When we say bitcoin miners face squeeze as hash price nears break-even levels, we are referring to the pressure on mining operations caused by a combination of factors: declining revenue per hash, rising input costs (electricity, hardware depreciation, maintenance), and increasing competition (higher network hashrate and difficulty). In mining lingo, “hash price” is defined as the expected daily revenue a miner can earn per terahash/s (TH/s) or petahash/s (PH/s) of computing power.

In recent months, the hash price for Bitcoin has plunged to near-multi-month or even multi-year lows. Reports show figures around US$43 per PH/s/day, levels unseen since April for this metric. When the revenue per unit of hash power drops toward or below the sum of electricity, depreciation and other fixed costs, miners are literally operating at break-even or worse. That is the “squeeze” being referenced.

This environment places tremendous strain on miners: older, less efficient rigs become unprofitable; miners at higher electricity rates are at high risk; and operators face tough decisions on scaling, exiting, or pivoting.

Why Hash Price Is Dropping: Key Drivers

Declining Bitcoin Price and Weak Transaction Fees

One major reason the hash price is under pressure is that the price of Bitcoin itself has corrected. The drop in coin price reduces the USD value of the block reward that miners receive. In addition, mining revenue has traditionally included not just block rewards but also transaction and fee income. But transaction-fee income for Bitcoin has been subdued. For instance, average fees per transaction are at multi-year lows.

Rising Network Difficulty and Hash Rate

Meanwhile, the network hashrate (the total computing power securing the Bitcoin network) remains elevated—over 1.1 zettahashes/second (ZH/s) in some reports. With more competition, the protocol’s difficulty adjusts upward (recently ~156 trillion) and effectively means each miner’s share of the reward is squeezed.

Rising Costs: Electricity, Maintenance, Hardware Depreciation

On the cost side, miners cannot ignore increasing expenses. Electricity remains a major cost component. In many jurisdictions, power contracts may be variable or rising. Older hardware runs less efficiently, consumes more power per hash, and yields lower output. The squeeze happens when revenue falls, but costs remain fixed or rise.

Fixed Costs and Capital Commitments

Mining operations often require large upfront investment: ASIC hardware, cooling infrastructure, site leasing, power contracts, debt servicing. When the revenue per hash collapses, these fixed commitments become heavier burdens. Some miners, rather than hoard coins, are forced to sell to cover operating capital.

Together, these drivers converge to make the condition where bitcoin miners face squeeze as hash price nears break-even levels more than just a catchy phrase — it is a real economic stress test for the mining industry.

The Exact Keyword in Context: Bitcoin Miners Face Squeeze as Hash Price Near-Break-Even Levels

(Yes, this section uses the exact keyword as its heading)

When bitcoin miners face squeeze as hash price nears break-even levels, what does that specifically mean for mining firms and the broader ecosystem?

Mining firms are split into categories:

-

Those with ultra-cheap electricity (e.g., hydropower, subsidised power) and efficient hardware that can still generate meaningful margins even at low hash prices.

-

Those with higher cost structures, older hardware, less efficient power, or heavy debt—these are at immediate risk.

Given current data: for example, the hash price has dropped to around US$43/PH/s/day, while network difficulty is at an all-time high. A miner that consumes X kWh of electricity per PH/s at cost Y may find that revenue no longer covers cost plus depreciation.

The phrase “near break-even” is significant: it implies the margin between cost and revenue is extremely thin, leaving little room for errors, downtime, or power price increases. That means these miners are squeezed — they have less flexibility, less cash buffer, and higher risk of shutdown or consolidation.

In practical terms this may translate into: equipment shut-offs, site closures, miners resorting to selling mined coins rather than hoarding, or shifting business models (for example pivoting into AI/data centre hosting).

Further, when many miners hit break-even or below, the network’s security model could indirectly be impacted: a drop in hashrate, possible slower block times until difficulty adjusts, and increased centralisation risk.

