Pi Network Bank Driving a Human-Centric Crypto Revolution the cryptocurrency industry has long promised financial freedom, decentralization, and borderless transactions. Yet, for many everyday users, the reality has often felt complex, technical, and intimidating. Amid volatile markets, complicated wallets, and unfamiliar blockchain terminology, millions remain hesitant to participate in digital finance. This is where Pi Network Bank emerges as a transformative concept, positioning itself at the intersection of accessibility, innovation, and community empowerment.

Unlike traditional crypto projects that prioritize technical sophistication over user experience, Pi Network Bank focuses on a human-centric model. The goal is not just to build another digital asset platform, but to reimagine what banking could look like in a decentralized era. By blending blockchain technology, decentralized finance, and a community-driven ecosystem, Pi Network Bank is working to redefine financial inclusion on a global scale.

In this in-depth article, we will explore how Pi Network Bank is pioneering a new financial revolution in crypto, examine its core features, analyze its broader economic implications, and understand why its people-first philosophy could reshape the future of digital banking.

Pi Network Bank Driving a Human-Centric Crypto

The vision of Pi Network Bank goes beyond simple cryptocurrency transactions. At its core, it represents a movement toward democratized finance. Traditional banking systems have historically excluded large portions of the global population due to geographic, economic, or bureaucratic barriers. Crypto aimed to solve this, but high entry costs, energy-intensive mining, and complex user interfaces often created new barriers.

Pi Network Bank addresses these challenges by prioritizing accessibility. Built upon the broader ecosystem of Pi Network, the initiative focuses on enabling users to participate in the digital economy through simple mobile-based engagement. Instead of requiring expensive mining rigs or advanced technical knowledge, the system was designed to allow individuals to earn and interact with cryptocurrency through everyday devices.

This human-centric model shifts the narrative from speculation to participation. Rather than framing cryptocurrency solely as an investment vehicle, Pi Network Bank encourages users to view it as a practical tool for daily financial activities. This subtle but powerful shift is central to its revolutionary potential.

The Human-Centric Philosophy in Crypto Banking

The phrase human-centric is often used in technology marketing, but in the case of Pi Network Bank, it represents a structural design principle. The system emphasizes trust, security, ease of use, and community governance.

Accessibility Through Mobile-First Innovation

One of the defining aspects of Pi Network Bank is its mobile-first approach. While many crypto platforms began with desktop interfaces catering to tech-savvy traders, Pi Network Bank leverages smartphone accessibility to reach users worldwide. This aligns with the reality that billions of people globally rely on mobile devices as their primary gateway to the internet.

By simplifying onboarding and verification processes, the platform lowers the psychological barrier that often discourages new users from entering the digital banking ecosystem. Accessibility here is not just about technology; it is about empowerment.

Community Governance and Decentralization

Another pillar of the human-centric model is decentralization. In traditional banks, decision-making power is concentrated among executives and shareholders. In contrast, Pi Network Bank draws inspiration from decentralized governance frameworks where community participation shapes the ecosystem’s development.

This community-driven approach builds trust. When users feel ownership in a system, they are more likely to contribute to its stability and growth. Pi Network Bank’s reliance on distributed consensus mechanisms reinforces this participatory culture while maintaining network security.

Bridging the Gap Between Traditional Banking and Crypto

The emergence of Pi Network Bank signals an attempt to bridge two worlds: the regulated, structured environment of traditional banking and the innovative, borderless realm of cryptocurrency.

Reimagining Financial Services

Traditional banks offer loans, savings accounts, payment processing, and investment services. Pi Network Bank aims to replicate and modernize these services within a decentralized framework. By integrating smart contracts, peer-to-peer transactions, and blockchain-based recordkeeping, the system aspires to deliver familiar financial tools without centralized intermediaries.

This hybrid model could create a smoother transition for individuals hesitant to fully embrace decentralized finance. Instead of abandoning traditional structures entirely, Pi Network Bank adapts them into a blockchain-compatible format.

Enhancing Financial Inclusion

Financial inclusion remains one of the biggest promises of crypto. Billions of individuals remain unbanked due to lack of identification, credit history, or geographic access. Pi Network Bank’s emphasis on mobile participation and simplified onboarding addresses these challenges directly.

By removing the need for expensive infrastructure, the platform expands opportunities for people in developing economies. This inclusive strategy strengthens the narrative of a crypto banking revolution that serves not just investors, but communities.

Security and Trust in a Decentralized Era

Security concerns have long plagued the cryptocurrency space. High-profile hacks, scams, and exchange collapses have undermined public confidence. For Pi Network Bank to truly lead a financial revolution, trust must be foundational.

Consensus Mechanisms and Network Integrity

Pi Network Bank leverages a consensus algorithm designed to maintain network integrity without excessive energy consumption. This approach reflects growing awareness of sustainability within the crypto sector.

