Massive US Storm Forces Bitcoin Miners Offline Explained extreme weather events are no longer rare disruptions but recurring realities that increasingly intersect with global infrastructure, including digital systems once thought to be immune to physical forces. Recently, a massive US storm forced Bitcoin miners offline, triggering widespread discussion across the crypto market. For many investors and long-term participants, this raised an urgent question: what does this actually mean for Bitcoin holders?

Bitcoin is often described as a decentralized and resilient network, designed to function without reliance on any single country, company, or server. However, mining operations are physical by nature, relying on electricity, data centers, and stable environmental conditions. When a powerful storm sweeps through regions hosting significant mining capacity, the effects can ripple through the network, at least temporarily.

We will explores the situation in depth, analyzing how and why a massive US storm forces Bitcoin miners offline, how the Bitcoin network responds, and what implications this has for Bitcoin holders. By examining mining mechanics, network resilience, market psychology, and long-term fundamentals, this analysis provides clarity amid uncertainty and helps investors understand whether such events pose a genuine threat or simply short-term noise.

Massive US Storm Forces Bitcoin Miners

Bitcoin mining is the process by which transactions are validated and added to the blockchain. Miners use specialized hardware to solve cryptographic puzzles, competing to add new blocks to the network. In return, they receive block rewards and transaction fees. This system secures the network and ensures its decentralized nature.

Despite Bitcoin being digital, mining is grounded in physical reality. Mining farms require massive amounts of electricity, cooling systems, stable internet connections, and secure facilities. When a massive US storm forces Bitcoin miners offline, it disrupts these physical requirements, temporarily removing hashing power from the network.

Why the United States Plays a Major Role in Bitcoin Mining

Over the past several years, the United States has become one of the largest hubs for Bitcoin mining. Factors such as relatively cheap energy, regulatory clarity in certain states, and access to advanced infrastructure have attracted large-scale mining operations. As a result, a significant portion of the global Bitcoin hash rate is concentrated in specific US regions.

This concentration means that severe weather events can have noticeable short-term effects on the network. When storms disrupt power grids or force facilities to shut down for safety reasons, the impact becomes visible in network metrics and market sentiment.

How a Massive US Storm Forces Bitcoin Miners Offline

Power Outages and Grid Instability

One of the most immediate effects of a major storm is widespread power outages. High winds, flooding, snowstorms, or hurricanes can damage transmission lines and overwhelm local power infrastructure. Mining facilities, which consume large amounts of electricity, are often among the first to be shut down during grid emergencies.

When a massive US storm forces Bitcoin miners offline due to power loss, the network experiences a sudden drop in active mining power. This does not halt Bitcoin entirely, but it does slow block production until the system adjusts.

Safety Shutdowns and Operational Precautions

In many cases, miners proactively shut down operations before or during severe weather events. Protecting expensive mining hardware is a priority, as water damage, overheating, or electrical surges can cause permanent losses. These precautionary shutdowns are part of responsible operational management.

While these actions reduce immediate risk for mining companies, they contribute to a temporary reduction in network hash rate. For Bitcoin holders observing from the outside, this can appear alarming without proper context.

Immediate Effects on the Bitcoin Network

Hash Rate Decline and Network Adjustment

When a massive US storm forces Bitcoin miners offline, one of the first observable effects is a decline in the total network hash rate. Hash rate represents the combined computational power securing the network. A sudden drop may raise concerns about security or performance.

However, Bitcoin’s protocol is designed to adapt. The difficulty adjustment mechanism recalibrates mining difficulty approximately every two weeks. If miners go offline and blocks are produced more slowly, difficulty eventually decreases, making it easier for remaining miners to find blocks. This self-correcting feature is a cornerstone of Bitcoin’s resilience.

Block Times and Transaction Confirmations

In the short term, reduced hash rate can lead to longer block times. This means transactions may take slightly longer to be confirmed, especially during periods of high network activity. For everyday users and holders, this may result in temporary delays or higher transaction fees.

It is important to note that these effects are typically short-lived. Once power is restored and miners return online, block times normalize, and network performance stabilizes.