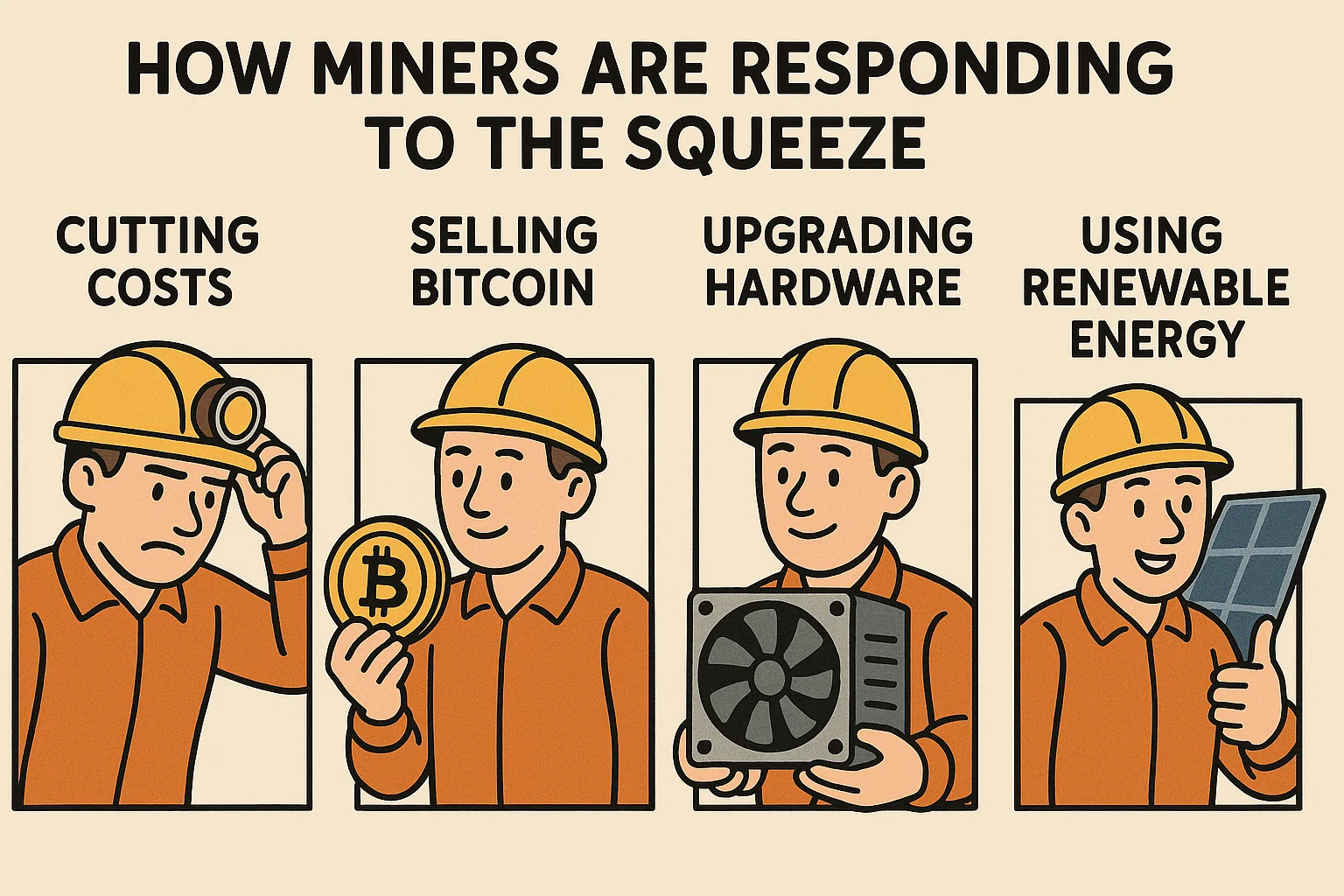

How Miners Are Responding to the Squeeze

Pivoting Business Models – From Pure Mining to Compute Hosting

One of the most prominent responses is that some mining firms are repurposing or augmenting their operations into AI and high-performance computing (HPC) hosting. As the article “Mining companies struggle to survive under squeezed profits” outlines, miners are turning to infrastructure-hosting, leasing excess power, or converting mining sites into data centres. For example, some operators have signed multi-year contracts with major tech firms to supply AI compute capacity. That shift gives them revenue streams less tied to block rewards, that are more stable, and that add flexibility when block reward margins collapse.

Improving Efficiency and Cutting Costs

Miners also double down on efficiency: upgrading to newer ASICs (more TH/s per watt), locating in regions with cheaper electricity, negotiating better power contracts, embracing renewable energy to reduce long-term cost base. Those with high cost structures simply won’t survive this squeeze. Reports show miners with electricity costs below US$0.04/kWh have a better survival profile.

Strategic Selling of Bitcoin Holdings

When revenue per hash falls, some miners switch from holding Bitcoin (anticipating price rises) to selling newly mined coins to stay liquid. One noted case: a major public miner announced that it would sell some of its newly mined Bitcoin to support operating capital needs under margin pressure. This shift signals that the bitcoin miners face squeeze as hash price nears break-even levels dynamic is forcing strategic changes.

Shutting Down Older Assets & Market Consolidation

As the squeeze intensifies, we also see weaker miners shutting down old rigs, going offline, or exiting via acquisition. This leads to a reduction in total hashrate from the least efficient operations, which may eventually ease competition and improve margins for survivors — albeit after a painful transition.

