Altcoin mining is still important in the dynamic cryptocurrency ecosystem since it helps verify transactions and keeps blockchain networks secure. Altcoin mining has risen substantially as the cryptocurrency ecosystem diversifies, although Bitcoin (BTC) mining has received the most attention. Because of technological developments, regulation shifts, and changes in market dynamics, cryptocurrency mining will be more critical than ever in 2024. This essay delves into the present situation of cryptocurrency mining, discussing the opportunities and threats it faces and its potential future trajectory.

The Altcoin Landscape

Altcoins, or alternative cryptocurrencies to Bitcoin, encompass many digital assets, each with unique characteristics and use cases. Ethereum (ETH), Litecoin (LTC), and Monero (XMR) are some of the most prominent altcoins. Still, the term also includes thousands of other cryptocurrencies with varying levels of popularity and market capitalization.

While Bitcoin operates on a proof-of-work (PoW) consensus mechanism that relies on miners to validate transactions and secure the network, many altcoins have adopted different approaches. Ethereum, for example, transitioned from PoW to proof-of-stake (PoS) with the Ethereum 2.0 upgrade, drastically altering its mining dynamics. However, many altcoins rely on PoW, making mining a vital part of their ecosystem.

The Evolution of Altcoin Mining

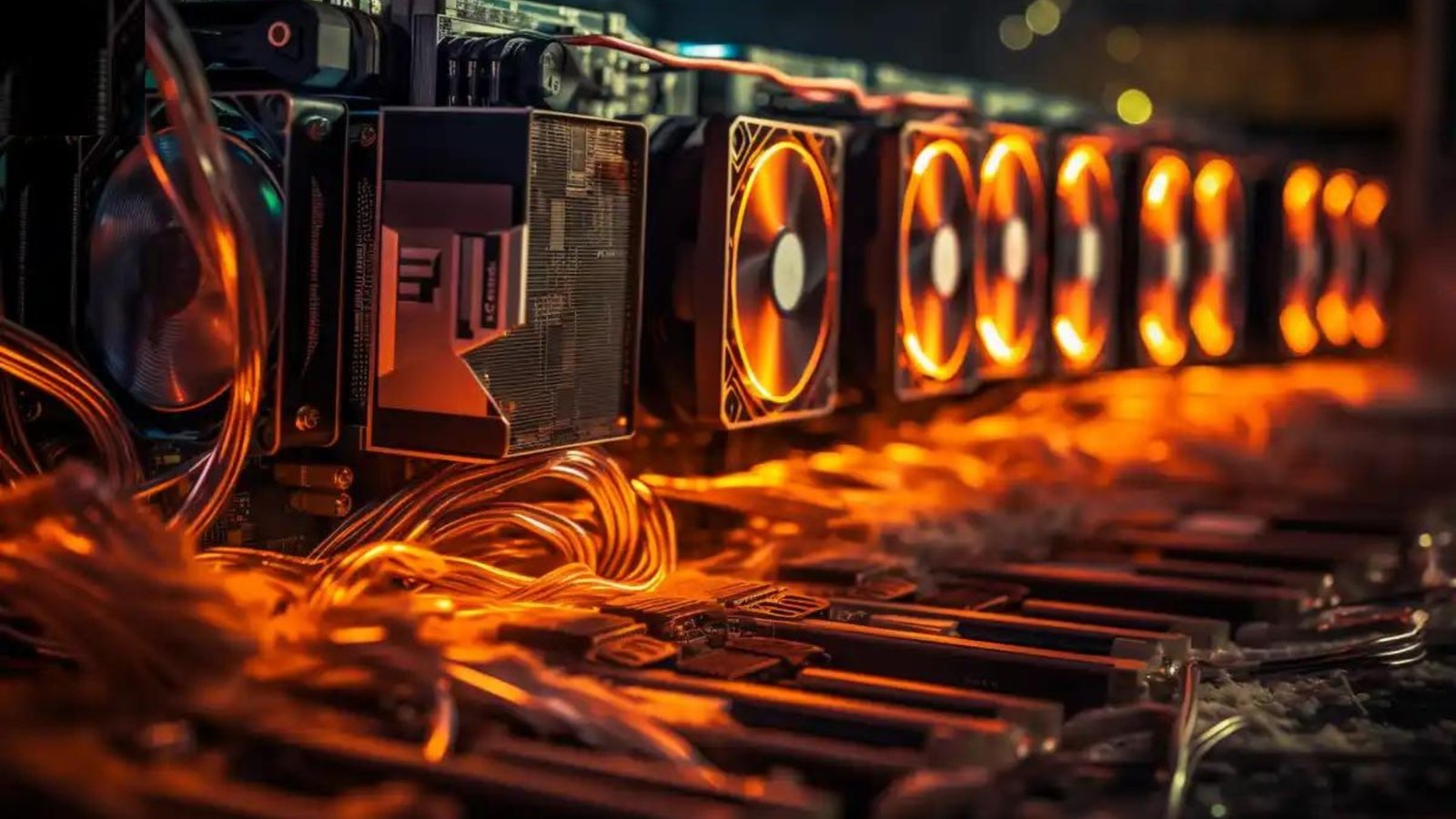

Altcoin mining has evolved significantly since its inception. In the early days, mining was a relatively straightforward process that could be done using a standard CPU. However, as the popularity of cryptocurrencies grew, so did the difficulty of mining. This led to the development of specialized hardware, such as Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs), which are far more efficient at solving the complex mathematical problems required for mining.

In 2024, the landscape of altcoin mining is characterized by several key trends:

The Shift to Environmentally Friendly Mining

Environmental concerns have become increasingly prominent in the cryptocurrency community. Bitcoin mining, in particular, has faced criticism for its high energy consumption and carbon footprint. In response, many altcoin projects have prioritized eco-friendly mining practices.

Altcoins like Chia (XCH) have introduced innovative consensus mechanisms such as proof-of-space (PoSp), which relies on unused hard drive space instead of energy-intensive computations. Other projects are exploring hybrid models that combine PoW with PoS or other mechanisms to reduce energy consumption while maintaining security.

