Here we examine the main triggers contributing to the current decline in digital-asset values. One of the most direct reasons behind the crypto market crash is the surge in forced liquidations. According to reports, when margin positions unwind rapidly, this can create a feedback loop that drives prices down more sharply. In other words, when traders’ leveraged bets on tokens go wrong, the unwinding itself becomes part of the selling pressure.

Weak technical structure on Bitcoin and major altcoins

Technical chart patterns are flashing warning signs. In the case of Bitcoin, indicators such as “death-cross” (when a short-term moving average crosses below a long one) and failed support zones are being cited. When Bitcoin’s base cracks, many altcoins follow—so the crypto market crash becomes broad-based rather than isolated.

Rising US dollar strength and macro headwinds

Another factor behind the crypto market crash is macroeconomic: when the US Dollar Index (DXY) strengthens, risk assets like cryptocurrencies often suffer. Investors may shift funds away from crypto into “safer” assets when the dollar rallies, reducing inflows into digital-asset markets.

Regulatory and institutional pressures driving the crypto market crash

Regulatory uncertainty and clampdowns

Cryptocurrency markets live in a regulatory shadow. Governments and financial regulators tightening rules can rattle investor confidence. For example, regulatory crackdowns or threats thereof can spark a sudden risk-off move. In the context of the crypto market crash, even rumors of regulatory intervention can trigger outsized reactions.

Institutional money pulling back

When institutional investors reduce exposure or hold off on fresh commitments, that dries up a key source of upward momentum. Without large-scale institutions buying, the crypto market crash can deepen because fewer players are available to support recovery. Also, some of the “easy money” flows that helped drive previous rallies may no longer be present.

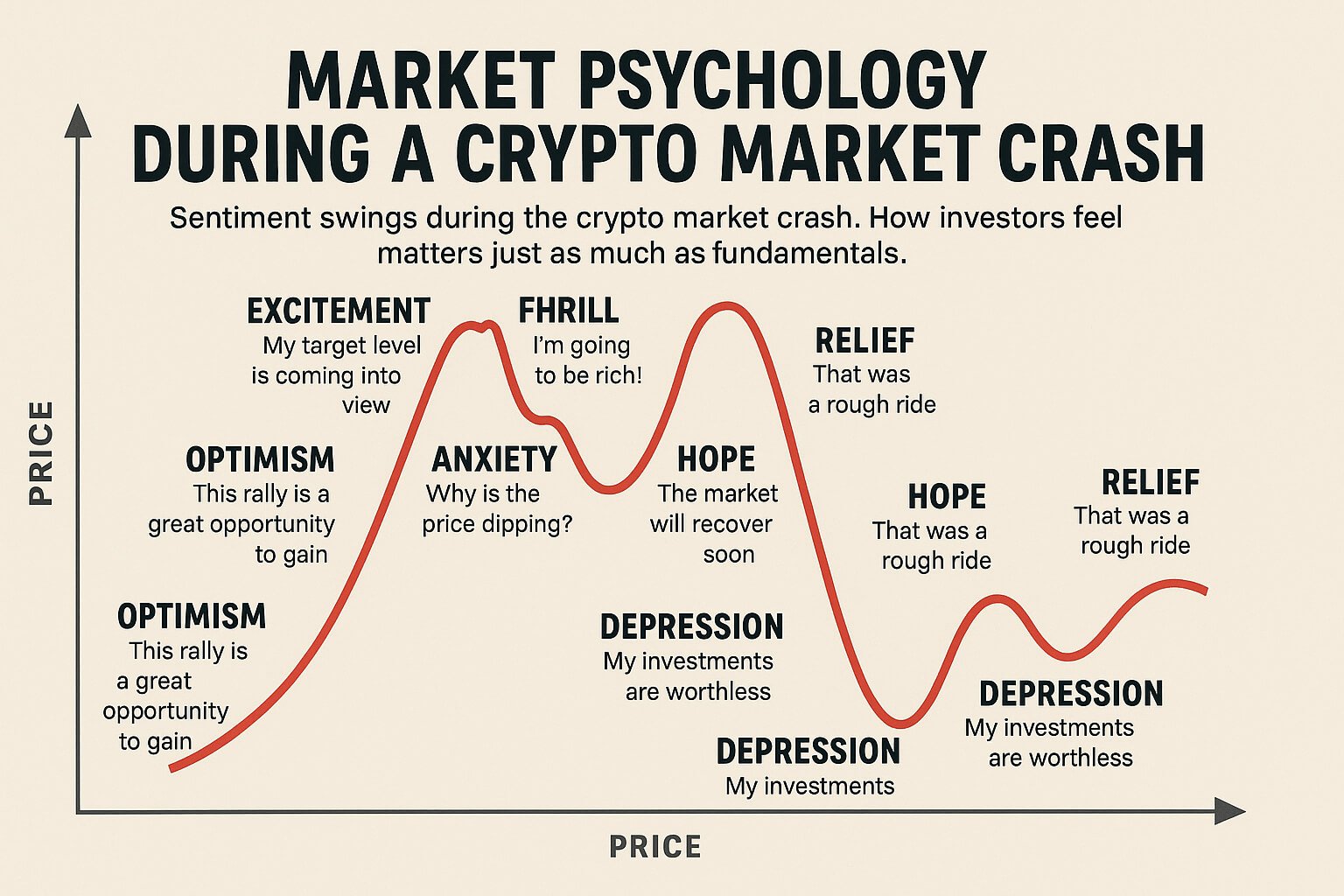

Market psychology and sentiment swings during the crypto market crash.How investors feel matters just as much as fundamentals?