Implications for the Bitcoin Mining Ecosystem

Network Security & Difficulty Adjustment

When many miners face squeeze and potentially shut down, the network’s total hash power (hashrate) could dip. A drop in hashrate triggers the protocol’s difficulty adjustment to lower difficulty, thereby lowering the cost of proof-of-work for remaining miners. In effect, the mining squeeze can lead to a market‐driven reset: inefficient miners exit, which improves economics for the remaining ones.

Entry Barriers Rise, Consolidation Accelerates

Early in mining cycles, smaller players could enter. But as the squeeze deepens, only those with scale, low cost structures, efficient hardware, or diversified business models survive. That increases consolidation: larger firms buy or push out smaller ones, leading to fewer players controlling more hash power. This may raise centralisation concerns over time.

Impact on Bitcoin Price, Investments & Infrastructure

From an investment perspective: investors in public mining firms need to monitor not just Bitcoin price but hash price, electricity costs, hardware efficiency, diversification into AI/compute hosting, and balance sheet strength. When bitcoin miners face squeeze as hash price nears break-even levels, companies with weaker cost structures become higher risk.

From a wider infrastructure viewpoint: mining farms may evolve into compute hubs, data-centres, or AI hosting facilities, repurposing power contracts, land and cooling infrastructure. The mining industry might become more of a “compute infrastructure” industry than purely coin production.

Environmental & Regulatory Considerations

When squeeze occurs, mines may seek cheaper power which may be tied to fossil generation or subsidised energy, potentially raising regulatory or environmental scrutiny. Additionally, the pivot to AI/computing may implicate new regulatory risks or capital investment requirements, altering the risk matrix for mining operations.

What to Watch: Key Metrics and Signals

When assessing the condition where bitcoin miners face squeeze as hash price nears break-even levels, here are key metrics and signals to monitor:

-

Hash Price (US$/PH/s/day) — the lower it goes, the tighter margins become. Current levels ~US$43 per PH/s/day in recent reports.

-

Network Difficulty & Hashrate — rising difficulty and hashrate compress margins for each miner.

-

Electricity Cost per kWh — the major expense line for miners. Lower power cost offers a survival buffer.

-

Hardware Efficiency — newer ASICs, better watt/TH ratios lower cost per hash.

-

Transaction Fees & On-Chain Usage — rising fees increase miner revenue beyond block subsidies. Currently fees are weak.

-

Power Contract Terms / Renewable or Subsidised Power Access — gives competitive edge.

-

Corporate Balance Sheet & Capital Expenditure — high fixed costs or debt increase risk under squeezed margins.

-

Signs of Miner Pivoting or Shut-Downs — e.g., infrastructure repurposing for AI/HPC hosting, miners selling Bitcoin reserves to raise cash.

By tracking these signals, one can gauge whether mining operations are likely to weather the pressure, consolidate, or exit — and thus gauge broader ecosystem stress points.

How Specific Mining Firms Are Handling the Squeeze

Large-Scale Miners with Diversified Operations

Some large mining firms have responded proactively: leveraging their scale, negotiating low cost power, investing in efficient hardware, and even pivoting into AI/data centre services. For example, in a recent headline the shift toward AI infrastructure was emphasised as a way to mitigate the squeeze. These firms illustrate how wealth, scale and diversification allow survival even when the hash price is near break-even.

Mid/Small-Scale Miners Under Pressure

Conversely, smaller miners with higher power costs, older rigs, or less access to cheap power face acute pressure. Some are being forced to shut down rigs, reduce running capacity, or sell newly mined coins just to cover operating expenses. These examples highlight the meaning behind the phrase bitcoin miners face squeeze as hash price nears break-even levels in real terms.

The Infrastructure Pivot

Another key example is firms that are repurposing mining infrastructure into hosting AI or HPC workloads. They use the cooling, power and connectivity assets built for mining and sell them as data centre services. This shift shows how mining companies attempt to escape from purely block-reward-driven economics and open a new revenue modality.

Risks and What Could Go Wrong

Even for miners who are reasonably positioned, there are several risks to consider in this squeezed environment:

-

If Bitcoin’s price falls further, the hash price will drop further, worsening the squeeze.

-

If electricity costs rise (power contract renewals, subsidies removed, regulatory changes), margins tighten further.

-

If hardware fails, breaks down, or becomes obsolete, cost per hash increases, reducing flexibility.

-

If a wave of miner shutdowns leads to sell-offs of mined Bitcoin, it could create downward pressure on Bitcoin’s price and exacerbate the network stress.

-

If regulatory or environmental actions impose higher cost burdens on mining (e.g., carbon taxes, power curtailments), profitability becomes even more tenuous.