The push for sustainable mining has also led to a resurgence in interest in renewable energy sources. Miners increasingly seek regions with abundant hydroelectric, solar, or wind power to reduce their environmental impact and lower operational costs.

The Rise of ASIC-Resistant Altcoins

Due to their unparalleled efficiency, ASICs have become the dominant hardware in Bitcoin mining. However, this has led to centralization concerns, as only those with access to expensive ASICs can compete effectively in the mining process. In response, many altcoins have developed ASIC-resistant algorithms designed to level the playing field and ensure that mining can be done with consumer-grade hardware like GPUs.

Monero (XMR) is a prime example of an altcoin that has continuously adapted its mining algorithm to resist ASICs. By regularly updating its proof-of-work algorithm, Monero ensures that mining remains accessible to a broader audience, promoting decentralization and network security.

Other altcoins, such as Ravencoin (RVN) and Vertcoin (VTC), have also embraced ASIC resistance as a core principle. This trend reflects a broader movement within the altcoin community to prioritize decentralization and prevent the concentration of mining power in the hands of a few.

The Role of Cloud Mining and Mining Pools

As mining difficulty has increased, solo mining has become less viable for most individuals. Instead, miners have turned to mining pools and cloud mining services to increase their chances of earning rewards.

Mining pools allow miners to combine their computational power, increasing the likelihood of successfully mining a block and earning rewards. These rewards are distributed among the participants based on their contribution to the pool’s total hash rate. In 2024, mining pools remain popular for altcoin miners, particularly those mining more established cryptocurrencies like Ethereum Classic (ETC) or Litecoin (LTC).

On the other hand, cloud mining allows individuals to rent mining hardware from a provider, eliminating the need to purchase and maintain their equipment. While cloud mining has been met with skepticism due to the prevalence of scams, reputable services continue to offer a convenient way for individuals to participate in altcoin mining without the technical know-how or upfront investment required for traditional mining.

Challenges in Altcoin Mining

Despite the opportunities, altcoin mining is not without its challenges. To succeed, miners must navigate a complex technical, regulatory, and economic landscape.

Regulatory Uncertainty

Regulatory uncertainty remains a significant challenge for the cryptocurrency industry, and altcoin mining is no exception. Governments worldwide are grappling with how to regulate cryptocurrencies, and mining activities often fall under the scrutiny of environmental, financial, and legal regulations.

