Maybe you’re considering taking a break from the cryptocurrency market, need cash for personal expenditures, or would like to secure some of your Bitcoin profits. Regardless, maximizing your profit from a Bitcoin sale requires familiarity with cashing out your holdings. A lot depends on whatever Bitcoin withdrawal method you use.

Every Bitcoin transaction method has advantages and disadvantages, whether you like the security of a P2P deal, the ease of a centralized exchange, or the anonymity of Bitcoin ATMs. This tutorial outlines the main methods and provides advice on how to trade securely to assist you in choosing the best way to sell Bitcoin.

Direct Selling via Exchanges

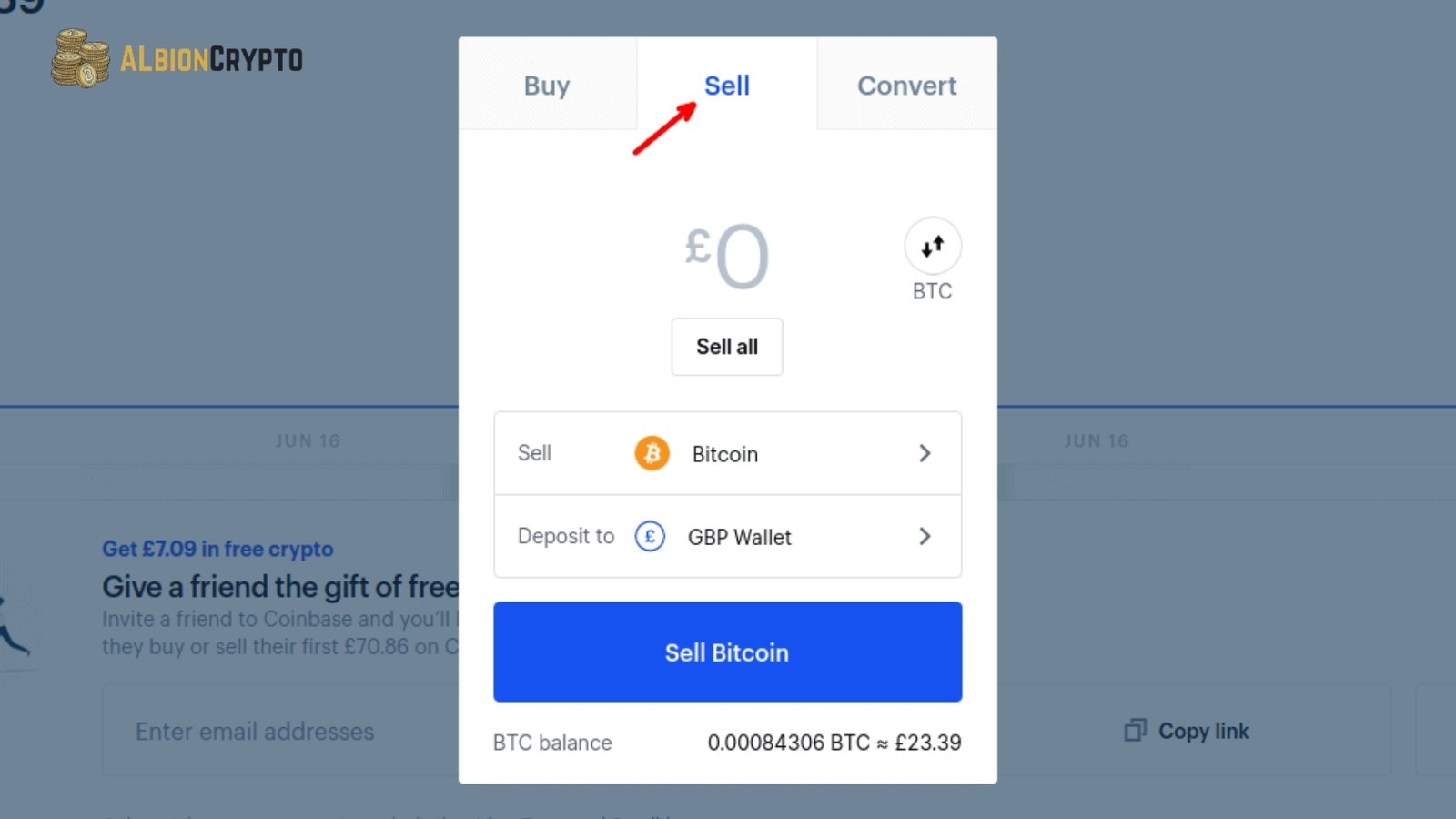

You can sell your Bitcoin easily on centralized exchanges such as Binance, Coinbase, and Kraken. Here is how to withdraw Bitcoin from your holdings. Joining an exchange is the first step. Know Your Customer (KYC) procedures necessitate submitting identification documents and evidence of residence. Put Bitcoin into your exchange wallet when verification is complete. You can easily find a “Sell” button on most sites to sell your Bitcoin. You can sell it at market price or set your price.

