Data Tests Key Support Zone The cryptocurrency market is once again witnessing heightened volatility as Bitcoin retests the key $30,000 support zone, a level that has historically held immense psychological, technical, and market-driven significance. This renewed correction comes at a time when fresh on-chain and macroeconomic data highlight shifting investor sentiment, tightening liquidity, and intensifying uncertainty across risk assets.As the world’s largest cryptocurrency by market capitalization,Bitcoin’s price action often dictates broader market behavior.

Therefore, its ability—or failure—to hold the $30K range will likely shape short-term and medium-term momentum for the entire digital asset ecosystem. With institutional flows, derivatives activity, exchange reserves, and macroeconomic indicators all flashing mixed signals, traders are now closely monitoring whether Bitcoin can protect this critical zone or if more downside pressure is looming.In this in-depth article, we explore why the $30K level matters, what current data reveals, how investors are reacting, and what could be next for Bitcoin as volatility intensifies.

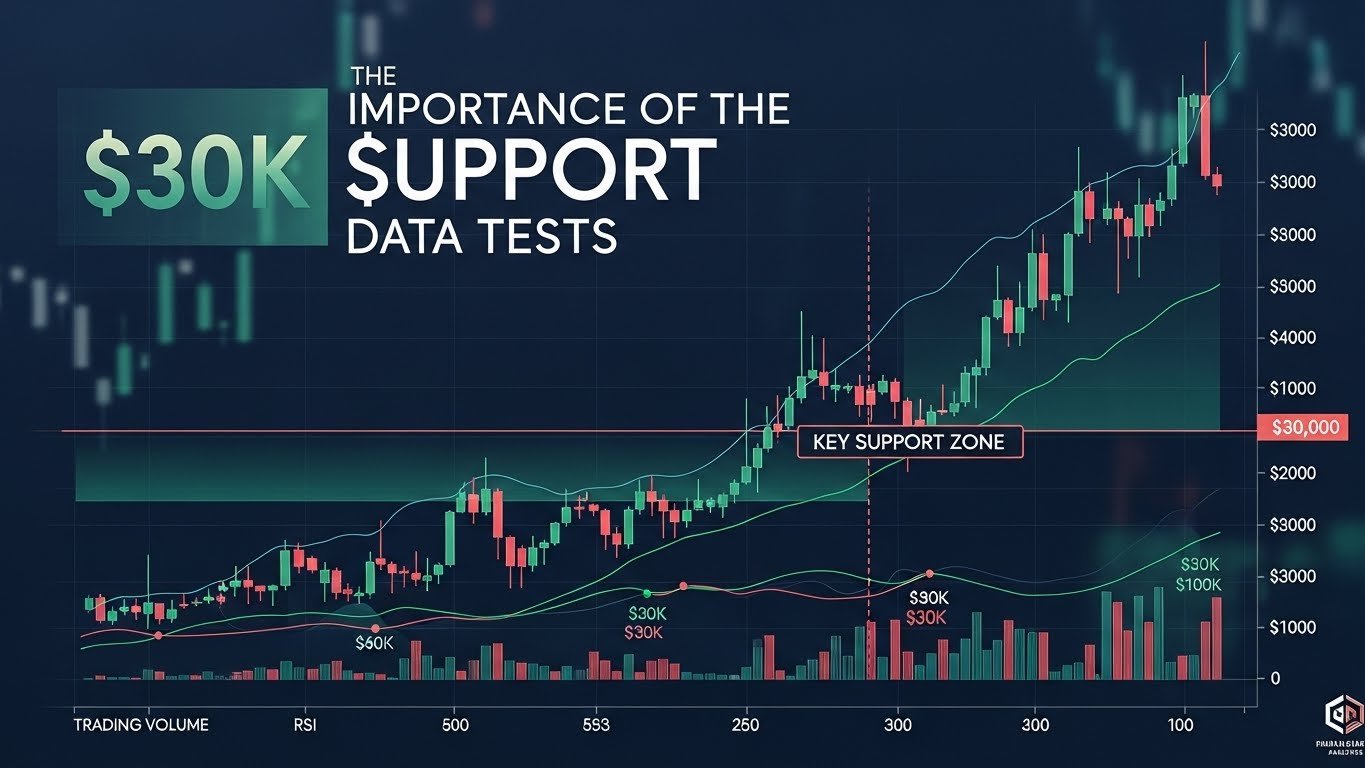

The Importance of the $30K Support Data Tests Key Support Zone

The $30,000 support zone is more than a simple psychological benchmark—it represents a pivotal price level shaped by years of trading history, investor behavior, and long-term accumulation trends. For many, $30K has become a symbolic threshold that illustrates whether Bitcoin is within a bullish or bearish macro environment.