-

If the pivot to AI/HPC fails to secure stable contracts quickly, the anticipated diversification may not shore up the business.

In short: the margin for error is small when the hash price is near break-even. This is exactly why the phrase bitcoin miners face squeeze as hash price nears break-even levels is so apt—it captures the fragile state of many mining operations right now.

Outlook: What’s Likely to Happen Next?

Given current conditions, several plausible scenarios emerge:

-

Consolidation and Exit – Many higher-cost miners will likely exit, sell assets, shut down rigs, or be acquired. This reduces hashrate, possibly easing competition and raising hash price for survivors.

-

Recovering Hash Price – If Bitcoin price rises, network fees increase, or transaction activity spikes (e.g., via inscriptions/ordinals or other on-chain demand), then hash price could recover, improving miner margins. Reports suggest this kind of turnaround is possible.

-

Mining → Compute Infrastructure Transition – More miners will make the shift to AI/HPC hosting, leasing power/infrastructure rather than purely block-mining. This could redefine what it means to be a miner in coming years.

-

Increased Risk of Network Impact – If enough miners exit and hashrate drops before difficulty adjusts, block times could slow and network security could temporarily be weaker, though the protocol is designed to self-correct.

From a strategic investor or operator perspective, the key takeaway is: mining is increasingly a cost-play, efficiency play and infrastructure play — not just a “buy hardware and hope for block reward” play.

Why It Matters for Investors and Crypto Enthusiasts

Understanding when bitcoin miners face squeeze as hash price nears break-even levels matters because:

-

It signals a structural risk in the mining industry. If many miners fail, the ecosystem could see ripple effects: miner sell-offs, equipment resale gluts, power contract renegotiations, and potential network impacts.

-

It influences the supply side of Bitcoin. Miners may sell coins to cover costs rather than hold them — increasing supply pressure. As one article notes, miner transfers to exchanges have increased in response to margins being squeezed.

-

It gives insights into hardware and infrastructure investment decisions. If you’re buying mining hardware, entering a mining operation or investing in a mining firm, you need to know that profitability is narrowing.

-

It broadens one’s lens beyond coin price. Even if Bitcoin’s price rises, if network difficulty, hashrate, and costs rise too, mining margins might still be poor.

-

It may present opportunities. If you’re an infrastructure investor, the pivot of mining firms into AI/HPC hosting may open up avenues for exposure beyond pure coin mining.

Practical Advice for Mining Operators and Prospective Entrants

If you are operating in or considering entering the mining space, here are some practical takeaways given that bitcoin miners face squeeze as hash price nears break-even levels:

-

Assess your cost structure carefully. Know your electricity cost per kWh, hardware efficiency (watt/TH), cooling and maintenance overhead. Are you near break-even at current hash price?

-

Scenario-plan for hash price drops. Build models assuming hash price stays low for several months. What happens if revenue falls 20–30%?

-

Prioritise efficiency. Newer ASICs, renewable energy access, favourable power contracts, location near cheap power or cooling advantages all matter.

-

Diversify revenue streams. Consider ways to lease out power, host AI/HPC workloads, or provide colocation services. This diversification may make the difference between survival and exit.

-

Monitor metrics. Keep an eye on hashrate, difficulty, hash price, Bitcoin price, transaction fee levels, power costs, and hardware depreciation cycles. These are indicators of when margin squeeze will worsen.

-

Prepare for consolidation. If you are smaller or higher cost, you may face acquisition or exit pressures. Consider exit strategies or partnerships.

-

Maintain cash buffers. With margins squeezed, downtime, maintenance or site issues can quickly become existential threats. A cash buffer helps you weather the storm.

Conclusion

The phrase bitcoin miners face squeeze as hash price nears break-even levels captures a critical moment for the mining industry. Margins are razor thin, competition is fierce, and only the most efficient, well-positioned operators are likely to thrive. For those unable or unwilling to adapt, the squeeze may force difficult decisions: shut down hardware, sell mined coins, or exit the business entirely.

For anyone involved in the crypto-mining ecosystem — whether as an operator, investor or advisor — this is not just a passing cycle: it is a structural inflection point. The mining business is evolving from purely chasing block rewards toward a broader compute infrastructure business. If you are considering entering or scaling a mining operation, now is the time to reassess your economics, review your risk exposure and ask whether you can endure the squeeze.

If you’d like to explore how specific mining firms are handling this margin squeeze, or analyse geographic regions with the best cost structures, I can help dig into that next. Let me know if you’d like a deeper dive into miner cost benchmarks, hardware efficiency comparisons or regional electricity pricing dynamics linked to mining.

See More:Altcoin Mining the Cryptocurrency Mining Scene in 2024