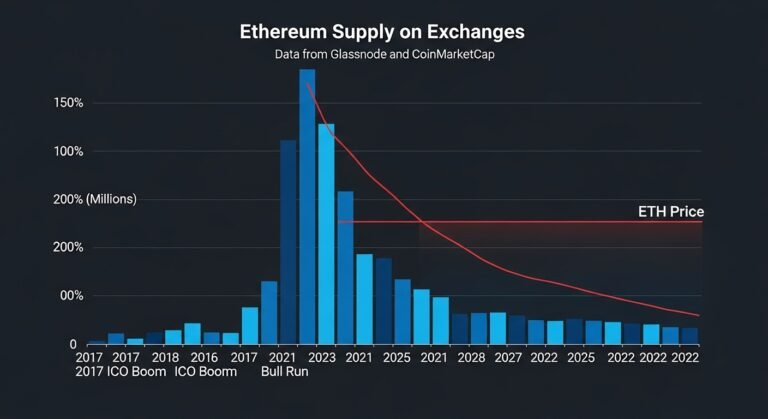

The phrase Ethereum supply on exchanges plunges rapidly refers to the amount of ETH that is held in wallets known to belong to centralized or sometimes large decentralized exchanges. Blockchain analysts track these wallets and estimate how much ETH is “available” to be traded or sold quickly.When exchange balances fall, it means more ETH is being withdrawn to non-exchange wallets. These can include hardware wallets, institutional custodians, DeFi protocols, staking pools and personal self-custody solutions. This migration of coins suggests that holders are not preparing to sell immediately but instead are positioning for longer-term strategies like yield farming, staking rewards or simply “hodling” for future price appreciation.

Exchange Supply and Market Liquidity

One of the main reasons why it matters that Ethereum supply on exchanges plunges rapidly is its direct connection to market liquidity. Liquidity refers to how easily an asset can be bought or sold without causing a large change in price.When there is plenty of ETH on exchanges, large buyers and sellers can trade more easily, and the market can absorb big orders with less slippage. However, when the amount of ETH on exchanges shrinks, the available order book gets thinner. In extreme cases, a sudden surge of demand can push prices up quickly because there is simply not enough ETH being actively offered for sale at current levels.This is why many analysts consider low exchange balances to be a possible precursor to a supply shock. While not guaranteed, periods where Ethereum supply on exchanges plunges rapidly often align with later phases of strong bull markets, especially when demand for ETH is increasing at the same time.

Why Ethereum Supply on Exchanges Is Dropping

Growth of Staking After Ethereum’s Transition to Proof of Stake

One of the biggest drivers behind the trend where Ethereum supply on exchanges plunges rapidly is the shift from Proof of Work to Proof of Stake (PoS). With PoS, ETH holders can lock up their coins to help secure the network and earn staking rewards.This has turned ETH from a purely speculative asset into a yield-bearing one. Instead of leaving ETH idle on exchanges, many holders are choosing to stake directly or via staking providers and liquid staking tokens such as stETH, rETH, and cbETH. The more ETH that is staked, the less remains freely available on exchanges.Because staked ETH is often locked or committed for longer periods, it effectively reduces circulating supply from a trader’s perspective. This is a major reason why the Ethereum ecosystem has seen its exchange balances fall as staking participation has grown.

The Rise of DeFi and On-Chain Use Cases

Another key factor behind why Ethereum supply on exchanges plunges rapidly is the expanding DeFi ecosystem. Instead of leaving ETH on centralized trading platforms, users increasingly deploy it into lending protocols, liquidity pools, yield aggregators and other on-chain financial applications.By depositing ETH into smart contracts like Aave, MakerDAO, Uniswap or Curve, users can earn interest, borrow against their holdings or provide liquidity in exchange for fees. This makes ETH far more productive on-chain than sitting in an exchange wallet.As DeFi matures and becomes more user-friendly, more ETH is drawn away from exchanges and into these on-chain opportunities. This reinforces the pattern where Ethereum supply on exchanges plunges rapidly while total locked ETH across DeFi and staking continues to rise.