What This Means for Bitcoin Holders in the Short Term

Market Sentiment and Price Volatility

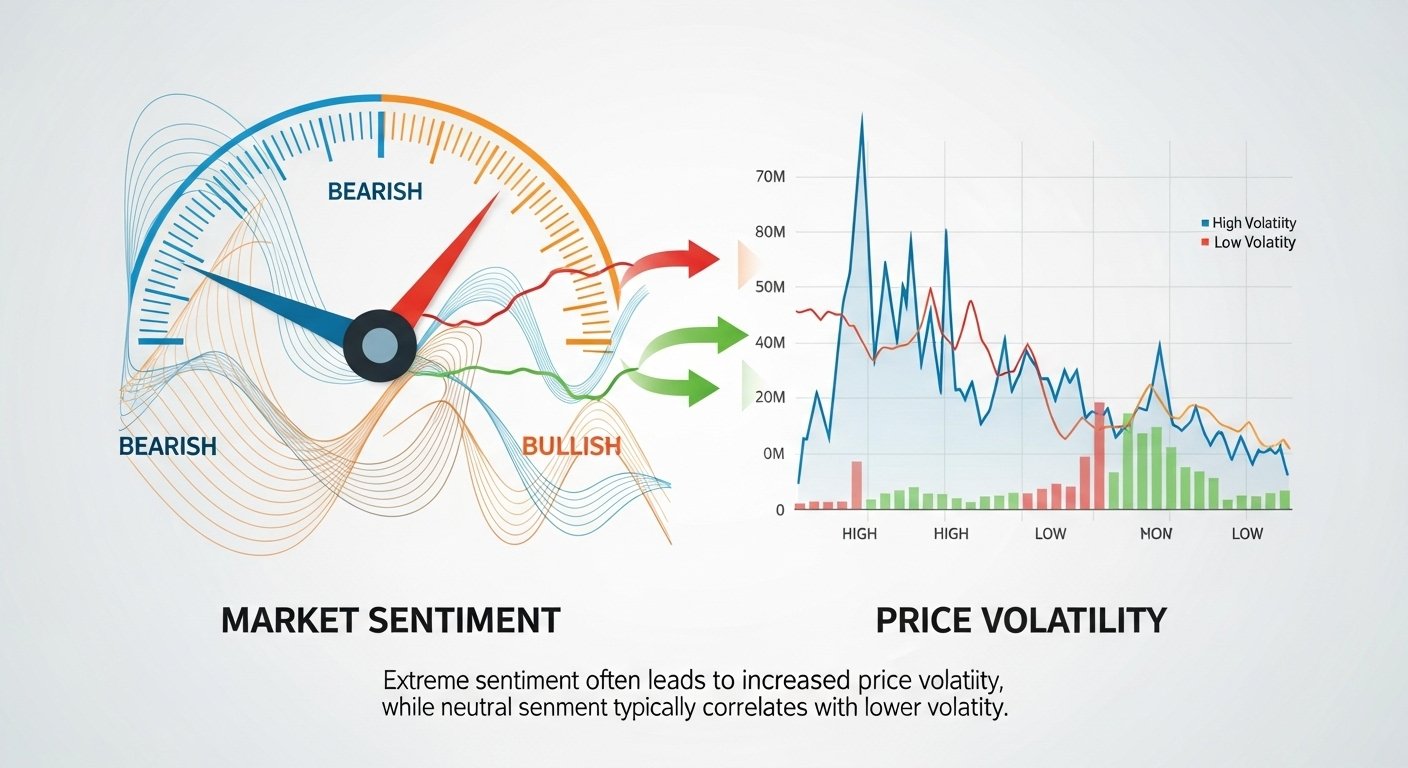

News that a massive US storm forces Bitcoin miners offline can influence market sentiment, particularly among less experienced investors. Headlines highlighting reduced hash rate or operational disruptions may trigger fear, uncertainty, and doubt, leading to short-term price volatility.

For Bitcoin holders, this volatility can be unsettling, but it is often driven more by perception than by fundamental changes to the network. Historically, similar events have resulted in temporary price fluctuations rather than long-term downturns.

Network Security Concerns Explained

A common fear is that reduced hash rate makes Bitcoin more vulnerable to attacks. While it is true that a lower hash rate theoretically reduces the cost of attacking the network, the scale of Bitcoin’s remaining hash power is still enormous even after significant disruptions.

Moreover, attacks such as a 51 percent attack require sustained control over the majority of hash power, which remains extremely difficult and expensive. For holders, understanding this context helps separate realistic risks from exaggerated fears.

Long-Term Implications for Bitcoin’s Decentralization

Geographic Distribution of Mining

Events where a massive US storm forces Bitcoin miners offline highlight the importance of geographic diversification. While concentration in energy-rich regions offers efficiency, it also exposes the network to localized risks.

Over time, such disruptions encourage miners to diversify locations, invest in more resilient infrastructure, or explore alternative energy sources. This gradual shift can strengthen Bitcoin’s decentralization and reduce future vulnerability to regional events.

