The Expand Bitcoin Holdings news cycle had the most remarkable support as the BTC price climbed. Marathon Digital Holdings (MARA) has successfully raised $1 billion through a record 0% convertible senior notes offering due to maturity in 2030.

The corporation’s main objectives are to deploy the capital in one way and, among others, to increase its Expand Bitcoin Holdings (BTC) holdings, debt repayment, and corporate activities. So, this strategic approach demonstrates that the market remains highly confident from the point of view of Bitcoin’s record-high price of $98,000.

AI and ML in Education Supporting and Engaging Students

Almost all of the $980 million net proceeds from the IPO are expected to be spent by Marathon on acquiring more Bitcoin. The company has, however, a market capitalization of $2.52 billion, and its money is worth 25,945 BTC. Moreover, Marathon’s newfound cryptocurrency hype ties in with its long-term plan of beating other firms and thus becoming a top-tier crypto leader. The impressive market news of Bitcoin was indeed a part of the improvement.

Aside from this, a repurchase of $199 million of convertible notes due to be redeemed in 2026 is also part of the financial restructuring move. Marathon plans to go through diversification and better capital allocation to maximize shareholder value. This move only supports their self-confidence in the upcoming years of Bitcoin price growth.

They are getting the most significant market share and rising in Marathon Digital, which has previously been the second-largest Expand Bitcoin Holdings public companies. Other companies that already have the cryptocurrency in their wallet are MicroStrategy and others that have ramped up the number of Bitcoins and intensified the contest. However, BTC’s bullish run is still far from over; the company still creates a bullish environment, and the investors will strike with high profits.

MARA Sets Record in Bitcoin Mining Capital

The senior notes are convertible notes that investors can repay in cash, shares, or a combination of both, depending on their appetite. In this view, the terms are desirable to investors, and at the same time, they give Marathon a high degree of operational flexibility. Marathon can redeem at the total value with interest accrued, settle in part at the principal value, or pay only the accrued interest.

Marathon’s success in the BTC mining industry, achieved by huge capital from outside BTC mining firms, tells a story for the entire Bitcoin mining industry. This flexibility could potentially motivate more institutional investors to Marathon and help the company be one of the most successful in the market. Besides, the company holds a different view on growing financially while practicing discipline.

