Ethereum Price Today ETF Outflows The cryptocurrency market continues to face headwinds as Ethereum price today experiences renewed pressure following substantial institutional withdrawal activity. On Wednesday, December 17, 2025, Ethereum’s spot price dropped to approximately $2,822, representing a steep 4.4% decline from the previous session’s close. This downward movement comes as ETF outflows have dominated market sentiment for four consecutive trading days, creating a challenging environment for the second-largest cryptocurrency by market capitalization.

Ethereum Price Today ETF Outflows The current price action reflects a significant shift in institutional sentiment that has unfolded throughout mid-December. After briefly touching an intraday high near $3,024 during early Asian trading hours, Ethereum encountered aggressive selling pressure that pushed the digital asset down to a session low of approximately $2,793. This volatility pattern underscores the fragile state of market confidence as year-end approaches and institutional investors reassess their cryptocurrency exposure amid broader macroeconomic uncertainty.

The Current Ethereum ETF Outflows Crisis

The institutional landscape for Ethereum has undergone a dramatic transformation in recent trading sessions. According to data from Farside Investors and SoSoValue, U.S. spot Ethereum ETFs recorded a staggering $224.9 million in net outflows on December 16. Ethereum Price Today ETF Outflows This marked the fourth consecutive day of withdrawals from these investment vehicles, creating mounting pressure on spot market dynamics and contributing directly to the price weakness observed across cryptocurrency exchanges globally.

Ethereum Price Today ETF Outflows BlackRock’s iShares Ethereum Trust emerged as the epicenter of this redemption wave. On December 16 alone, BlackRock accounted for roughly $221.3 million of that total, marking one of the largest single-day withdrawals in recent weeks. Ethereum Price Today ETF Outflows The concentration of outflows within BlackRock’s flagship product raises important questions about the nature of this selling pressure and whether it represents tactical repositioning by sophisticated institutional investors or a more fundamental reassessment of Ethereum’s near-term prospects.

Technical Analysis Key Support and Resistance Levels for Ethereum Price

Ethereum Price Today ETF Outflows technical structure for Ethereum price today has deteriorated significantly as the digital asset fails to maintain critical support zones that previously acted as demand areas during prior consolidation phases. Ethereum Price Today ETF Outflows current price action around $2,822 places Ethereum in a precarious technical position, trapped between weakening momentum indicators and increasingly bearish chart patterns that suggest further downside risk remains elevated unless buyers can mount a convincing defense of current levels.

Based on today’s classical pivot point with the value of $2,944.19, Ethereum has support levels of $2,910.65, $2,856.90, and the strongest at $2,823.37, while resistance levels are at $2,997.94, $3,031.48, and $3,085.23. These pivot-derived levels provide valuable reference points for intraday traders seeking to identify potential turning points and areas where order flow concentrations may trigger reversals or accelerations in prevailing trends.