Growing Preference for Self-Custody and Security

The crypto industry has also seen a noticeable shift toward self-custody and improved security practices. High-profile exchange hacks, insolvencies and regulatory uncertainty have pushed more users to hold their coins in non-custodial wallets where they control the private keys.Because of this, many investors only transfer ETH to exchanges when they actively want to trade. Otherwise, they prefer to keep their coins in cold storage or multi-sig wallets. This behavior contributes to the continuous decline in exchange balances and reinforces the idea that many ETH holders view their positions as long-term rather than short-term trades.When Ethereum supply on exchanges plunges rapidly, it can therefore reflect a combination of security awareness, regulatory caution and growing trust in self-custodial solutions like MetaMask, hardware wallets and Web3 interfaces.

What Falling Exchange Supply Could Mean for Ethereum’s Price

Reduced Sell Pressure and Potential for a Supply Squeeze

From a market dynamics perspective, one of the most discussed implications when Ethereum supply on exchanges plunges rapidly is the reduction in immediate sell pressure. If fewer coins are sitting on exchanges, it is generally harder for large holders to rapidly dump their ETH without first moving it, which adds friction and time to the process.At the same time, if new demand enters the market—for example from institutional investors, DeFi users, or retail traders—the thin supply on exchanges can magnify price movements. A sudden wave of fresh buy orders can cause Ethereum price to move higher more quickly because there is simply less ETH available at current levels.This dynamic is sometimes described as a potential supply shock. While not automatic or guaranteed, a persistent trend where Ethereum supply on exchanges plunges rapidly often strengthens the bullish narrative, especially if it coincides with rising transaction activity, growth in layer-2 networks, and wider adoption of Web3 dApps.

Impact on Volatility and Market Cycles

Another important aspect is how declining exchange balances might influence Ethereum’s volatility. In theory, a smaller pool of ETH on exchanges could lead to sharper price swings when large trades occur, because the order books are thinner. This could make short-term price moves more intense in both directions.Over longer periods, however, if more ETH is locked in staking and DeFi, it can create a form of structural support for the market. Long-term holders and stakers are often less sensitive to short-term noise and more focused on network fundamentals, fee revenue, and deflationary mechanisms like EIP-1559, which burns a portion of transaction fees.When we observe that Ethereum supply on exchanges plunges rapidly while on-chain engagement remains healthy, it may suggest that the market is transitioning from speculative trading to more fundamental-driven participation. This could gradually reduce the influence of short-term “whale dumps” and high-frequency trading on overall price trends.

Ethereum vs Bitcoin How Do Their Exchange Trends Compare?

Similarities in Shrinking Exchange Balances

Both Bitcoin and Ethereum have seen long-term declines in exchange balances as crypto matures. For Bitcoin, this has often been associated with long-term accumulation, institutional custody and adoption as a store of value.In Ethereum’s case, the story is slightly different. While long-term conviction is still a major factor, the network also provides rich utility through DeFi, NFTs, stablecoins and layer-2 scaling solutions. This means that when Ethereum supply on exchanges plunges rapidly, it reflects not just hodling, but also the active use of ETH as gas and collateral in a wide range of applications.Both assets show that as markets mature, more supply moves away from exchanges and into more specialized forms of custody or on-chain activity. This is an important signal of growing infrastructure and evolving investor behavior.

Key Differences Driven by Staking and Utility

The main difference is Ethereum’s shift to Proof of Stake, which directly rewards holders for locking up their ETH. Bitcoin does not have a native staking mechanism; instead, it relies on miners and Proof of Work.Because staked ETH cannot be instantly sold like exchange balances, it effectively tightens supply from a trader’s perspective. This makes the trend where Ethereum supply on exchanges plunges rapidly even more significant for ETH than similar trends for BTC, especially when evaluating potential supply-demand imbalances.Furthermore, Ethereum’s deep integration into stablecoin ecosystems, cross-chain bridges and layer-2 networks means that ETH can be wrapped, bridged, collateralized and used in many ways that do not require it to sit on a centralized exchange. This multiplies the channels through which ETH can leave exchange wallets and highlights why its declining exchange balance is such a critical metric to monitor.

