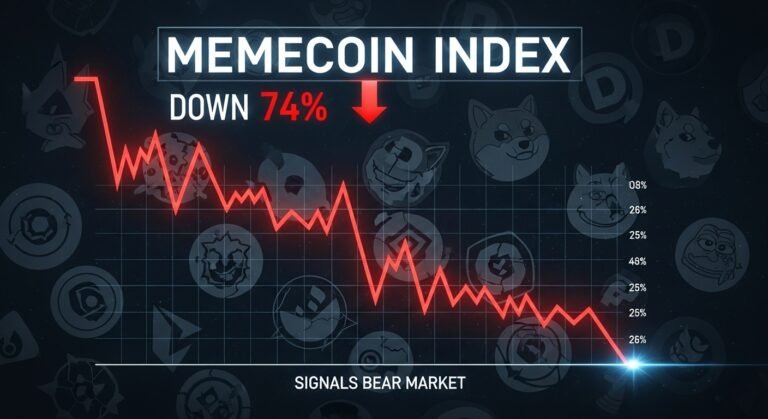

Memecoin Index Signals Bear Market: Down 74% in the Past Year the world of cryptocurrency is often associated with volatility, sudden surges, and equally rapid declines. However, recent developments have underscored the harsh realities of the market, particularly in the memecoin sector. The memecoin index, which tracks the performance of popular meme-based cryptocurrencies, has plummeted by 74% over the past year, painting a stark picture for investors who rode the hype wave. This decline has triggered debates about the sustainability of memecoins and whether the exuberance surrounding these digital assets was ever justified.

Unlike more established cryptocurrencies like Bitcoin and Ethereum, memecoins often rely on social media momentum, celebrity endorsements, and viral marketing rather than fundamental value. As a result, they are particularly vulnerable to market sentiment, and the recent downturn in the memecoin index reflects a growing caution among investors. Understanding this crash requires an examination of broader market trends, investor behavior, and the psychological factors that drive crypto speculation.

Memecoin Index Signals Bear Market Down 74%

The memecoin index serves as a benchmark for evaluating the overall performance of meme-based cryptocurrencies. These are digital tokens primarily created for entertainment purposes or as social experiments, often inspired by internet culture, jokes, or viral memes. While some memecoins achieve massive short-term popularity, their long-term value is often untested.

Over the past year, the memecoin index has shown a consistent downward trend. This 74% decline highlights that many memecoins failed to retain investor interest after the initial hype faded. Factors contributing to this downturn include market saturation, a lack of real-world utility, and regulatory uncertainties. Unlike major cryptocurrencies, memecoins rarely offer technological innovation, making them highly dependent on speculative demand.

The index’s decline is a reminder that crypto markets are not immune to corrections. While memecoins can skyrocket in a matter of days due to viral attention, the absence of intrinsic value often results in steep losses when hype diminishes. This reinforces the notion that investors need to evaluate risk versus reward carefully, especially in highly speculative markets.

Factors Driving the Memecoin Market Decline

Several factors have contributed to the memecoin index’s dramatic fall. The first is the overall bear market in the cryptocurrency space. Over the past year, broader crypto market sentiment has shifted as investors contend with rising interest rates, economic uncertainty, and increasing scrutiny from regulators. These conditions have reduced appetite for speculative assets like memecoins, leading to significant sell-offs.

Another critical factor is the inflation of memecoin supply. Many memecoins are launched without strict limits on token creation, resulting in oversupply and diminishing value. When the initial buzz wears off, investors are left with a large pool of tokens that no longer hold the same speculative appeal. This creates a downward spiral that amplifies losses in the memecoin index.

Finally, social media and hype-driven trends, while initially advantageous, have proven volatile. Memecoins often experience rapid surges when a celebrity or influencer mentions them, but this effect is fleeting. Once public attention shifts, prices can collapse just as quickly. The 74% drop in the memecoin index illustrates how psychological factors and social sentiment dominate this market segment.

Comparing Memecoins to Traditional Cryptocurrencies

While the memecoin index has fallen dramatically, established cryptocurrencies like Bitcoin and Ethereum have displayed more resilience. These major cryptocurrencies benefit from technological advancements, institutional adoption, and use cases that extend beyond speculative trading. For example, Ethereum’s smart contract ecosystem continues to grow despite market fluctuations, offering tangible value to developers and investors alike.

Memecoins, in contrast, lack such infrastructure. Their value is heavily tied to community engagement and viral trends, making them highly unpredictable. This difference is crucial for investors to understand. While memecoins can deliver spectacular short-term gains, they also carry extreme risk. The memecoin index’s recent performance underscores this reality, demonstrating that reliance on hype without fundamentals can lead to substantial losses.