Mining operations have faced crackdowns in some regions due to concerns over energy consumption and environmental impact. For example, China, once a dominant player in cryptocurrency mining, has implemented strict regulations that have forced many miners to relocate. In contrast, countries with more favorable regulatory environments, such as Kazakhstan and the United States, have seen an influx of mining operations.

However, regulatory landscapes can change rapidly, creating uncertainty for miners. The potential for new regulations targeting energy use, taxation, or even the legality of mining itself poses ongoing risks to the industry.

Technological Advancements and Obsolescence

The rapid pace of technological advancement in the mining industry presents opportunities and challenges. On the one hand, new hardware and software can significantly improve mining efficiency, allowing miners to stay competitive. On the other hand, these advancements can render older equipment obsolete, forcing miners to invest in new technology continually.

For example, introducing more efficient ASICs can quickly make older models unprofitable. Similarly, changes to mining algorithms, such as Ethereum’s transition to PoS, can render entire hardware categories redundant. Miners must stay informed and be prepared to adapt to these technological shifts to remain profitable.

Market Volatility

Cryptocurrency markets are notoriously volatile, and altcoin prices can fluctuate dramatically over short periods. This volatility presents a significant challenge for miners, whose profitability is directly tied to the market value of the coins they mine.

In a bull market, high coin prices can make mining extremely profitable, attracting more participants and driving up competition. Conversely, during bear markets, declining prices can squeeze profit margins, reducing mining activity and, in some cases, closing mining operations.

Some miners diversify their operations by mining multiple altcoins or converting their earnings into stablecoins to mitigate market volatility risks. Others may use financial instruments such as futures contracts to hedge against price fluctuations.

The Future of Altcoin Mining

Looking ahead, the future of altcoin mining will be shaped by a combination of technological innovation, regulatory developments, and market dynamics. Several key trends are likely to influence the direction of the industry:

The Transition to Proof-of-Stake and Hybrid Models

As the cryptocurrency ecosystem evolves, more projects are exploring alternatives to the traditional proof-of-work model. Proof-of-stake, which requires validators to hold a certain amount of the cryptocurrency to participate in the network, has gained traction as a more energy-efficient and scalable consensus mechanism.

Ethereum’s successful transition to PoS with Ethereum 2.0 has paved the way for other projects to follow suit. As more altcoins adopt PoS or hybrid models that combine PoW and PoS, the demand for traditional mining could decline. However, PoS introduces challenges, including concerns about centralization and the potential for new attack vectors.

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are beginning to play a role in optimizing mining operations. AI algorithms can analyze vast amounts of data to predict market trends, optimize mining strategies, and even identify the most profitable coins to mine at any given time.

For example, AI-powered software can adjust mining settings in real-time based on changes in network difficulty, electricity costs, and coin prices. This optimization level can significantly improve mining profitability and reduce the risk of losses due to market volatility.

In addition, AI and ML can be used to develop more sophisticated mining algorithms that are resistant to ASICs and other forms of centralization. As these technologies advance, they will likely become an integral of the ecosystem.

The Impact of Quantum Computing

Quantum computing, with its potential to perform calculations exponentially faster than classical computers, poses both a threat and an opportunity for cryptocurrency mining. On the one hand, quantum computers could potentially break current cryptographic algorithms, rendering existing blockchain networks vulnerable to attacks. On the other hand, quantum computing could revolutionize mining by making it possible to solve complex mathematical problems far more efficiently than current hardware.

While practical quantum computers are still experimental, the cryptocurrency community is already exploring quantum-resistant cryptography and other measures to protect blockchain networks. Miners who stay ahead of these developments and adapt to the changing technological landscape will be better positioned to thrive.

In Summary

Altcoin mining remains a dynamic and evolving field that continues to play a crucial role in the broader cryptocurrency ecosystem. As technology advances, environmental concerns grow, and regulatory landscapes shift, miners must navigate complex challenges and opportunities.

In 2024, altcoin mining is characterized by a push towards sustainability, the rise of ASIC-resistant algorithms, and the increasing use of AI and machine learning to optimize operations. While the future of mining may see a shift towards proof-of-stake and other consensus mechanisms, the fundamental principles of decentralization and network security will remain in the industry. The world of cryptocurrencies continues to evolve, and so will the landscape of altcoin mining. This exciting and rapidly changing industry offers risk DS for those who choose tote.

[sp_easyaccordion id=”3433″]