On-Chain Metrics to Watch Alongside Exchange Supply

Active Addresses, Gas Usage and Network Fees

When analysts notice that Ethereum supply on exchanges plunges rapidly, they do not look at this metric in isolation. To get a fuller picture, they also track other on-chain metrics such as active addresses, transaction counts, gas usage and network fees.High levels of on-chain activity combined with shrinking exchange balances can be a strong bullish signal. It suggests that ETH is not only being held but also actively used for transactions, DeFi interactions and NFT trades. If, on the other hand, exchange balances fall while the network appears quiet, it could simply mean that coins are moving to cold storage without much active adoption.Network fees and gas usage further reveal how much demand there is for block space. As more layer-2 solutions like Arbitrum, Optimism and Base grow, some activity moves off mainnet, but ETH still plays a central role as the underlying asset and settlement layer.

Staking Participation and Liquid Staking Tokens

Because staking is so central to Ethereum’s PoS design, metrics around staking participation are crucial for understanding why Ethereum supply on exchanges plunges rapidly. Analysts look at the total amount of ETH staked, the number of validators, and the share of ETH locked through liquid staking protocols.Higher staking participation means a larger fraction of ETH is effectively “parked” for long periods. Liquid staking tokens add a twist by letting users earn staking rewards while still having a derivative token they can trade or use in DeFi. This creates a complex but powerful ecosystem where ETH can be economically active without sitting on exchanges.If both staking and liquid staking are growing while exchange balances keep falling, it reinforces the narrative that ETH is becoming a yield-bearing, productive asset at the core of the Web3 economy.

Risks and Caveats: It’s Not All Guaranteed Upside

A Low Exchange Balance Doesn’t Eliminate Downside

Even though it sounds bullish when Ethereum supply on exchanges plunges rapidly, it is important not to assume that price can only go up. Markets are influenced by many factors, including macro conditions, regulation, liquidity in traditional finance and sentiment across the broader crypto market.In a severe risk-off environment, even long-term holders can be forced to sell, especially if they are leveraged or using ETH as collateral. In such cases, coins can quickly flow back onto exchanges as holders prepare to exit positions. This means that exchange balances are dynamic and can increase again in times of stress.

Regulatory and Security Uncertainties

Another factor to consider is regulatory risk. If new regulations target exchanges, staking services or DeFi platforms, it could change how and where ETH is held. Sudden rule changes could encourage more coins to move back onto compliant exchanges or, alternatively, push even more into decentralized protocols and self-custody.Security incidents, such as major hacks or smart contract vulnerabilities, can also alter the flow of ETH. When users lose trust in certain platforms, they may rush to move funds, causing short-term spikes or drops in exchange balances.Therefore, while the trend where Ethereum supply on exchanges plunges rapidly is an important signal, it should always be interpreted alongside a broader understanding of the market, regulation and security landscape.

How Traders and Investors Can Use This Information

Long-Term Investors

For long-term investors, seeing that Ethereum supply on exchanges plunges rapidly can reinforce a thesis that ETH is becoming scarcer on trading venues, particularly as staking and DeFi grow. This may encourage a strategy focused on gradual accumulation, staking participation and long-term holding, rather than frequent short-term trades.Long-term holders often combine exchange balance data with other indicators such as realized price, holder age bands, and macro trends to build a more complete picture. If these all point toward increasing conviction and limited selling, the case for long-term exposure can appear stronger.

Active Traders and Short-Term Participants

Short-term traders can also benefit from tracking exchange balances. When they notice that Ethereum supply on exchanges plunges rapidly while demand appears to be rising, they may anticipate higher volatility and potential upside breakouts.However, traders also need to be cautious. Thin order books can cut both ways, amplifying downside moves just as much as upside. Using risk-management tools like stop losses, sensible position sizing and attention to broader market sentiment remain essential.Many traders now incorporate on-chain metrics into their technical analysis and fundamental analysis, viewing Ethereum’s exchange balances as one layer of insight alongside price charts, funding rates and derivatives data.

