Cardano 4x Potential How High Can ADA Price Climb This Year Cardano still has 4x potential as altcoins begin the road to recovery, and this statement is gaining renewed attention as the broader crypto market shows signs of stabilization and cautious optimism. After a prolonged period of bearish sentiment, shrinking liquidity, and shaken investor confidence, many altcoins are starting to regain momentum. Among them, Cardano stands out not just because of its strong community, but due to its methodical development approach, expanding ecosystem, and long-term vision for blockchain scalability and decentralization.

The question investors are now asking is simple but critical: how high can ADA price climb this year? While short-term price action is often driven by speculation, long-term valuation depends on fundamentals, network growth, and broader market cycles. Cardano has historically lagged during hype-driven rallies but often gains strength when markets begin to mature and refocus on real utility. As altcoins slowly recover alongside improving macro conditions, Cardano’s position in the market deserves a closer, more nuanced analysis.

We explores whether Cardano still has 4x potential, what factors could drive ADA price higher, and how realistic different price scenarios are in the current market environment. By examining technology, adoption, investor psychology, and historical cycles, we can better understand how high ADA price could climb this year without falling into unrealistic hype.

Cardano’s Position in the Altcoin Market

Cardano occupies a unique place in the altcoin ecosystem. Unlike many projects that prioritize rapid deployment and aggressive marketing, Cardano has followed a research-driven and peer-reviewed development model. This approach has often drawn criticism during bull markets, where speed and narrative dominate price action, but it has also earned Cardano a reputation for resilience and technical rigor.

As altcoins begin the road to recovery, investors are increasingly looking beyond short-term speculation. Cardano’s focus on blockchain scalability, security, and sustainability aligns well with this shift. ADA is not just another token competing for attention; it is the fuel behind a growing smart contract ecosystem that aims to support decentralized applications, identity solutions, and financial infrastructure at a global scale.

When evaluating whether Cardano still has 4x potential, it is important to recognize that ADA’s valuation has historically lagged behind its technological milestones. This gap between development progress and market pricing is one reason many analysts believe ADA may be undervalued relative to its long-term prospects.

Cardano 4x Potential

Altcoin recovery rarely happens in isolation. It is typically tied to broader crypto market cycles, especially Bitcoin’s behavior and overall liquidity conditions. As Bitcoin stabilizes after periods of volatility, capital often flows into established altcoins with strong fundamentals. This rotation is a recurring pattern across multiple market cycles.

Cardano still has 4x potential largely because it sits at the intersection of maturity and growth. It is no longer an experimental project, yet it has not fully realized its adoption potential. As altcoins begin the road to recovery, investors tend to favor networks that survived previous downturns and continued building during bearish phases. Cardano fits this profile well, having maintained consistent development activity even during market lows.

Market psychology also plays a role. When confidence returns, investors often revisit projects they believe were left behind or unfairly discounted. ADA’s previous all-time high creates a psychological anchor, making a multi-x recovery seem plausible if conditions align.

Cardano’s Technology and Why It Matters for Price

At the core of Cardano’s long-term value proposition is its technology. The network is built on a proof-of-stake consensus mechanism that emphasizes energy efficiency and decentralization. This design choice positions Cardano favorably in an era where environmental concerns and regulatory scrutiny are increasingly important.

Cardano’s smart contract capabilities have expanded significantly, enabling developers to build decentralized applications across finance, gaming, and governance. While adoption has been slower compared to some competitors, the emphasis on formal verification and security reduces the risk of catastrophic failures. For investors evaluating whether Cardano still has 4x potential, this focus on reliability is a critical factor.

Technology alone does not drive price, but it creates the foundation for sustainable growth. As more applications launch and user activity increases, demand for ADA as a network utility token may rise, supporting higher valuations over time.

Ecosystem Growth and Real-World Use Cases

One of the most important drivers of ADA price is ecosystem growth. Cardano’s network now supports decentralized exchanges, lending protocols, NFT platforms, and identity solutions. While these sectors are still developing, they represent meaningful steps toward real-world adoption.

Cardano still has 4x potential if its ecosystem continues to mature and attract developers and users. Unlike speculative narratives that rely on future promises, ecosystem growth can be measured through on-chain activity, transaction volumes, and total value locked. These indicators provide insight into whether Cardano is transitioning from a development-focused network to a usage-driven platform.

Real-world partnerships also strengthen the case for long-term growth. Cardano’s work in digital identity and infrastructure solutions, particularly in emerging markets, highlights its ambition to solve practical problems beyond trading and speculation. This broader vision differentiates ADA from many altcoins whose use cases remain narrowly focused.

ADA Price History and Key Lessons From Past Cycles

To understand how high ADA price can climb this year, it is useful to examine its historical performance. Cardano has experienced dramatic price swings across previous cycles, rising sharply during periods of widespread optimism and correcting heavily during downturns. These movements reflect both market-wide forces and project-specific narratives.

One key lesson from ADA’s history is that its strongest rallies often occur later in the cycle, after foundational upgrades and ecosystem milestones are completed. This pattern supports the argument that Cardano still has 4x potential if the broader market enters a sustained recovery phase.