After you sell, you will have fiat money in your account. Depending on the exchange, there are several ways to withdraw the money.

- Bank transfer: Most exchanges, like Coinbase and Kraken, allow you to transfer fiat directly to your bank account. This is the most straightforward method, though processing times and fees vary. For example, Coinbase charges about 1.5% for fiat withdrawals, while Kraken’s fees may be lower, depending on your country. With a bank transfer, the funds move through the traditional banking system via an automated clearing house, wire transfer or the Single Euro Payments Area (SEPA).

- Debit card withdrawals: Some exchanges, like Binance, offer withdrawals directly to a debit card. Debit card networks such as Visa and Mastercard handle the withdrawal, making it faster than bank transfers but sometimes at a higher cost.

- Third-party payment services: Exchanges often integrate services like PayPal or SEPA for users in certain regions. PayPal is especially popular for fast, low-cost withdrawals, but not all platforms support it. SEPA transfers are a common option in Europe and are typically low-cost.

- P2P withdrawal: Some platforms, like Binance, also offer a P2P service through which you can sell Bitcoin to other users for local fiat currencies. You choose a buyer, and once the payment is confirmed, Binance releases the BTC. It’s a bit more hands-on but offers flexibility, especially if you prefer payment methods like cash or bank transfer outside the exchange. There will be more on this withdrawal method later.

Verify the rates and limitations on withdrawals. Binance is one platform that provides minimal trading costs (as low as 0.1%), yet different withdrawal methods have different rates. Using exchanges securely is of the utmost importance. Always use two-factor authentication to secure your account further, and only use reputable, long-standing platforms. It is wise to transfer cash from the exchange to a safe wallet once a sale is finalized if you do not engage in regular deals.

To increase security and prevent breaches, centralized cryptocurrency exchanges generally keep many of their users’ crypto assets in cold storage, offline wallets that aren’t linked to the internet. To protect user money, Binance allegedly stores over 90% of its cash in cold storage.

P2P Platforms

Instead of a centralized exchange, you may sell Bitcoin to other users on specialized platforms like Paxful and LocalBitcoins. Some centralized exchanges also include P2P portals. On a P2P site, selling Bitcoin is a rather easy procedure. You may start selling Bitcoin after signing up and verifying your identity. Here’s a step-by-step breakdown:

- Finding buyers: You create an offer that specifies the amount of Bitcoin you’re selling, the price, and the payment method. Buyers browse through available offers and choose when to initiate trades. Alternatively, you can browse buyers’ requests and agree to their terms.

- Payment methods: P2P platforms offer various payment methods, including bank transfers, mobile payments, gift cards, and cash in person. The flexibility in payment options is one of the biggest draws of P2P platforms.

- Escrow system: Once a buyer agrees to your offer, the platform locks your Bitcoin in an escrow account while the buyer sends the payment. This protects both parties. After the payment is confirmed, you release the Bitcoin to the buyer, completing the transaction.

By allowing you to trade with minimum Know Your Customer (KYC) and a range of payment options, including PayPal, cash, or gift cards, P2P sales provide more privacy and freedom than centralized exchanges. Excessive exchange costs can also be avoided. It is critical to always trade with confirmed purchasers because the potential for fraud is increased, particularly when using reversible payment methods such as PayPal. Platform fees may be cheap, but additional fees are associated with some payment methods, and processing times may increase while you wait for purchases and funds to clear.

Bitcoin ATMs

You may purchase or sell Bitcoin for cash at physical kiosks called Bitcoin ATMs. If dealing with cash is more convenient for you than going via conventional banking channels, they are a good choice to consider. The procedure is simple: find an ATM, scan the QR code of your wallet, transmit Bitcoin, and then you will receive cash after the transaction is verified.

Use a tool like Coin ATM Radar, which shows you where Bitcoin ATMs are located, to locate one in your neighbourhood. After you locate one, the next step is to validate your identity and the amount of Bitcoin you wish to sell. Note that the majority of ATMs impose daily limitations.

Bitcoin ATMs’ primary benefit is how convenient they are. There is no need to wait for bank transfers to acquire the money you need. On the negative side, fees might sometimes be somewhat high—up to 15%. If you need cash quickly, an ATM is a good choice. However, you might want to explore elsewhere to sell a lot or avoid paying fees.

Vancouver, Canada’s coffee shop, was the first to have a Bitcoin ATM installed in 2013. Since then, the number of Bitcoin ATMs has grown exponentially, with over 35,000 machines in 75+ countries!

