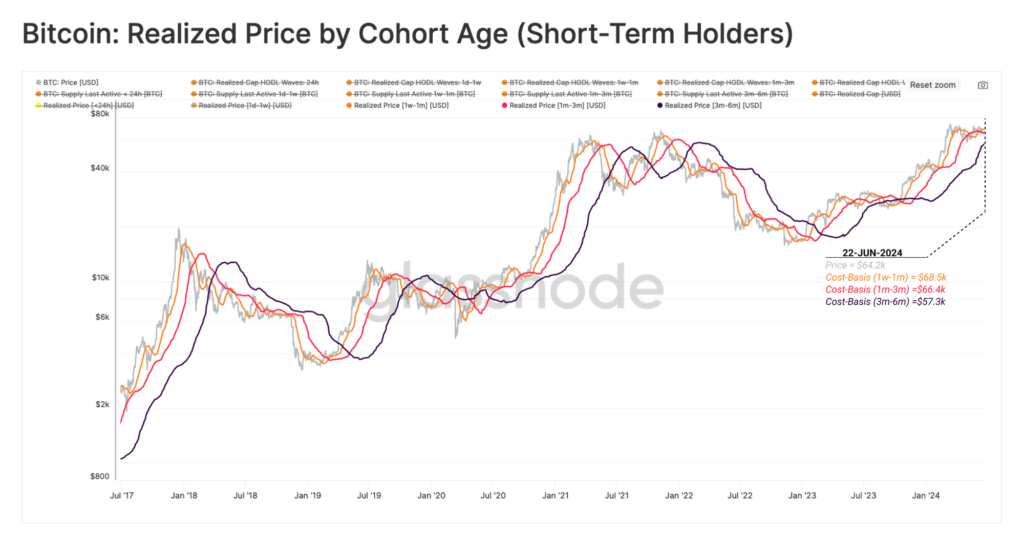

In its latest weekly report. The on-chain analytics firm Glassnode discussed how the short-term Bitcoin holders have reacted to the recent market downturn. The “short-term holders” (STHs) refer to the Bitcoin investors who purchased their coins within the past 155 days. This cohort includes the new entrants into the market, who tend not to be too resolute. As such, the group can panic in times of volatility. Understanding this cohort’s behavior helps market observers identify moments of extreme seller exhaustion. Which have historically presented opportunities for longer-term investors notes Glassnode.