However, history also shows that ADA is not immune to overvaluation and sharp corrections. This reinforces the importance of realistic expectations and disciplined risk management when considering upside scenarios.

On-Chain Metrics and Network Activity Trends

On-chain data provides valuable insights into the health of the Cardano network. Metrics such as active addresses, transaction counts, and staking participation reveal whether user engagement is growing. A steady increase in these indicators suggests organic adoption rather than speculative churn.

Cardano’s staking model encourages long-term holding, which can reduce circulating supply pressure during recovery phases. High staking participation reflects confidence in the network and aligns incentives between users and validators. This structural feature supports the idea that Cardano still has 4x potential under favorable market conditions.

As altcoins begin the road to recovery, on-chain trends often precede price movements. Sustained growth in network activity can signal underlying demand that eventually translates into higher valuations.

Developer Activity and Innovation Pace

Developer activity is another critical factor in assessing long-term potential. Cardano consistently ranks highly in terms of development commits and research output. This ongoing innovation ensures that the network remains competitive as the blockchain landscape evolves.

Cardano still has 4x potential because development is not stagnant. Improvements in scalability, interoperability, and tooling make the platform more attractive to builders. Over time, a richer developer ecosystem can lead to more applications, users, and demand for ADA.

While markets may overlook developer metrics during speculative phases, they become increasingly relevant during recovery periods when investors seek durable value rather than hype-driven gains.

Market Sentiment and Investor Confidence

Sentiment plays a powerful role in determining how high ADA price can climb. After prolonged bearish conditions, even modest positive developments can shift narratives quickly. As confidence returns, investors often re-enter positions they believe offer asymmetric upside.

Cardano still has 4x potential partly because sentiment toward ADA remains cautious rather than euphoric. This lack of extreme optimism suggests that much of the upside is not yet priced in. When sentiment transitions from skepticism to cautious optimism, prices can move rapidly.

However, sentiment is a double-edged sword. Negative news or broader market shocks can quickly reverse gains. Understanding this dynamic helps investors contextualize price targets within realistic risk frameworks.

Comparing Cardano to Other Major Altcoins

Relative valuation is an important consideration. When compared to other major smart contract platforms, Cardano often appears undervalued based on market capitalization versus development progress. Some competitors command higher valuations despite similar or lesser levels of decentralization and research rigor.

This comparative gap supports the thesis that Cardano still has 4x potential, especially if the market begins to reward fundamentals more consistently. As altcoins recover, capital allocation decisions increasingly favor networks with long-term viability rather than short-lived trends.

That said, competition remains intense. Cardano must continue executing its roadmap effectively to maintain relevance and capture market share in a crowded ecosystem.

Macroeconomic Factors Influencing ADA Price

Broader economic conditions also influence crypto markets. Interest rates, inflation expectations, and global liquidity shape investor risk appetite. As macro uncertainty stabilizes, speculative assets like cryptocurrencies often benefit from renewed capital inflows.

Cardano still has 4x potential if macro conditions support a broader risk-on environment. While crypto remains volatile, improving economic clarity can create tailwinds for high-quality altcoins. ADA’s relatively strong fundamentals position it to benefit from such shifts, provided investor confidence continues to recover.

Macroeconomic factors do not guarantee price increases, but they set the stage upon which market narratives unfold.

