Michael Saylors Bitcoin last few years, Michael Saylor’s strategy has been one of the boldest experiments in corporate finance. Through his company, now branded as Strategy (formerly MicroStrategy), he transformed a traditional analytics business into the world’s most aggressive corporate Bitcoin treasury. Instead of parking excess cash in bonds or staying defensive, the company went all in on a long-term Bitcoin accumulation strategy, turning itself into a kind of high-octane Bitcoin proxy stock.As of late 2025, Strategy controls about 650,000 BTC, roughly 3% of all Bitcoin that will ever exist, making it the largest corporate Bitcoin whale on the planet. For years, Michael Saylor repeated a simple motto: never sell Bitcoin.

That mantra became central to the company’s identity and to the wider Bitcoin HODL strategy culture. But the tone has shifted. A severe downturn in the crypto market, heavy leverage, and growing scrutiny pushed Strategy’s CEO, Phong Le, to admit that under specific crisis conditions, the company might sell part of its Bitcoin stockpile. This admission has sent a shockwave through markets that had assumed Saylor’s “never sell” stance was absolute.So, is this just sensible risk management language, or is Michael Saylor’s strategy edging closer to actually selling Bitcoin? To answer that, we need to examine how the strategy was built, how fragile it has become under stress, and what new signals are really telling us.

How Michael Saylor’s Bitcoin Strategy Took Over His Company

Michael Saylors Bitcoin first started buying BTC in 2020, it was a mid-sized business intelligence and analytics firm generating steady but unexciting software revenues. Saylor argued that holding large cash reserves in a world of high money printing and low interest rates was irrational. In his view, fiat currencies were melting ice cubes, and Bitcoin as digital gold offered better long-term preservation of value.

From that logic grew a radical Bitcoin treasury strategy. Instead of simply diversifying into Michael Saylors Bitcoin made the centerpiece of its balance sheet. The company used equity offerings, convertible notes, and later preferred stock to raise capital, which it then converted into Bitcoin. As BTC rallied, Strategy’s stock tended to surge even more, letting it raise additional capital at higher valuations. That capital loop fueled further Bitcoin purchases, deepening its role as a leveraged, publicly traded Bitcoin holder.Over time, theMichael Saylors Bitcoin traditional analytics business became almost a side note. Revenue from software still exists and remains meaningful, but the market now mainly prices Strategy based on its BTC exposure and the perceived future of Bitcoin price appreciation.

How Big Is Strategy’s Bitcoin Stockpile Today?

Michael Saylors Bitcoin holdings is crucial to understanding why its decisions matter so much. According to recent disclosures referenced by multiple outlets, Strategy now holds around 650,000 BTC, worth tens of billions of dollars even after the latest drawdown.

These holdings were built through a relentless series of buys during both bull runs and brutal drawdowns. Earlier in 2025, for example, the company continued to acquire Bitcoin as prices climbed to an all-time high and then retreated, reinforcing its image as a committed long-term Bitcoin buyer.Michael Saylors Bitcoin The firm’s average purchase price has risen over time as it continued to buy during higher market levels, but the overall bet is still anchored in a belief that Bitcoin’s long-term value will eclipse current and even previous peak prices. That belief is what underpins Michael Saylor’s strategy of using debt and equity to amplify exposure to BTC.

The “Never Sell” Philosophy and the Bitcoin-Maximalist Identity

Michael Saylors Bitcoin , Saylor’s public stance was unambiguous. He described Bitcoin as “perfect money” and repeatedly insisted that you do not sell your Bitcoin. On social media and in interviews, he promoted a strict HODL mindset, portraying BTC as an intergenerational asset you accumulate and pass down, not something you flip for short-term gains.This Bitcoin maximalist viewpoint did more than attract attention. It helped position Strategy as the ultimate institutional Bitcoin conviction play. While other corporations might hold a modest allocation, Saylor’s firm appeared to have crossed a one-way bridge, turning into a permanent, ultra-bullish Bitcoin treasury.