Over-the-counter Trading

Without the involvement of intermediaries like brokers or specialized services, buyers and sellers engage in what is known as over-the-counter (OTC) trading. Unlike public exchanges, one advantage of over-the-counter (OTC) negotiations is that they do not impact the market price. This makes them a good choice for managing huge Bitcoin transactions.

One major perk of over-the-counter trading is that it allows you to sell a lot of Bitcoin without letting the price sink. For instance, your return may be reduced if you sell a significant number of Bitcoin on a standard exchange, which might cause the price to fall. Over-the-counter (OTC) desks offer a more regulated setting, guaranteeing a discreet and efficient execution of your deal.

Major exchanges like Binance and Coinbase Prime have specialist desks for high-volume traders, allowing them to access over-the-counter services. These marketplaces put you in touch with big vendors and buyers, and they usually even provide you with a personal broker to help you through the deal.

Although it varies per platform, the minimum trade amount for over-the-counter transactions usually begins at $50,000. Traders who transfer $100,000 can use Kraken’s over-the-counter facility, whereas Binance has a $10,000 minimum deal.

Unregulated trade has certain dangers. Due to the lack of transparency compared to public exchanges, it is crucial to collaborate with a trustworthy broker to safeguard yourself against fraud. Before moving forward, you should complete your research since prices could fluctuate somewhat based on market rates, and liquidity can change based on deal size.

The biggest known over-the-counter Bitcoin deal occurred in 2013, with an anonymous buyer allegedly buying 194,000 BTC for around $147 million. That deal would be worth billions if it happened now!

Selling Bitcoin for Goods and Services

When you use Bitcoin as a payment mechanism, which is gaining popularity, you may spend Bitcoin (BTC) without turning it into fiat money. Thanks to all the websites and companies that take Bitcoin, you can buy just about anything with it. Many well-known businesses, including Overstock, Microsoft, AT&T, and others, accept Bitcoin as a payment option. Gift cards to popular stores and services like Uber, Airbnb, and Amazon may easily be purchased using Bitcoin on platforms like Bitrefill.

Avoiding the trouble and costs of converting Bitcoin to currency is a big benefit of using it directly. By doing so, you are also contributing to the larger trend of using cryptocurrency as a standard form of payment. Spending Bitcoin instead of selling it could be a better tax plan in some areas because you won’t have to pay taxes on capital gains.

The amount of Bitcoin you spend now may be worth more tomorrow due to the volatile volatility. But if you’d rather spend your Bitcoin than cash it out, you’re in luck: more and more businesses are starting to accept it.

Converting Bitcoin to Stablecoins

To avoid losing your Bitcoins to fiat currency, you may convert them to stablecoins like USDt or USD Coin. The price of stablecoins, a type of digital currency, is rather constant since it is tethered to the value of more traditional assets, such as the dollar. So, they are a good alternative if you want to stay in the crypto market but don’t want to risk Bitcoin’s volatility.

One major perk of transferring to stablecoins is the ability to protect your Bitcoin investment from price swings by locking in its present value. If the price of Bitcoin were to fall, for instance, your stablecoins would retain their value, allowing you to reinvest when conditions are better. You may trade other cryptocurrencies using stablecoins or transfer cash between exchanges without converting to currency.

You may utilize the majority of major exchanges to convert Bitcoin to stablecoins. It is an easy process: After funding your Bitcoin wallet, you may choose a stablecoin (USDT or USDC) and complete the deal. Offering stability and flexibility during times of market volatility, stablecoins are readily available and can be converted back to Bitcoin or other cryptocurrencies when you’re ready.

Best of Luck with your Trade!

Because the tax consequences of selling Bitcoin might differ greatly from nation to country, it is necessary to know them. Bitcoin is considered property in the United States and is liable to capital gains tax upon sale. You must include in your tax return the amount by which the purchase price is less than the sale price.

On the other hand, Germany takes a more supportive stance, encouraging long-term ownership by offering tax-free profits for Bitcoin holdings beyond one year. Even though capital gains tax applies to Bitcoin in Australia, you can deduct losses from other investments from your earnings when you sell Bitcoin. Also, the reporting standards are different. Coinbase and similar US exchanges may provide a 1099 form to assist you with your tax filings.

Still, in Japan, sales of Bitcoin are classified as “miscellaneous income,” necessitating a distinct method of reporting. It would be best to prioritise generating earnings while avoiding fees and considering tax implications. Selling at the right time is essential. Keep an eye on the market for favourable circumstances and avoid Bitcoin ATMs and other high-fee alternatives whenever you can. Choose a low-fee exchange like Kraken or Binance, and always use two-factor authentication to ensure your transactions are safe.