Unlike proof-of-work systems that demand massive computational power, Pi’s model emphasizes efficiency and scalability. By reducing environmental impact, Pi Network Bank aligns itself with the broader movement toward responsible blockchain innovation.

Transparent Ecosystem Development

Transparency plays a crucial role in fostering trust. A human-centric financial system must provide clarity regarding governance, token economics, and security protocols. By maintaining open communication with its community, Pi Network Bank strengthens user confidence and reinforces its commitment to long-term stability.

Economic Implications of a Human-Centric Crypto Bank

The potential economic impact of Pi Network Bank extends beyond individual users. If successfully implemented, it could reshape how digital assets interact with real-world economies.

Token Utility and Real-World Integration

For any cryptocurrency to achieve sustainable growth, it must offer genuine utility. Pi Network Bank emphasizes token utility, encouraging real-world transactions rather than purely speculative trading.

This shift could stabilize token value over time. When users adopt a cryptocurrency for payments, savings, or remittances, demand becomes rooted in functionality. Such practical integration differentiates Pi Network Bank from projects that rely heavily on hype cycles.

Encouraging Localized Digital Economies

Another transformative possibility lies in localized digital economies. Communities using Pi-based financial tools could establish internal marketplaces, fostering economic resilience. This decentralized economic model reduces dependency on centralized institutions and enhances community autonomy.

The Role of Technology in the Financial Revolution

Behind the human-centric philosophy lies sophisticated technological architecture. Blockchain, cryptographic security, and distributed networks form the backbone of Pi Network Bank’s operations.

Scalability and Network Growth

Scalability remains a major challenge in cryptocurrency systems. As user bases expand, networks must handle increased transaction volumes without sacrificing speed or security. Pi Network Bank’s infrastructure is designed with long-term scalability in mind, supporting global adoption without bottlenecks.