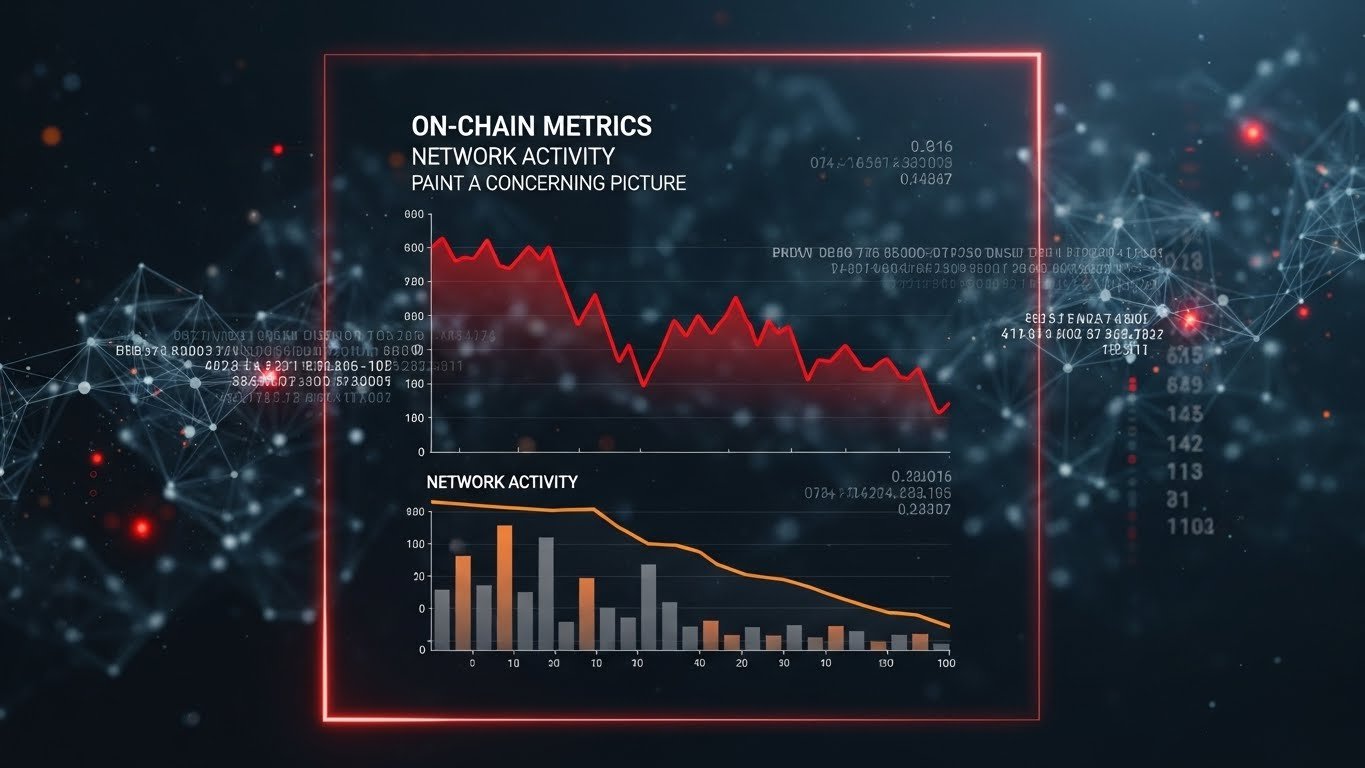

On-Chain Metrics and Network Activity Paint a Concerning Picture

Ethereum Price Today ETF Outflows Beyond price action and technical analysis, blockchain data provides valuable insight into the underlying health of the Ethereum ecosystem and the genuine demand dynamics that will ultimately determine medium-term price trajectory. Recent metrics paint a sobering picture of declining network engagement that aligns uncomfortably with the bearish price action and institutional withdrawal patterns observed in Ethereum ETF outflows.

Active address counts have experienced a sharp contraction throughout December. FXStreet cites a sharp December drop in weekly active addresses, from approximately 440,000 to approximately 324,000, levels last seen in May. This 26% decline in network participation over such a compressed timeframe raises questions about user engagement and suggests that speculative interest in Ethereum-based applications and protocols has cooled significantly as price momentum has deteriorated.

The Fusaka Upgrade Long-Term Bullish Catalyst Overshadowed by Short-Term Weakness

Ethereum Price Today ETF Outflows While near-term price action and institutional flows present significant headwinds, Ethereum’s fundamental development roadmap continues to advance with major technical milestones that could reshape the network’s capabilities and competitive positioning. The Fusaka upgrade, which activated on December 3, 2025, represents one of the most significant protocol improvements in Ethereum’s history, though its immediate price impact has been overwhelmed by broader market weakness and Ethereum price today ETF outflows.

Historical precedent suggests that major Ethereum upgrades rarely produce immediate and sustained price appreciation. Ethereum Price Today ETF Outflows The Shanghai upgrade in April 2023, which enabled staked ETH withdrawals, initially triggered concerns about selling pressure that proved largely unfounded but didn’t immediately catalyze a strong rally. Similarly, the Dencun upgrade in March 2024 introduced blob functionality that has proven transformative for Layer 2 economics but took months to translate into meaningful price appreciation as the market gradually recognized its implications.

Institutional Perspective Why Smart Money Is Stepping Back

The magnitude and timing of recent Ethereum ETF outflows invite deeper examination of the institutional reasoning behind these redemptions. Understanding why sophisticated capital allocators are reducing exposure provides valuable context for individual investors attempting to assess whether current price weakness represents a buying opportunity or the beginning of a more extended consolidation period.

One contributing factor appears to be broad-based deleveraging across risk assets as macro uncertainty intensifies heading into year-end. Federal Reserve policy expectations have oscillated between scenarios of continued rate cuts and potentially extended higher-for-longer positioning, creating uncertainty that encourages institutional investors to reduce exposure to higher-beta assets.

Market Sentiment and Trader Positioning Fear Dominates as Year-End Approaches

Sentiment indicators across cryptocurrency markets reflect the defensive positioning and negative outlook that has characterized December trading. The Crypto Fear and Greed Index, which aggregates multiple market factors to gauge overall investor psychology, has declined substantially from the optimism witnessed in November following Donald Trump’s presidential election victory and the initial wave of post-election cryptocurrency enthusiasm.

Social media analysis and trading forum discussions reveal widespread frustration among retail investors who had anticipated that spot ETF approvals would create sustained institutional buying pressure that would drive prices significantly higher throughout 2025. The reality of persistent Ethereum ETF outflows during Q4 has challenged these assumptions and forced many market participants to recalibrate expectations about the pace and magnitude of institutional adoption.

Price Forecast and Strategic Considerations for December and Beyond

Analyzing the confluence of technical factors, on-chain metrics, institutional flows, and sentiment indicators allows for construction of probability-weighted scenarios that can inform trading and investment decisions. While all forecasting contains inherent uncertainty, especially in cryptocurrency markets known for their volatility, the current setup suggests several distinct paths that Ethereum price today might follow over the coming weeks.

The base case scenario involves continued consolidation in the $2,750 to $3,000 range as the market digests recent weakness and awaits catalysts that might shift the prevailing negative sentiment. This outcome assumes that ETF outflows moderate as tax-loss harvesting completes and institutional positioning stabilizes, while technical support zones in the high $2,700s attract sufficient buying interest to prevent cascade breakdowns.

Conclusion

The current challenges facing Ethereum price today reflect a complex interplay of institutional positioning dynamics, technical deterioration, and sentiment shifts that have created a difficult environment for bulls. The persistence of ETF outflows through four consecutive trading days, culminating in the substantial $224.9 million redemption on December 16, represents a meaningful headwind that has contributed directly to price weakness and created overhang that must be absorbed before sustained recovery becomes possible.

Technical analysis indicates that Ethereum remains trapped in a clear downtrend structure characterized by lower highs and lower lows, with price trading below all major moving averages and hugging the lower Bollinger Band. Critical support exists in the $2,750 to $2,850 zone, while meaningful resistance extends from $2,980 up through $3,140, creating a well-defined range within which price is likely to oscillate until a decisive breakout or breakdown occurs.