Fear, greed index and sentiment deterioration

Investor sentiment has turned more negative, which ties directly into the crypto market crash. Reports show that indices like the “Crypto Fear & Greed” gauge have moved into the fear zone, signalling less participation and more hesitation. When sentiment is weak, even modest negative news can amplify the crash because investors are already keyed for downside.

Profit taking after rapid growth

Prior strong gains in cryptocurrencies often lead to profit-taking. When large holders realise gains, they may sell, putting downward pressure and triggering the broader market to follow. This dynamic is a classic part of asset-bubbles unwinding and plays directly into the current crypto market crash.

Specific triggers amplifying the crypto market crash

Key collapses and exchange failures

The collapse of major entities (e.g., FTX) and broader ecosystem failures have left a mark on investor trust. Even though that particular instance predates some of the latest crash, the residual distrust affects current behaviour—hastening the crypto market crash when fresh pressure comes.

Rapid coin/token devaluation and bubble corrections

When a particular token or protocol falls sharply, it can trigger contagion. For example, the collapse of the TerraUSD/LUNA ecosystem exposed weaknesses in stablecoin mechanisms and domino-effects across crypto. These structural vulnerabilities feed into the wider crypto market crash by undermining confidence in the system.

Macro events & global sell-offs

Broad financial market weakness, trade tensions and other global events (e.g., geopolitical risk) affect crypto too. As one analysis showed, trade tensions triggered part of the last big fall. In times like these, the crypto market crash is not isolated—it’s part of a wider risk-off environment.

Why altcoins suffer even more during the crypto market crash

Higher risk, lower liquidity

Many altcoins are less liquid, less established, and depend on Bitcoin’s trend. When Bitcoin falls, altcoins often suffer magnified losses as liquidity dries up and investors seek safe-harbour bitcoin or exit entirely.

Rotation away from speculative plays

During the crypto market crash, speculative altcoins tend to get sold off first. Investors move toward perceived “safer” cryptos or exit crypto altogether. This dynamic accelerates altcoin drawdowns and widens losses relative to Bitcoin.

Tokenomics, unlocks and supply shocks

For some altcoins, upcoming token unlocks or unlock events create supply pressure. When large holders dump tokens post-unlock, it adds downward pressure. Such supply shocks often go overlooked until the crypto market crash is well underway.

How to navigate the crypto market crash (without panic)

While the decline is painful, there are steps you can take to weather the storm.

Reassess your portfolio and risk tolerance

This is a good moment to ask: can you handle sharper declines? Should you adjust exposure to high-volatility altcoins? During a crypto market crash, being honest about your risk profile can save you emotional and financial strain.

Diversify and consider hedges

Diversification across cryptos and non-crypto assets can reduce crash-impact. Additionally, stablecoins or low-volatility assets may serve as a buffer while the market stabilises. When the crypto market crash hits, having a mix helps.

Focus on longer-term themes & fundamentals

While the crash may be driven by short-term waves, long-term structural themes (e.g., blockchain adoption, decentralised finance, token utility) may still hold. During a crypto market crash, those projects with stronger fundamentals may weather the storm better.

Keep an eye on support levels and key signals

If you follow crypto charts, pay attention to whether Bitcoin reclaims broken trendlines and whether altcoins hold critical zones. According to analyses of the current crash, weak volume and broken technicals are key warning flags.Monitoring these signals can help you time re-entry or reduce risk.

What could reverse the crypto market crash?

Fresh institutional inflows

Renewed institutional interest or ETF approvals could bring in fresh capital and improve sentiment. If large investors step back in, the crypto market crash may slow or reverse.

Positive regulatory clarity

If regulators provide clearer, constructive frameworks for crypto, that could remove a major overhang. A shift from fear to clarity could be a turning point in ending the crypto market crash.

Macro easing or global risk-on shift

If global economic conditions improve, risk assets often benefit. A pivot in central-bank policy or easing of trade/geopolitical tensions could help cryptocurrencies recover. In a sense, a return of risk appetite may signal the end of the crypto market crash phase.

Conclusion

The crypto market crash is real, it’s painful, and it’s driven by a mix of liquidity events, weak technicals, regulatory pressures, sentiment shifts and broad macro headwinds. Whether you hold Bitcoin or a basket of altcoins, understanding these drivers empowers you to act with awareness—not just reaction. As the market seeks its next phase, stay vigilant, stay informed, and remember this moment could be as much an opportunity as a warning. If you’re ready to dig deeper into how the crypto market crash is affecting specific altcoins, or you’d like help evaluating your portfolio’s exposure—let’s take that step together.Call to action: Don’t let the next chapter of the crypto market crash surprise you—subscribe for ale

Seemore: Crypto Market Crash Bitcoin and Altcoins Are Falling