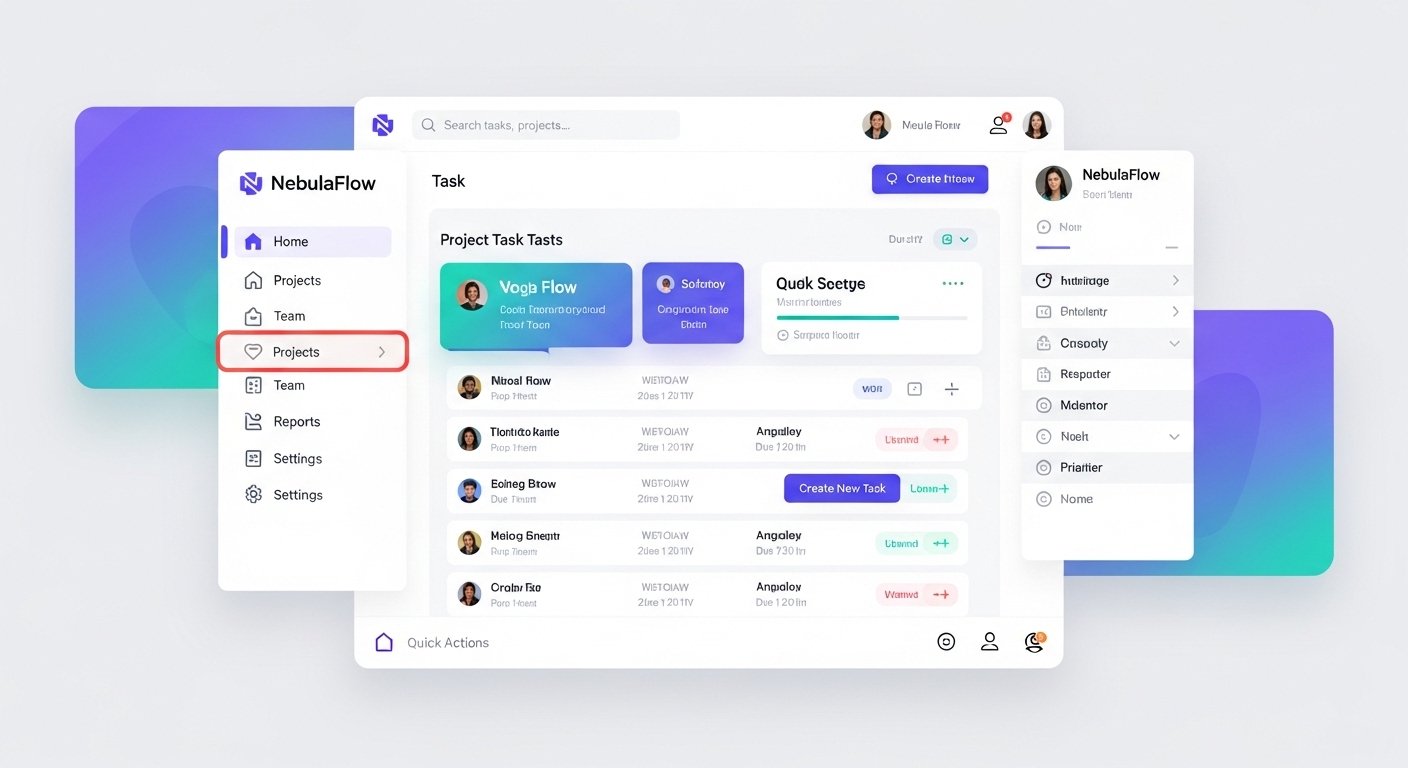

User Experience and Interface Design

Technology alone cannot drive adoption. User experience is equally critical. By prioritizing intuitive design, Pi Network Bank ensures that even individuals with minimal technical knowledge can participate confidently.

This emphasis on simplicity is not accidental. It reflects a broader understanding that mass adoption depends on usability as much as innovation.

Regulatory Considerations and Future Outlook

No financial revolution occurs in isolation from regulatory frameworks. Governments worldwide continue to evaluate and refine cryptocurrency regulations. Pi Network Bank must navigate this evolving landscape carefully.

A collaborative approach with regulators could enhance legitimacy and facilitate integration into mainstream financial systems. While decentralization remains a core principle, strategic compliance can build bridges rather than barriers.

Looking ahead, the future of Pi Network Bank depends on its ability to maintain trust, demonstrate real-world utility, and adapt to technological advancements. The human-centric model provides a strong foundation, but sustained innovation and transparent governance will determine long-term success.

Why Pi Network Bank Represents a Paradigm Shift

The crypto industry has matured significantly since the launch of Bitcoin in 2009. Early adopters focused primarily on decentralization and censorship resistance. Over time, the ecosystem expanded to include smart contracts, decentralized applications, and digital assets.

Pi Network Bank represents the next phase: integrating these technological advancements into a people-first financial ecosystem. By prioritizing accessibility, community governance, and practical utility, it challenges the perception that crypto is only for traders and technologists. This paradigm shift could redefine global finance. Instead of replacing traditional banking outright, Pi Network Bank offers an alternative that complements and gradually transforms existing systems.

Conclusion

Pi Network Bank stands at the forefront of a human-centric financial revolution in crypto. By combining accessibility, decentralization, and real-world utility, it seeks to bridge the gap between traditional banking and blockchain innovation. Its mobile-first design, community-driven governance, and emphasis on token utility position it as a transformative force within the evolving digital economy.

As the cryptocurrency landscape continues to evolve, projects that prioritize people over speculation are likely to shape the future. Pi Network Bank embodies this philosophy, offering a compelling vision of inclusive, decentralized finance that empowers individuals worldwide.

FAQs

Q: What makes Pi Network Bank different from traditional cryptocurrency platforms?

Pi Network Bank differentiates itself through its human-centric approach. While many crypto platforms prioritize trading and speculation, Pi Network Bank emphasizes accessibility, community participation, and real-world financial services. Its mobile-first design and focus on financial inclusion allow everyday users to engage with digital banking tools without requiring advanced technical knowledge or expensive equipment.

Q: Is Pi Network Bank designed to replace traditional banks entirely?

Pi Network Bank is not necessarily built to eliminate traditional banks overnight. Instead, it seeks to complement and modernize financial services through decentralized technology. By integrating blockchain-based solutions such as smart contracts and peer-to-peer transactions, it offers an alternative that may gradually reshape how banking operates while coexisting with established institutions.

Q: How does Pi Network Bank ensure security within its ecosystem?

Security within Pi Network Bank relies on distributed consensus mechanisms, cryptographic verification, and community-driven validation processes. By reducing reliance on centralized control and emphasizing transparency, the platform aims to minimize vulnerabilities. Additionally, its focus on energy-efficient validation models contributes to sustainable and secure network growth.

Q: Can Pi Network Bank contribute to financial inclusion in developing regions?

Yes, financial inclusion is one of the primary goals of Pi Network Bank. By leveraging mobile accessibility and simplified onboarding processes, it provides opportunities for individuals who may not have access to traditional banking infrastructure. This inclusive design aligns with the broader objective of expanding participation in the global digital economy.

Q: What is the long-term outlook for Pi Network Bank in the crypto industry?

The long-term outlook for Pi Network Bank depends on sustained innovation, regulatory adaptability, and real-world adoption. If it successfully maintains trust, scalability, and practical utility, it could become a significant player in the evolving landscape of decentralized finance. Its human-centric model positions it well to influence the next phase of crypto development focused on usability and mainstream integration.