Importantly, on-chain analysis and public filings showed that from 2020 up through much of 2025, the company had never sold a single Bitcoin. Even during severe crashes and periods where its Michael Saylors Bitcoin BTC position showed massive unrealized losses, the holdings remained intact.This track record gave credibility to Saylor’s words. Investors, especially in the crypto market, came to see Strategy as a kind of anchor: a big, publicly traded entity that would always be a net Bitcoin buyer, never a seller.

What Changed: mNAV, Market Stress, and the First Talk of Selling

Michael Saylors Bitcoin The recent change in tone is tied to something most retail investors had never heard of before: mNAV, a metric that compares Strategy’s enterprise value to the net value of its Bitcoin holdings. Put simply, it is a ratio that asks whether the market values Strategy’s stock and debt above, equal to, or below the BTC it controls.Recent market turmoil has hammered both Bitcoin and Strategy’s share price. BTC slid sharply from record highs, and Strategy’s stock fell even more steeply, with some reports noting a drop of more than 40–50% from recent peaks.As that happened, the company’s mNAV started to edge dangerously close to 1. In fact, some analyses show that at points, Strategy’s market capitalization briefly fell below the net value of its Bitcoin holdings, meaning the stock traded at a discount to the BTC it owns.

Against this backdrop, CEO Phong Le publicly acknowledged a scenario in which the company would sell Bitcoin. He explained that if mNAV drops below 1 and remains there, and if access to capital markets becomes restricted, Strategy could be forced to liquidate some BTC to protect Michael Saylors Bitcoin the company’s financial stability and meet its obligations.For a firm built around a “never sell” philosophy, this was a pivotal moment. It did not mean an immediate sale, but it revealed a clear kill-switch condition in Michael Saylor’s Bitcoin strategy.

The Hidden Kill Switch In The Strategy

mNAV relates Strategy’s enterprise value (market capitalization plus net debt) to the mark-to-market value of its Bitcoin holdings. When mNAV is above 1, the market is effectively assigning additional value to Strategy beyond the BTC it owns. That extra value might reflect its software business, its brand as a Bitcoin leader, or the belief that the company Michael Saylors Bitcoin can continue to leverage Bitcoin price cycles to grow.

When mNAV hovers around 1 or slips below it, the market is signaling something very different. In that regime, investors are saying that the company as a whole may be worth no more than, or even less than, the BTC it holds, after accounting for debt. That is a warning sign about leverage, sustainability, and long-term risk.Recent reports suggest that mNAV is sitting precariously close to that threshold, and at times, Strategy’s market cap has indeed dipped below the net value of its BTC stash.

Phong Le has now tied a potential Bitcoin sale directly to this metric. If mNAV were to fall meaningfully below 1 and remain there while capital markets freeze up, the company would have fewer ways to roll over debt, raise new funding, or manage obligations. Under those conditions, he has described selling a portion of the BTC as a last-resort but rational decision.In other words, Michael Saylor’s strategy still aims to hold Bitcoin indefinitely, but the company now openly admits that balance sheet pressure can override ideology.