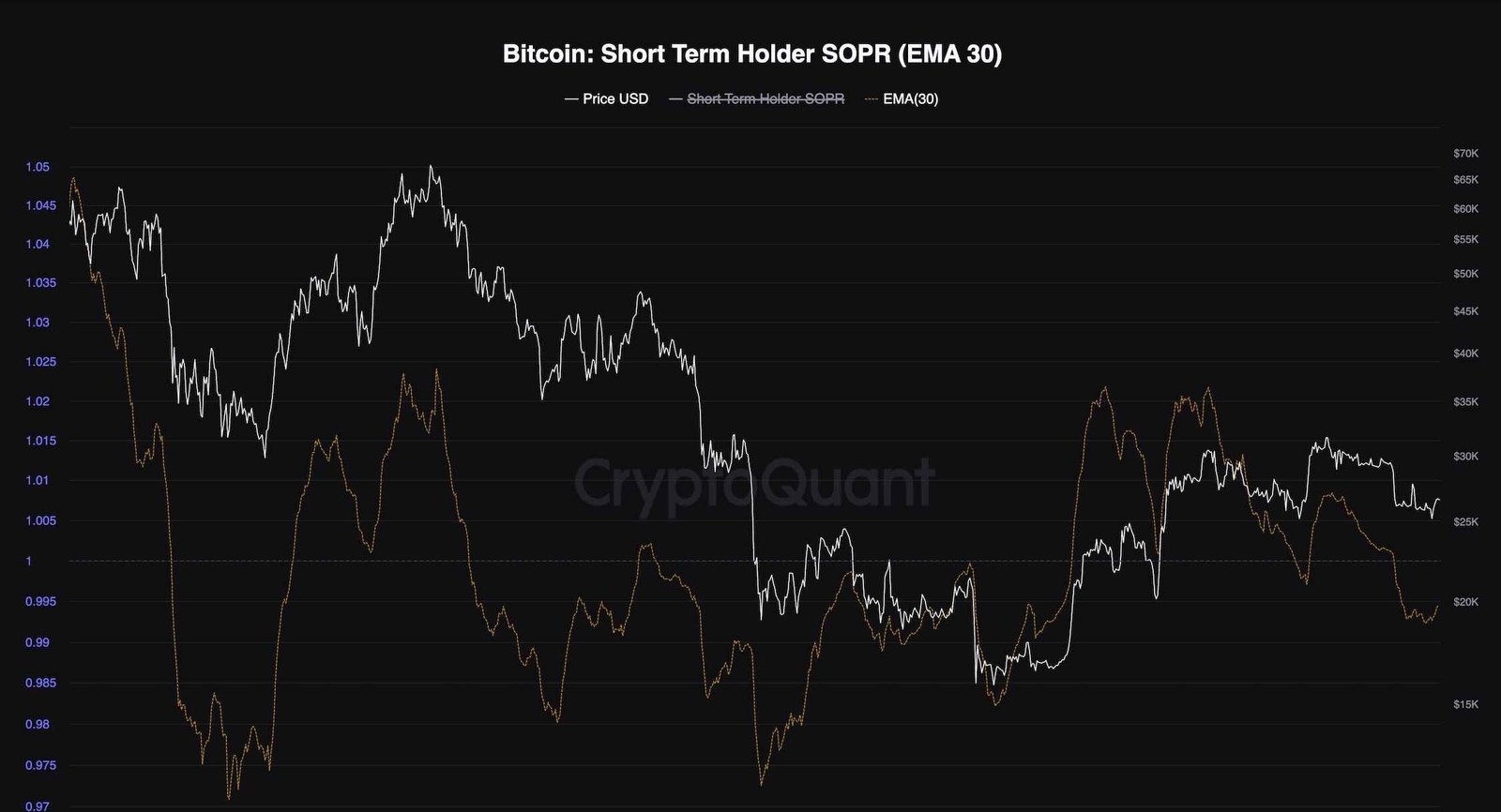

Naturally, the latest sharp price action in the cryptocurrency would also have forced these investors into selling. The way this selloff tends for the group. Profit or loss realization can be determined using the “Spent Output Profit Ratio” (SOPR) indicator.

Bitcoin STH sopr Analysis

The indicator works by reviewing the transaction history of each token sold by the STHs. They find the price at which they initially purchased the coins. If the previous price is less than the current spot price for any token. Its sale is added to the profit transactions. Similarly, transfers of the opposite type fall in the loss category. When the SOPR is greater than 1, the investors’ part of the group is realizing a higher profit than loss. On the other hand. It being under the level suggests that loss-taking is the dominant form of selling among the cohort.

Here is the chart shared by the analytics firm that shows the trend in the 196-hour moving average (MA) of the Bitcoin STH SOPR time. For the last couple of years, as displayed in the above graph, the Bitcoin STH SOPR has fallen below one recently, which implies that these recent buyers have started selling at a loss.

Bitcoin Selloff and Potential Bottom

At the height of this selloff the metric’s value reached the 0.97 level. They are close to the low observed during the August capitulation. This persistent downside momentum has left new investors on edge, leading to widespread panic selling at a loss,” reads the report. “Such conditions often precede local seller exhaustion, a dynamic that long-term investors may monitor for potential re-entry opportunities.” STH capitulation tends to help Bitcoin reach a bottom because coins tend to transfer to more resolute hands during such an event.

These HODLers have their cost basis at the lower post-crash prices, so it’s easier for them to sit through any further price plunges. It remains to be seen whether the STH loss-taking that has occurred thus far would be enough for BTC to reach a bottom.

Bitcoin Price

On March 13, 2025, Bitcoin (BTC) is trading at roughly PKR 23,309,801. With a move of 802.0 (0.00973%), the USD price is roughly 83,213.0. The previous close was the intraday low of 80,625.0 USD and the intraday high of 84,302.0 USD. Note that the values of cryptocurrencies are quite erratic and fast-flooding. Check reliable financial sources for the most current rates.

Bitcoin has been marching up since the low from the start of the week, but at its current price of $83,200, it has still not quite recovered from the plunge.

Final thoughts

Emphasizing the Spent Output Profit Ratio (SOPR), the paper thoroughly studies the behavior of Bitcoin short-term holders (STHs) in response to recent market declines. The primary lesson is that, as seen by the SOPR falling below 1, the recent collapse in Bitcoin’s price has prompted a sizable fraction of these temporary holders to sell their holdings at a loss. Since it results in coins being transferred to more robust long-term holders less inclined to panic in the face of future price falls, this capitulation among younger investors is sometimes interpreted as a premonition of a possible market bottom.

In essence, the paper emphasizes a pivotal point in the price action of Bitcoin when fear rules the market attitude among short-term holders. Yet, this dynamic could indicate the depletion of selling pressure and provide chances for more long-term investors to re-enter. It also emphasizes the erratic and cyclical character of the market, where such events usually come before times of recovery or stabilization. The article still allows room for ambiguity since it implies that it is still to be seen if the present selling is sufficient to indicate a clear market bottom.