Recently, the market for cryptocurrencies has seen an unusual trend, whereby Bitcoin (BTC) maintains a consistent position while altcoins are actively searching for breakout chances. While Bitcoin continues to rule, hovering around essential price levels, altcoins—from well-known names like Ethereum (ETH) to more recent newcomers like Chainlink (LINK)—are showing signs of trying for more market share and more investor attention.

The latest change in the continuous growth of the digital currency scene is this difference between the stability of Bitcoin and the volatility of altcoins.

Bitcoin’s Stability Amid Market

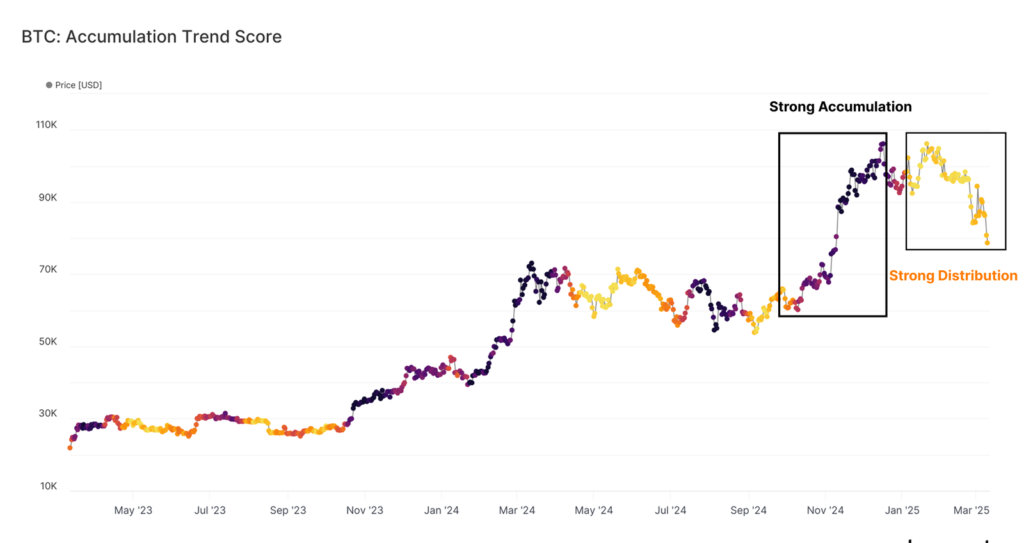

Despite the more general market volatility of the previous few months, Bitcoin’s price has shown fantastic consistency. With sporadic swings but no notable pullbacks, Bitcoin’s price as of mid-March 2025 has been staying somewhere above $90,000. The primary cryptocurrency is still the pillar of the digital asset class; its relatively consistent performance helps to stabilise the market. Bitcoin has been consolidating in this price range for some time, but it has avoided significant declines or corrections, an indication of increasing institutional confidence and retail support.

The relative calm Bitcoin has experienced contrasts significantly with the erratic price movements seen in numerous altcoins’ prices. Since Bitcoin is still the most known and reliable cryptocurrency, investors keep swarming to it. The price stability of digital assets has been influenced by their market leadership and reputation as a “haven” in the erratic crypto scene. Both individual and institutional investors use Bitcoin because of its security and general acceptance, especially in light of ongoing financial product development such as Bitcoin exchange-traded funds (ETFs).

Altcoins Gaining Momentum

Although Bitcoin’s superiority is indisputable, altcoins have not lost their goal of questioning the leading cryptocurrency’s power. Many of the best-performing altcoins available on the market exhibit indications of growing interest and potential for breakout, providing significant returns for those who correctly time their entry points.

Notable advancements in recent weeks have come from altcoins, including Chainlink (LINK), Solana (SOL), and Injective Protocol (INJ). These coins have shown notable increasing velocity since each one is positioned to seize more market share. Investors are closely observing these coins, seeking opportunities to diversify outside of Bitcoin and investigate the expansion possibilities of other blockchain initiatives.

Particularly, Chainlink has been gaining from its inclusion in several distributed finance (DeFi) apps and ongoing efforts to improve innovative contract capability. Developers creating blockchain projects find the cryptocurrency interesting because of its unique value proposition—a distributed oracle network linking smart contracts with actuals.

Ethereum and Altcoins

Long leading front in altcoin movements, Ethereum (ETH), the second-largest crypto market capitalisation, is still essential in the changing scene of digital assets. Still a cornerstone of Ethereum’s supremacy in the altcoin market is its capacity to enable distributed apps (dApps) through innovative contract capability. Ethereum has witnessed notable expansion with its move to Ethereum 2.0, which seeks to increase network efficiency and lower energy usage, despite scaling problems and high transaction fees.

Still, other altcoins are attracting interest not just from Ethereum. Built on Ethereum’s network, ERC-20 tokens have grown in popularity, driving many distributed finance initiatives, gaming ecosystems, and non-fungible token (NFT) markets. The ERC-20 token market has seen great expansion but also pressure as Ethereum’s scalability problems become more noticeable.

Bitcoin and Altcoin Markets

Plenty of legal obstacles have existed in the bitcoin market, which still significantly affect the price paths of both Bitcoin and alternatives. Investors in the altcoin market continue to be worried about regulatory uncertainties, especially as governments and financial authorities worldwide examine how to manage digital assets. Strict criteria may hamper altcoins’ acceptability and expansion in some countries.

On the other hand, Bitcoin has experienced a surge in institutional acceptance, primarily due to its recognition as a digital asset. The introduction of Bitcoin ETFs has let conventional investors into the cryptocurrency market without personally buying and storing Bitcoin. This tendency may open the path for similar products for altcoins in the future and help explain Bitcoin’s stability.

Final thoughts

While Bitcoin is staying constant, cryptocurrencies are aggressively looking for market breakthrough chances. Although Bitcoin is still the clear leader in the field of cryptocurrencies, the increasing number of viable altcoin initiatives points to plenty of scope for diversity and invention. The present dynamics between Bitcoin and altcoins show the changing character of the digital asset market, where both stability and development can coexist and present a spectrum of chances for investors.

Nonetheless, anyone trying to seize the possibilities inside the crypto ecosystem still needs to exercise care and strategic planning, considering the continuous market volatility and legislative developments.