Implications for Investors

The collapse of the memecoin index has several implications for both retail and institutional investors. First, it highlights the importance of diversification. Relying solely on memecoins for portfolio growth can be perilous, particularly in bear markets. Investors should balance their exposure to speculative assets with more stable cryptocurrencies or traditional investments.

Second, the decline emphasizes the need for due diligence. Understanding the fundamentals behind any memecoin, including its supply structure, community engagement, and long-term prospects, can mitigate losses. Blindly following trends or social media hype is a strategy fraught with risk, as evidenced by the 74% drop in the index.

Finally, this downturn may encourage the market to mature. Investors are increasingly seeking memecoins that offer utility or innovation rather than mere entertainment value. This shift could lead to a new phase in the memecoin market, where only those projects with sustainable communities and real-world applications survive.

Lessons from the Memecoin Market Collapse

The memecoin index’s decline offers several lessons for crypto enthusiasts. One key takeaway is that market psychology plays a central role in price movements, particularly for assets without intrinsic value. Understanding sentiment trends, hype cycles, and social dynamics is essential for navigating the memecoin market.

Another lesson is the importance of risk management. Investors must recognize that high-reward speculative assets can deliver equally high losses. Using strategies like portfolio diversification, position sizing, and stop-loss orders can reduce exposure to sudden downturns.

Lastly, the crash underscores the potential for market correction. While memecoins can appear to defy logic during bull runs, reality eventually asserts itself. The 74% decline serves as a cautionary tale, reminding investors to approach high-volatility assets with skepticism and careful planning.

The Future of Memecoins

Despite the severe downturn, the memecoin market is not necessarily doomed. Memecoins have repeatedly demonstrated resilience, bouncing back after periods of decline due to renewed hype or innovative iterations. The key to long-term success may lie in integrating utility, gamification, or community-driven mechanisms that extend beyond simple meme culture.

Emerging trends indicate that some memecoins are experimenting with NFT integrations, decentralized finance features, and blockchain-based rewards systems. These innovations could provide tangible value to holders, making them less susceptible to purely speculative swings. If executed effectively, these developments might stabilize the memecoin index and attract a more cautious, long-term investor base.

However, the market will likely continue to experience extreme volatility. Investors should remain aware that memecoins will probably remain high-risk, high-reward assets, and the lessons from the 74% decline should guide future investment decisions.

Conclusion

The 74% decline in the memecoin index over the past year is a stark reminder of the inherent volatility and risks of speculative cryptocurrency markets. While memecoins capture the imagination and excitement of the public, their lack of intrinsic value and dependence on social hype make them vulnerable to severe downturns. Investors must approach this market with caution, emphasizing diversification, due diligence, and risk management.

Looking ahead, the memecoin market may evolve, incorporating utility and innovation to attract more sustainable investment. Until then, the index’s performance serves as a cautionary tale for those chasing viral trends without understanding the fundamentals of crypto investing.

Q: Why has the memecoin index fallen by 74% in the past year, and what does this indicate for investors?

The memecoin index has fallen primarily due to declining market sentiment, over-saturation of new tokens, and the fleeting nature of hype-driven investments. This 74% drop signals that speculative assets without intrinsic value are highly vulnerable in bear markets, and investors should be cautious about overexposure to memecoins.

Q: How do memecoins differ from major cryptocurrencies like Bitcoin and Ethereum in terms of market stability?

Memecoins rely heavily on social hype and viral trends, whereas major cryptocurrencies like Bitcoin and Ethereum have technological foundations, institutional support, and real-world applications. This difference makes memecoins far more volatile, as demonstrated by the memecoin index’s steep decline.

Q: What lessons can investors learn from the memecoin market crash and how can they protect their portfolios?

Investors can learn the importance of diversification, careful risk management, and due diligence. Protecting portfolios involves balancing high-risk assets like memecoins with more stable investments, analyzing token fundamentals, and avoiding decisions driven solely by social media trends.

Q: Is there potential for recovery in the memecoin market despite recent losses, and what factors could drive a rebound?

Recovery is possible if memecoins integrate utility, decentralized finance features, or community-driven mechanisms that go beyond mere entertainment. Renewed social attention, strategic innovation, and increased adoption could stabilize prices and attract long-term investors, potentially reversing the downward trend.

Q: Should new investors consider entering the memecoin market after such a severe decline, and what strategies can minimize risk?

New investors can enter cautiously, but they should focus on tokens with clear value propositions, sustainable communities, and transparent supply mechanisms. Minimizing risk involves diversification, investing only what one can afford to lose, and avoiding hype-driven decisions without research.