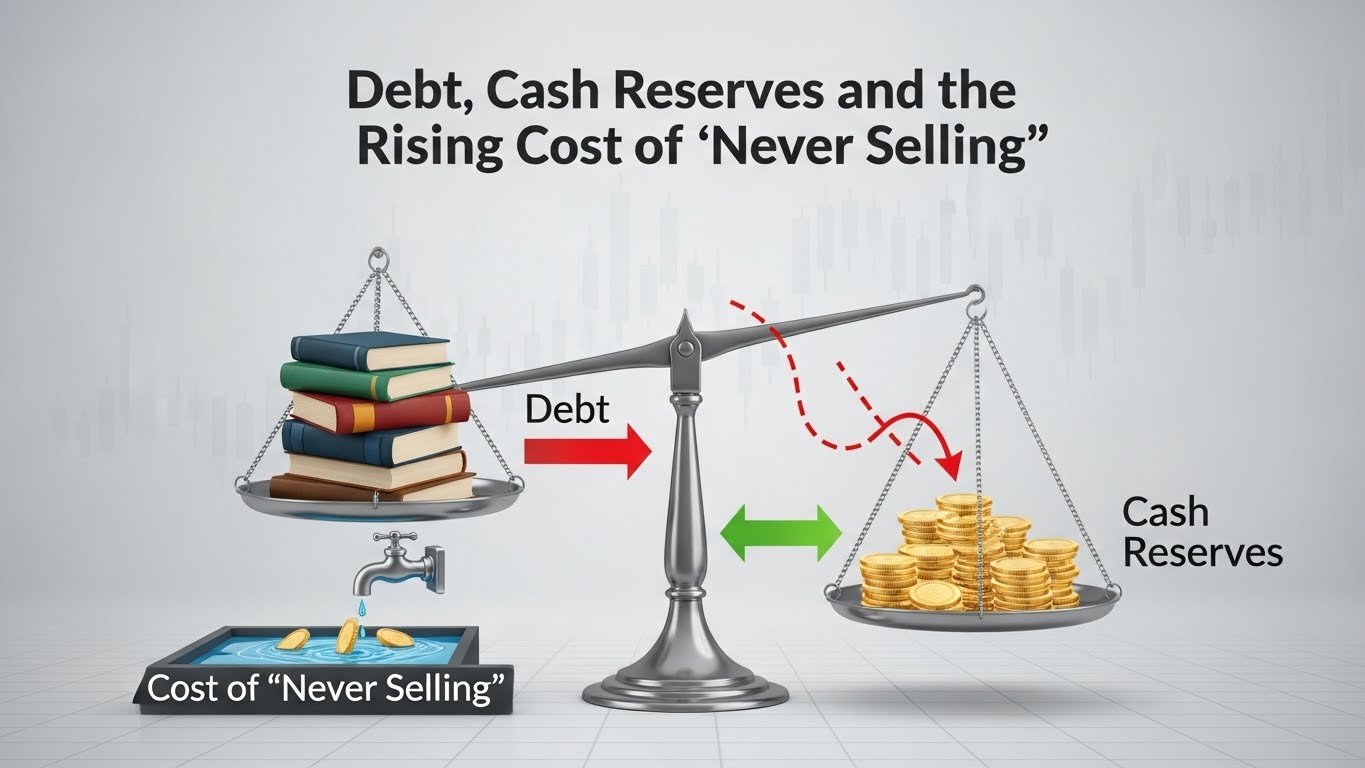

Debt, Cash Reserves, and the Rising Cost of “Never Selling”

Strategy’s Bitcoin bet has always been amplified by leverage. The company has issued billions of dollars’ worth of convertible notes, preferred stock, and other instruments to fund its Bitcoin accumulation strategy. This has created a growing burden of interest and dividend payments that must be serviced regardless of Bitcoin’s price.Analysts estimate that the firm currently faces annual interest and dividend obligations in the range of hundreds of millions of dollars, approaching roughly $700 million per year and expected to rise over time as more capital instruments stack up.

To avoid being forced into a Bitcoin sale every time the market dips, Strategy has taken an important step: it built a massive cash reserve. In late 2025, the company raised roughly $1.4–$1.44 billion, primarily by issuing new shares, and set that money aside as a liquidity wall to cover upcoming interest and dividends for an extended period.This move serves two purposes. First, it reassures investors worried that the company would be forced to sell BTC at the worst possible time. Second, it buys time for the strategy to survive a potential Bitcoin bear market or prolonged Bitcoin winter. However, it also dilutes existing shareholders and does not remove the underlying long-term risk. Debt maturities in 2027 and 2028 still loom, and if the stock remains depressed or Bitcoin underperforms the company’s assumptions, the pressure could return.The cost of maintaining a massive, leveraged Bitcoin treasury is high. The cash wall reduces the odds of an immediate fire sale, but it does not eliminate the possibility that, under extreme stress, Strategy might eventually have to sell BTC.