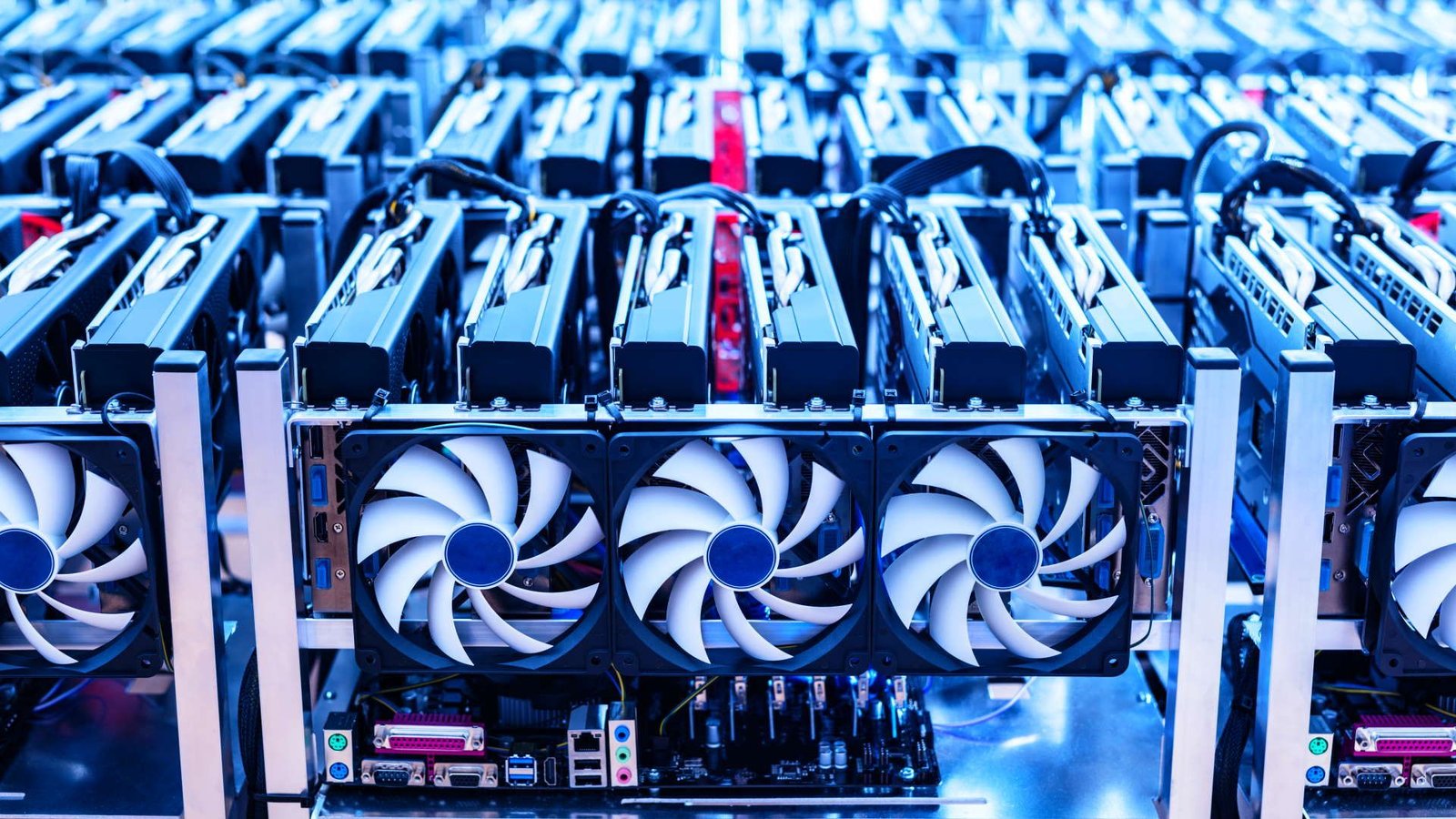

Marathon said it has obtained $1 billion, which will help it achieve its goal to purchase Bitcoin and improve operational efficiencies. A 93% growth in hash rate over the past month sparks a major increase in their mining capability. The increase in hash rate exemplifies better mining capabilities. These stronger operations, in turn, may translate into Marathon’s long-term profitability.

Public Companies Ride BTC’s Bullish Momentum

The news concerning Marathon’s decision to add to its BTC reserves indicates a more significant trend of companies accumulating the cryptocurrency as the bull market progresses. Recently, MicroStrategy issued $1.75 billion in convertible notes to beef up its cryptocurrency stash. Besides, a critical case of such developments is how this has led to the growth of MicroStrategy’s value and the evolution of the market power, which has been remarkably aggressive.

In the same way, there is always a need in business. Still, Bitcoin’s many times hitting record highs recently made investors more optimistic, causing some to buy exchanges and invest in related companies. Big firms like Marathon and MicroStrategy absorb this to reach long-term growth. Meanwhile, those who contribute to this vibrant trend, namely the institutional players, will be the beneficiaries and will also show up on the radar of such an approach.

Final Thought

Marathon Expand Bitcoin Holdings‘ $1 billion zero-coupon convertible notes offering represents a pivotal moment in the institutionalization of Bitcoin as a corporate treasury asset. This bold financial maneuver—deploying nearly all proceeds to acquire more BTC while the price hovers near $98,000—signals unwavering confidence in Bitcoin’s long-term trajectory despite short-term price volatility risks.

The strategic brilliance lies in the dual benefit: Marathon not only expands its Bitcoin holdings to compete with MicroStrategy’s dominance but also restructures its debt by retiring $199 million in 2026 notes, improving its capital efficiency. The 93% hash rate growth demonstrates operational strength backing this financial aggression.

FAQs

How much did Marathon Digital raise and what will they do with it?

Marathon Digital Holdings raised $1 billion through 0% convertible senior notes due in 2030. Nearly all of the $980 million in net proceeds will be used to acquire more Bitcoin, with an additional $199 million allocated to repurchase convertible notes maturing in 2026.

How large is Marathon’s current Bitcoin holdings?

Marathon currently holds 25,945 BTC with a market capitalization of $2.52 billion. This makes them the second-largest public company Bitcoin holder, trailing behind MicroStrategy.

What are convertible senior notes and why are they at 0%?

Convertible senior notes are debt instruments that investors can convert into cash, shares, or a combination of both at maturity. The 0% interest rate makes them attractive because it gives Marathon flexibility without ongoing interest payments, while investors benefit from potential upside through conversion to equity.

How has Marathon’s mining capability improved recently?

Marathon has achieved a 93% growth in hash rate over the past month, significantly boosting their mining capabilities. This operational improvement strengthens their ability to mine Bitcoin more efficiently and supports their long-term profitability.

Why are companies like Marathon accumulating Bitcoin now?

With Expand Bitcoin Holdings near $98,000 and the ongoing bull market momentum, companies like Marathon and MicroStrategy view Bitcoin as a strategic treasury asset. They’re confident in Bitcoin’s long-term growth trajectory and are positioning themselves as leaders in the institutional cryptocurrency space.