks?

Traders aksar Ripple Effects of Token Unlocks size, liquidity conditions, aur market sentiment ko analyze karte hain. Kuch log major unlocks se pehle exposure kum kar lete hain, jabke kuch traders unlock ke baad potential dip ko buying opportunity ke taur par dekhte hain. Strategy hamesha personal risk tolerance aur project ke fundamentals par depend karti hai.