Has Strategy Sold Any Bitcoin Yet?

Despite the shifting tone, available evidence still indicates that Strategy has not sold any Bitcoin to date. On-chain analyses and media reports continue to highlight that the company has held every coin it has purchased since 2020, even during crashes that pushed Bitcoin below prior support levels.There have been moments when the company paused buying, as seen in some regulatory filings earlier in 2025, but pauses in accumulation are very different from liquidation.

This is an important nuance. The narrative has evolved from “we will never sell under any circumstances” to “we will never sell unless we are forced to by extreme financial conditions.” The behavior so far still matches the HODL narrative: Strategy continues to be a net Bitcoin buyer rather than a seller, even as it outlines the circumstances under which that might change.

Could a Strategy Bitcoin Sale Crash the Market?

If Strategy ever does sell, the impact on the Bitcoin market would be both practical and psychological. On a practical level, Bitcoin is a deep, global market with large daily trading volume, and Strategy would likely manage any sale carefully. It could use over-the-counter desks, algorithmic execution, and derivatives to unwind part of its position without instantly flooding exchanges. However, the scale of its holdings means that even a gradual sale would be closely watched and could add real selling pressure over time.

Psychologically, the effect could be even more intense. For many investors, Michael Saylor’s strategy has been a symbol of unshakable conviction. A material sale would signal that even one of the most vocal Bitcoin maxis has reached the limits of “never sell.” That could trigger a wave of fear and liquidations, especially among leveraged traders and holders who modeled their own Bitcoin HODL strategy on Saylor’s rhetoric.At the same time, history shows that Bitcoin’s long-term trajectory does not depend on a single holder. While a Strategy sale could cause short- to medium-term volatility, the network’s global adoption, expanding institutional interest, and broader digital asset narrative likely ensure that BTC’s fate will ultimately be decided by far more than one corporate treasury.

How Close Is Michael Saylor’s Strategy to Selling Bitcoin Really?

The central question remains: does all this mean a sale is imminent, or are we still talking about a distant worst-case scenario?Right now, the evidence suggests that Strategy is preparing for the possibility without actively moving to sell. The company has raised a large cash reserve precisely to avoid being forced into panic selling. It has made it clear that selling BTC would only be considered if mNAV dropped decisively below 1 and access to fresh capital dried up.

In other words, Michael Saylor’s strategy is still fundamentally bullish. It remains a heavily leveraged bet that Bitcoin will recover, set new highs, and make the company’s aggressive treasury play look visionary rather than reckless. The new disclosures are not proof that a sale is around the corner; instead, they are an admission that the firm cannot pretend balance sheet math does not exist.However, the margin for error is getting thinner. The company’s stock has fallen sharply, leveraged ETFs tied to it have suffered massive losses, and the market is increasingly focused on whether the premium that once surrounded Strategy’s Bitcoin accumulation strategy will return—or whether the company will be pushed into a more defensive posture.For now, the strategy is intact, but the emergency exit has been clearly marked.

What It Means for Bitcoin Holders and MSTR Investors

For Bitcoin holders, Strategy is both a symbol and a potential source of volatility. Its continued Bitcoin buying strategy has been a powerful endorsement of BTC as a store of value, and its willingness to endure deep drawdowns reinforces the long-term, digital gold narrative. At the same time, the sheer size of its Bitcoin treasury introduces a new kind of concentration risk: a single corporate decision could swing sentiment dramatically.For MSTR shareholders, the implications are even more direct. Owning Strategy stock is effectively owning a leveraged, equity-wrapped version of Bitcoin, layered with corporate, regulatory, and credit risk. The traditional business offers some cushion, but the stock’s behavior is dominated by BTC and by the market’s confidence in Michael Saylor’s strategy and its ability to manage debt through volatile cycles.In both cases, investors need to pay attention not only to Bitcoin price charts, but also to Strategy’s SEC filings, earnings calls, and updates about mNAV, capital access, and liquidity planning. Those details now form part of the fundamental picture for anyone exposed to Saylor’s Bitcoin-centered vision.