Historical Role of the $30K Price Region

Bitcoin has interacted with the $30K region on multiple occasions, each time establishing it as a critical battleground between bullish accumulation and bearish selling pressure. Data Tests Key Support Zone During past bull cycles, this level acted as a launching pad for major rallies. In bearish environments, it often represented the last strong foothold before further significant declines.

This repetition strengthened the price zone’s identity as a “long-term value area”, where both retail and institutional investors have shown willingness to accumulate BTC over time. Whenever Bitcoin approaches this region, the market tends to see amplified trading activity, fear-driven sentiment swings, and heightened liquidity.

Investor Psychology and Market Sentiment

The psychology surrounding the $30K level extends beyond charts. Because it represents a round-number milestone, it influences behavior among both experienced traders and newcomers. Data Tests Key Support Zone When Bitcoin retests this area, many investors question whether the market is heading toward a deeper correction or preparing for a strong rebound.

This sentiment-driven uncertainty contributes to increased volatility, often creating sharp intraday price movements. The current retest fits this historical pattern, highlighting just how relevant this zone remains to Bitcoin’s broader narrative.

Fresh Data Highlights Shifting Market Conditions

As Bitcoin retests the $30K support zone, various forms of on-chain data, macro data, and market indicators are offering insights into the forces shaping price action. These data points illustrate the current tug-of-war occurring between bullish and bearish participants.

On-Chain Metrics Reveal Mixed Investor Behavior

On-chain data shows conflicting signals that reflect a market stuck between uncertainty and cautious optimism. Exchange balances indicate a steady decline in the amount of Bitcoin held on centralized platforms, suggesting long-term investors are continuing to withdraw and hold BTC in self-custody—a historically bullish trend.

However, short-term holders, who are typically more sensitive to price fluctuations, are increasingly offloading their positions as Bitcoin approaches $30K. Data Tests Key Support Zone This short-term selling pressure contributes to temporary weakness, even while long-term fundamentals remain resilient.Additionally, realized profit and loss indicators highlight an increase in realized losses, meaning more traders are selling at a loss compared to recent acquisition prices. Data Tests Key Support Zone This typically signals fear-driven capitulation, a common occurrence during major support retests.

Macroeconomic Data Adds Pressure to Risk Assets Data Tests Key Support Zone

Beyond the crypto ecosystem, broader macroeconomic trends are significantly influencing Bitcoin’s price. Persistently high inflation, fluctuating interest rate expectations, and liquidity tightening across global markets are creating difficult conditions for risk assets.

Data Tests Key Support Zone Bitcoin, increasingly categorized as a macro-sensitive asset tethered to liquidity cycles, naturally reacts to these economic shifts. When liquidity tightens, risk sentiment weakens, pushing Bitcoin toward key support zones like $30K.

Derivatives Market Signals Increasing Caution

In the Bitcoin derivatives market, funding rates and open interest levels highlight rising caution among traders. Funding rates have moved closer to neutral or slightly negative, indicating that long positions are no longer dominating the market.

At the same time, open interest remains elevated, suggesting that a significant number of leveraged positions remain active. This combination creates a fragile environment where sudden volatility—especially near key support—can trigger liquidations that amplify price movement in either direction.

Institutional Flows Show Slowed Momentum

During previous bullish cycles, strong institutional inflows through ETFs, OTC channels, and custody platforms helped drive Bitcoin beyond major resistance zones. In the current environment, however, institutional buying has slowed, partly due to broader market uncertainty and regulatory concerns.Although institutional interest remains intact, the short-term decline in inflows underscores the cautious approach that many large investors are taking, further contributing to Bitcoin’s struggle to maintain its support levels.

Why Bitcoin Continues to Hover Around Critical Support

With so much data at play, Bitcoin’s repeated retests of the $30K zone appear to be a result of both internal and external forces.

Whale Accumulation and Distribution Patterns

Large holders—often referred to as “whales”—have been showing mixed behavior. Some whales are accumulating aggressively during dips, reinforcing the support level. Others are distributing into strength, attempting to capitalize on price spikes.This push and pull has created a balanced but tense environment where neither side fully dominates.

Market Liquidity and Trading Volume Trends

Liquidity plays a crucial role in determining whether Bitcoin holds support levels. Recent trends reveal that liquidity around the $30K region has tightened, leading to increased slippage for large orders.Reduced liquidity often translates to wider price swings, making support zones more vulnerable during periods of heavy selling.