The Bigger Picture: Ethereum as a Scarce, Productive Asset

As the ecosystem matures, Ethereum is increasingly viewed not just as a speculative token but as a scarce, productive asset that powers a vast digital economy. The consistent trend where Ethereum supply on exchanges plunges rapidly tells a story of holders who are more inclined to stake, build, lend and use ETH rather than simply trade it.Combined with features like the EIP-1559 fee burn, which can reduce net issuance under high network usage, this shrinking exchange supply feeds into the narrative of ETH as a potentially deflationary, high-utility asset. While nothing is guaranteed, the structural forces pulling ETH away from exchanges—and into staking, DeFi and self-custody—are likely to continue shaping its long-term supply-demand balance.

Conclusion

The fact that Ethereum supply on exchanges plunges rapidly is far more than a passing headline. It reflects deep and structural changes in how ETH is used, stored and valued within the evolving crypto landscape. As more coins move into staking, DeFi protocols and secure self-custody, the amount of ETH readily available for quick sale on exchanges shrinks.This can reduce immediate sell pressure, increase the potential for supply squeezes when demand spikes, and align Ethereum more closely with the behavior of scarce, yield-bearing assets. However, it does not remove risk or guarantee nonstop price appreciation. Macroeconomic conditions, regulation, security issues and shifting market sentiment can still have strong effects on ETH’s trajectory. For both long-term investors and active traders, understanding why Ethereum supply on exchanges plunges rapidly and how it interacts with other on-chain metrics is essential. It offers a window into the underlying health, maturity and adoption of the Ethereum ecosystem—and provides powerful context for making more informed decisions in an increasingly data-driven crypto market.

FAQs

Q:- Why is Ethereum supply on exchanges plunging rapidly?

Ethereum supply on exchanges plunges rapidly mainly because more ETH is being moved into staking, DeFi protocols and self-custody wallets. As Ethereum’s Proof of Stake design rewards holders for locking up their coins, many prefer to earn staking rewards rather than keep ETH idle on trading platforms. Additionally, the growth of DeFi, where ETH is used as collateral and liquidity, and the rise of self-custody due to security and regulatory concerns, all contribute to a sustained decrease in exchange balances.

Q:-Does a lower Ethereum exchange balance always mean the price will go up?

No, a lower Ethereum exchange balance does not guarantee that price will rise, even though it can be a bullish signal. When Ethereum supply on exchanges plunges rapidly, it indicates reduced immediate sell pressure and the possibility of a supply squeeze if demand increases. However, broader factors like macroeconomic conditions, risk sentiment, regulation and overall crypto market performance can still push prices down, even in a low-supply environment.

Q:-How can I track Ethereum supply on exchanges myself?

You can track the trend where Ethereum supply on exchanges plunges rapidly using on-chain analytics platforms that identify exchange wallets and aggregate their balances. These platforms usually display charts showing exchange inflows and outflows, total holdings on exchanges, staking participation and other metrics like active addresses, gas usage and network fees. By watching how these metrics evolve together, you can gain a deeper understanding of Ethereum’s underlying market structure and sentiment.

Q:-What is the role of staking in reducing Ethereum exchange supply?

Staking plays a major role in the pattern where Ethereum supply on exchanges plunges rapidly. Under Proof of Stake, ETH holders lock up their coins to help secure the network and earn yield. This process takes ETH out of circulation, at least in the short to medium term. Staked ETH is not immediately available for sale on exchanges, especially when locked in staking contracts or pooled via staking providers and liquid staking tokens. As staking participation grows, more ETH leaves exchanges, tightening available supply for traders.

Q:- Is it safer to keep Ethereum on exchanges or in self-custody?

Whether it is safer to hold ETH on exchanges or in self-custody depends on your experience and risk tolerance. Many people move ETH off exchanges into hardware wallets or non-custodial wallets, which is one reason why Ethereum supply on exchanges plunges rapidly over time. Self-custody gives you direct control over your assets but requires careful management of private keys and backups. Exchanges can offer convenience and some security measures, but they also carry risks related to hacks, insolvency or withdrawal restrictions. For many users, a balanced approach—using exchanges for active trading and self-custody for long-term holdings—can be a sensible strategy.