Conclusion: A High-Conviction Strategy With a Clearly Marked Exit

Michael Saylors Bitcoin spent years building a reputation on a simple, extreme idea: you do not sell your Bitcoin. Through Strategy, he scaled that idea into a massive, leveraged corporate Bitcoin strategy that reshaped both his company and the narrative around institutional BTC adoption.Today, the story is more complicated. The company remains the largest corporate Bitcoin buyer, still holding and occasionally adding to its immense stack. It has not sold any BTC yet. But rising debt costs, brutal volatility, and the hard math of mNAV have forced management to admit what many suspected in the background: there is a line beyond which even the most passionate Bitcoin HODL strategy must bow to financial reality.The company has tried to push that line far into the future by raising a huge cash reserve and clarifying that any Bitcoin sale would be a last resort. Whether that buffer is enough will depend on how deep and long any new Bitcoin winter becomes, and on whether capital markets remain open to a business whose fate is tied so tightly to a single volatile asset.For now, Michael Saylor’s strategy is still to buy and hold Bitcoin. But for the first time, the world knows exactly when—and why—that strategy could change.

FAQ:

Is Michael Saylor’s company actually planning to sell Bitcoin?

At the moment, Strategy has not announced any concrete plan to sell its Bitcoin. Public comments from CEO Phong Le frame selling BTC as a last-resort move tied to specific crisis conditions, such as mNAV falling below 1 and capital markets becoming inaccessible. The firm remains publicly committed to its long-term Bitcoin accumulation strategy, and recent actions show preparation and risk management rather than an immediate intent to liquidate.

Has Strategy ever sold any of its Bitcoin holdings?

Michael Saylors Bitcoin Available data and on-chain analysis still indicate that Strategy has never sold any Bitcoin since it began accumulating in 2020. Even during periods of extreme volatility and large unrealized losses, the company held every coin it acquired. That track record is a major part of Michael Saylors Bitcoin narrative, though new disclosures now acknowledge that sales are possible under severe stress.

What exactly is mNAV and why does it matter for Bitcoin holders?

mNAV compares Strategy’s enterprise value to the net value of its Bitcoin holdings. When mNAV is above 1, the market values the company more than the BTC it holds, reflecting optimism about its business and strategy. When mNAV drops near or below 1, it signals that the market sees limited value beyond the Bitcoin itself and is worried about leverage and liquidity risks. Since management has tied a potential BTC sale to mNAV falling below 1 in combination with funding stress, this metric has become a key indicator of whether Michael Saylor’s strategy might be forced to change.

Could a Strategy Bitcoin sale cause a major Bitcoin price crash?

A large BTC sale by Strategy would certainly be market-moving, especially in the short term. The company holds such a significant amount of Bitcoin that any liquidation would add meaningful selling pressure and could damage sentiment, particularly because Michael Saylors Bitcoin has been one of Bitcoin’s most vocal supporters. However, Bitcoin trades across a deep global market, and any sale would likely be structured carefully rather than dumped all at once. While a sale could trigger volatility and fear, Bitcoin’s long-term trajectory ultimately depends on its global adoption and wider demand, not just one corporate holder.

What should investors watch if they are exposed to Saylor’s Bitcoin strategy?

Investors in BTC and MSTR Michael Saylors Bitcoin should watch more than just Bitcoin price action. Key signals include Strategy’s quarterly filings, updates on its Bitcoin holdings, changes in mNAV, new debt or equity offerings, and any adjustments to its liquidity buffer or interest and dividend obligations. Michael Saylors Bitcoin Together, these factors reveal how much room the company still has to sustain its Bitcoin HODL strategy before a sale might become necessary.