Retail Investor Reaction and Fear Sentiment

Retail sentiment, often driven by emotional trading, intensifies whenever Bitcoin approaches a major level like $30K. Many retail traders see dips as opportunities for accumulation. Others panic sell, especially those with little experience navigating volatile markets.The resulting mix of buy and sell activity contributes to the ongoing struggle to maintain stability at support.

Potential Scenarios for Bitcoin’s Next Moves

Bitcoin’s future near the $30K zone hinges on multiple factors, including market sentiment, macroeconomic conditions, and investor behavior. Several potential scenarios could unfold depending on how these elements develop.

Scenario 1: Bitcoin Holds the $30K Support and Begins a Rebound

If bullish investors continue to accumulate, on-chain metrics improve, and macro pressures ease, Bitcoin could successfully defend the $30K support and generate upward momentum. A sustained bounce from this level may lead to retests of resistance zones around $32K, $34K, or even higher depending on market outlook.A rebound scenario would reinforce the long-term bullish perspective, validating the $30K range as a strong accumulation zone.

Scenario 2: Bitcoin Breaks Below $30K With Downside Continuation

If bearish pressure increases, long positions get liquidated, or macroeconomic headwinds worsen, Bitcoin could break below the $30K support. Such a breakdown might trigger a deeper correction toward subsequent support levels around $28K, $26K, or even lower.A decisive breakdown would likely shift sentiment into a more bearish phase, attracting short-term sellers and further increasing market volatility.

Scenario 3: Consolidation Around $30K Before Major Movement

Bitcoin may also choose a neutral path by consolidating within a tight range around $30K. Consolidation periods often precede large directional moves and are considered healthy for long-term stability.During consolidation, volatility decreases, market depth improves, and accumulation phases become more noticeable.

How Long-Term Fundamentals Influence Bitcoin’s Outlook

Despite short-term uncertainty, Bitcoin’s long-term fundamentals remain strong. Adoption continues to rise as more institutional investors, corporations, and financial platforms integrate Bitcoin into their portfolios and offerings.

Role of Scarcity and the Upcoming Halving Cycle

Bitcoin’s halving cycle, which reduces block rewards and slows new supply issuance, plays a major role in shaping long-term supply dynamics. Historically, halvings have preceded major bull cycles, as reduced supply often meets increasing demand.With the next halving approaching, scarcity-driven narratives may grow stronger, potentially creating upward momentum for BTC regardless of short-term volatility.

Growing Institutional Recognition and Regulation

While regulatory concerns sometimes create short-term fear, they also contribute to long-term legitimacy. As governments establish clearer frameworks, institutional adoption becomes more mainstream, solidifying Bitcoin’s role as a recognized asset class.This evolving landscape suggests that long-term fundamentals may outweigh short-term support retests.

Conclusion

Bitcoin’s retest of the crucial $30,000 support zone reflects the ongoing battle between bullish belief and bearish caution. Data Tests Key Support Zone Fresh data across on-chain metrics, derivatives markets, institutional flows, and macroeconomic indicators highlight a complex story—one where both confidence and fear coexist.Whether Bitcoin rebounds, breaks down, or consolidates, the $30K range will continue to act as a key pivot point shaping market sentiment and future price action.

While short-term volatility may unsettle many traders, long-term Data Tests Key Support Zone fundamentals such as scarcity, adoption, and increasing regulatory clarity remain solid foundations for Bitcoin’s future.As the market continues to evolve, traders and investors should closely monitor data-driven signals, maintain a balanced perspective, and approach Bitcoin with both caution and patience.

FAQs

Q: Why is the $30K support level so important for Bitcoin?

The $30K zone is historically significant due to high trading volume, strong accumulation, and multiple price interactions that make it a key psychological and technical level.

Q: What data is influencing Bitcoin’s current price movement?

On-chain metrics, derivatives activity, macroeconomic trends, and institutional inflows are all shaping Bitcoin’s volatility and testing the $30K support.

Q: Could Bitcoin fall below $30K?

Yes. If selling pressure increases or macro conditions worsen, Bitcoin could break below $30K. However, strong buyer interest at this level may help maintain support.

Q: What would cause Bitcoin to rebound from $30K?

Increased accumulation from long-term holders, improved macroeconomic sentiment, or rising institutional demand could trigger a rebound.

Q: Is Bitcoin’s long-term outlook still bullish?

Many analysts believe the long-term outlook remains strong due to Bitcoin’s scarcity, rising adoption, upcoming halving, and growing institutional interest.