Resilience Through Redundancy

Bitcoin’s design assumes that failures will occur. Nodes go offline, miners shut down, and external shocks happen. What matters is that no single failure can bring the system down. The ability of the network to continue functioning despite large-scale disruptions reinforces its long-term robustness.

For Bitcoin holders, these events serve as real-world stress tests that demonstrate the network’s capacity to endure and recover.

Energy, Climate, and the Future of Bitcoin Mining

Weather Extremes and Infrastructure Planning

As climate patterns become more extreme, mining companies must adapt. Flood-resistant facilities, diversified energy sources, and improved grid coordination are increasingly important. When a massive US storm forces Bitcoin miners offline, it underscores the need for long-term infrastructure planning.

Mining operations are already exploring ways to integrate renewable energy, flexible load management, and mobile mining units that can relocate during emergencies. These innovations aim to reduce downtime and environmental impact simultaneously.

The Role of Sustainable Mining Practices

Extreme weather events also reignite discussions about Bitcoin’s energy consumption. Critics often argue that mining strains power grids during crises. In response, many mining companies emphasize their role as flexible energy consumers that can shut down quickly when needed.

This flexibility can actually support grid stability during emergencies. Over time, sustainable mining practices may become a competitive advantage, benefiting both the network and local communities.

Historical Perspective on Mining Disruptions

Past Events and Market Reactions

Bitcoin has faced numerous disruptions throughout its history, including regulatory crackdowns, hardware shortages, and previous weather-related shutdowns. Each time, the network adjusted and continued to operate.

Looking at historical data, temporary hash rate drops have not derailed Bitcoin’s long-term trajectory. For holders, this perspective is crucial when evaluating the significance of current events.

Lessons Learned for Investors

The recurring pattern is clear. Short-term disruptions create noise, but long-term fundamentals remain intact. Understanding this pattern helps investors maintain discipline and avoid emotional decision-making during periods of uncertainty.

Should Bitcoin Holders Be Concerned?

Distinguishing Short-Term Noise From Long-Term Value

When a massive US storm forces Bitcoin miners offline, the immediate effects can seem dramatic. However, these events rarely alter Bitcoin’s underlying value proposition. Scarcity, decentralization, and censorship resistance remain unchanged.

For long-term holders, the key is to focus on fundamentals rather than headlines. Temporary operational disruptions do not equate to systemic failure.

Opportunities Hidden in Volatility

Periods of uncertainty often create opportunities. Market overreactions can lead to price dips that some investors view as entry points. While strategies vary, understanding the true impact of mining disruptions allows holders to make informed decisions rather than reactive ones.

Conclusion

The event where a massive US storm forces Bitcoin miners offline serves as a powerful reminder that even digital systems are influenced by physical realities. Power outages, safety shutdowns, and infrastructure challenges can temporarily reduce mining activity, affecting hash rate and market sentiment.

However, Bitcoin’s design is built for resilience. Difficulty adjustments, decentralized participation, and global distribution ensure that the network continues to function and recover. For Bitcoin holders, these events are less a cause for alarm and more a demonstration of the system’s ability to withstand real-world stress.

In the broader context, such disruptions may even strengthen Bitcoin by encouraging better infrastructure, greater geographic diversification, and more sustainable mining practices. Understanding these dynamics helps holders navigate uncertainty with confidence and clarity.

FAQs

Q: Why does it matter when a massive US storm forces Bitcoin miners offline?

It matters because mining is essential to securing the Bitcoin network. When miners go offline, hash rate temporarily drops, which can affect block times and market sentiment. However, the network is designed to adjust and recover, limiting long-term impact.

Q: Does a drop in hash rate make Bitcoin unsafe for holders?

A temporary drop in hash rate does not make Bitcoin unsafe. Even after significant disruptions, the remaining hash power is still extremely high, and Bitcoin’s difficulty adjustment mechanism helps maintain security over time.

Q: Can extreme weather events permanently damage Bitcoin mining operations?

While individual facilities may suffer losses, the network as a whole is resilient. Miners can relocate, rebuild, or upgrade infrastructure. Extreme weather highlights risks but does not threaten Bitcoin’s long-term viability.

Q: How should Bitcoin holders react to news about miners going offline?

Bitcoin holders should focus on long-term fundamentals rather than short-term headlines. Understanding how the network adapts helps prevent emotional reactions and supports more informed decision-making.

Q: Will climate-related disruptions become more common for Bitcoin mining?

As extreme weather events increase, disruptions may occur more frequently. However, mining companies are adapting through better infrastructure, energy diversification, and flexible operations, which can reduce future impact on the network.