Realistic Price Scenarios for ADA This Year

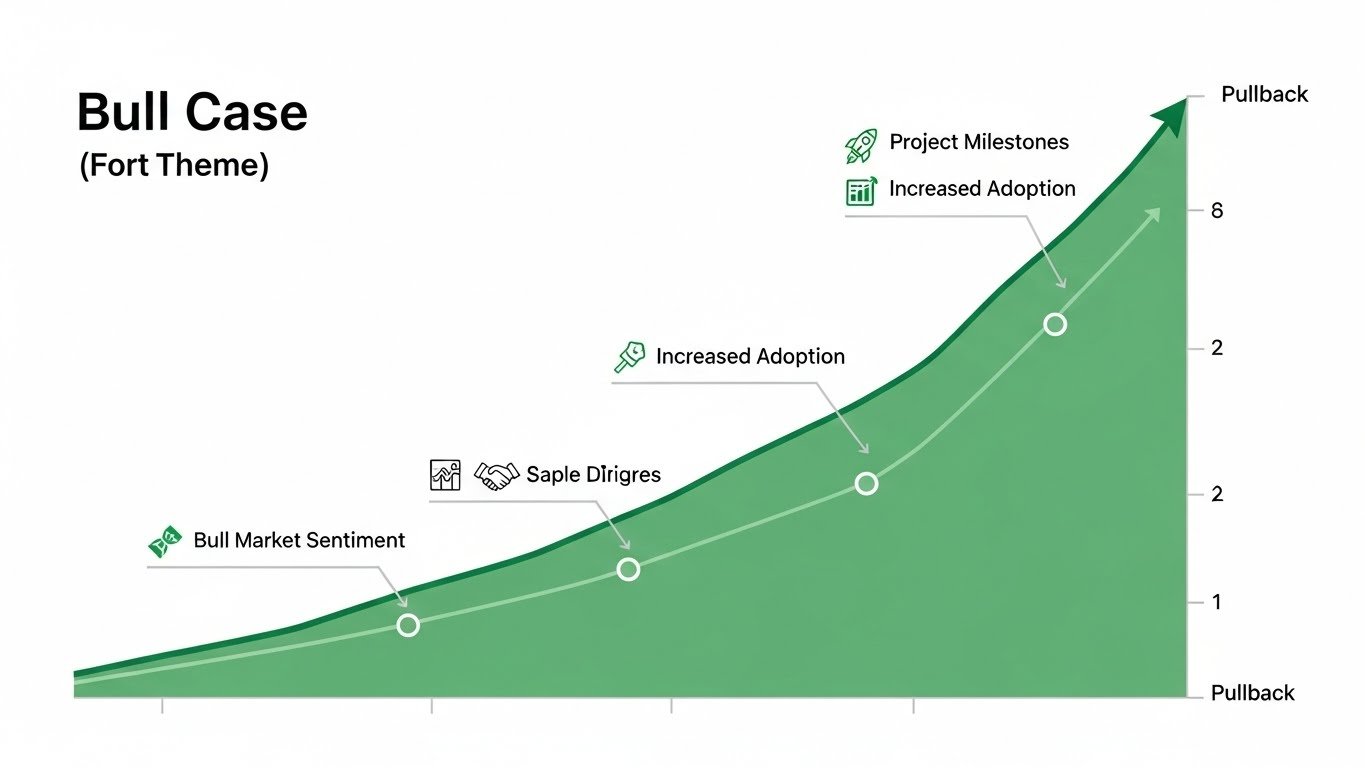

Speculating on exact price targets is inherently uncertain, but scenario analysis provides a useful framework. In a conservative recovery scenario, ADA may reclaim key resistance levels as ecosystem growth and sentiment improve. In a more optimistic scenario, renewed interest in altcoins could drive prices toward previous cycle highs.

The idea that Cardano still has 4x potential does not imply inevitability. It represents a possibility contingent on multiple variables aligning, including market conditions, adoption growth, and execution. Investors should view upside projections as ranges rather than guarantees.

Understanding these scenarios helps set balanced expectations and avoid emotional decision-making driven by hype or fear.

Risks and Challenges That Could Limit Upside

No analysis is complete without addressing risks. Cardano faces challenges related to adoption speed, competition, and regulatory uncertainty. Slow onboarding of developers or users could limit demand for ADA, even if the technology is sound.

Market-wide risks also remain. Sudden downturns, liquidity shocks, or negative regulatory developments could derail recovery narratives. While Cardano still has 4x potential, downside risks must be acknowledged to maintain a realistic perspective.

Balancing optimism with caution is essential in a market as dynamic as crypto.

Long-Term Outlook Beyond This Year

Looking beyond the current year, Cardano’s long-term outlook depends on its ability to transition from promise to widespread usage. The foundations are in place, but sustained adoption will determine whether ADA becomes a cornerstone of decentralized infrastructure or remains a niche platform.

Cardano still has 4x potential in the near to medium term, but its ultimate value proposition extends far beyond short-term price targets. For long-term participants, understanding this broader vision is key to navigating volatility with confidence.

Conclusion

Cardano still has 4x potential as altcoins begin the road to recovery, but realizing that potential depends on a combination of fundamentals, market cycles, and sentiment shifts. ADA’s strong technological foundation, consistent development, and growing ecosystem provide a compelling case for long-term relevance. As confidence gradually returns to the altcoin market, Cardano may benefit from renewed attention and capital inflows.

However, how high ADA price can climb this year remains uncertain and highly dependent on external conditions. Rather than focusing solely on optimistic targets, investors should consider Cardano’s progress, risks, and broader market dynamics. In doing so, they can better assess whether ADA’s recovery is driven by substance or speculation, and position themselves accordingly.

FAQs

Q: Why do analysts believe Cardano still has 4x potential?

Analysts point to Cardano’s relatively low valuation compared to its development progress, strong staking participation, and expanding ecosystem. These factors suggest that ADA may be undervalued if broader market conditions improve.

Q: How does altcoin recovery impact ADA price specifically?

Altcoin recovery typically brings renewed liquidity and investor interest. As capital rotates from Bitcoin into established altcoins, projects like Cardano with strong fundamentals often benefit from increased demand.

Q: What role does Cardano’s technology play in its price outlook?

Cardano’s proof-of-stake design, focus on security, and scalable architecture create a foundation for long-term adoption. While technology alone does not drive price, it supports sustainable growth over time.

Q: Are there risks that could prevent ADA from reaching higher prices this year?

Yes, risks include slow adoption, intense competition from other smart contract platforms, regulatory uncertainty, and broader market volatility. These factors could limit upside even if fundamentals remain strong.

Q: Is Cardano better suited for long-term or short-term investors?

Cardano is generally considered more suitable for long-term participants who value steady development and ecosystem growth. Short-term price movements can be volatile, making patience and risk management especially important.