Polygon Rises 13% After Developer Unveils New Stablecoin polygon has once again captured the attention of the global crypto community after a sharp market move that saw its native token surge by 13% in a short period. This rally did not happen in isolation. It was closely linked to a major announcement from the blockchain’s core development team, which unveiled a new stablecoin framework designed to reshape how value is issued, transferred, and settled across decentralized ecosystems. The news injected fresh optimism into the market at a time when investors have been cautiously watching for meaningful innovation rather than speculative hype.

Polygon has long positioned itself as a scalability-focused blockchain solution, aiming to make decentralized applications faster, cheaper, and more accessible. The unveiling of a stablecoin framework aligns with this broader vision, signaling that Polygon is not merely improving infrastructure but actively building financial primitives that can support the next wave of mass adoption. As Polygon rises 13% following the announcement, it highlights how closely innovation, developer credibility, and market confidence are intertwined in the crypto space.

We will explores why Polygon rose 13%, what the new stablecoin framework actually means, and how it could impact the broader blockchain ecosystem, decentralized finance, and institutional adoption. By examining the technical, economic, and strategic dimensions of this development, readers can gain a deeper understanding of why this moment matters and what it could mean for Polygon’s long-term trajectory.

Polygon and Its Role in the Blockchain Ecosystem

Polygon has evolved from a simple scaling solution into a comprehensive ecosystem that supports multiple blockchain networks. Initially known for addressing Ethereum’s congestion and high transaction fees, Polygon introduced a framework that allowed developers to build scalable and interoperable applications without sacrificing security. Over time, this vision expanded to include zero-knowledge technologies, app-specific chains, and enterprise-friendly solutions.

At its core, Polygon acts as a bridge between usability and decentralization. While Ethereum remains the backbone of decentralized finance, its limitations have pushed developers to explore alternatives that maintain compatibility while enhancing performance. Polygon’s success lies in its ability to complement Ethereum rather than compete with it directly. This synergy has attracted thousands of developers and applications across gaming, NFTs, DeFi, and Web3 infrastructure.

As Polygon rises 13% following the stablecoin framework announcement, it underscores the market’s recognition of Polygon’s growing role as a financial layer for decentralized applications. The blockchain is no longer viewed solely as a scaling tool but as a platform capable of supporting complex monetary systems.

The Market Reaction: Why Polygon Rose 13%

The immediate price reaction following the announcement reflects a broader trend in crypto markets where tangible innovation drives value. Polygon rises 13% not because of speculative rumors but because the stablecoin framework addresses real challenges facing the industry. Stablecoins are essential for liquidity, risk management, and user onboarding, yet they remain fragmented and often dependent on centralized issuers.

Investors interpreted the announcement as a sign that Polygon is positioning itself at the center of the next phase of crypto adoption. By enabling developers and institutions to issue compliant, interoperable, and programmable stablecoins, Polygon is expanding its utility beyond transactions and smart contracts. This shift has profound implications for capital flows, especially as regulatory clarity around stablecoins continues to evolve globally.

Market participants also responded positively to the credibility of Polygon’s development team. In an industry where promises often outpace delivery, Polygon’s track record of shipping scalable solutions gave weight to the announcement. The 13% rise reflects confidence that this framework is not theoretical but actionable.

The New Stablecoin Framework

The newly unveiled stablecoin framework is designed to provide a standardized, flexible foundation for issuing stablecoins on Polygon. Unlike traditional models that rely on a single issuer or rigid architecture, this framework allows multiple entities to create stablecoins tailored to specific use cases while maintaining interoperability across the network.

At a technical level, the framework emphasizes modularity. Developers can integrate compliance features, reserve management logic, and cross-chain functionality without reinventing the wheel. This approach reduces barriers to entry and encourages experimentation, which is crucial for fostering innovation in decentralized finance.

The framework also prioritizes transparency and security. By leveraging smart contracts and on-chain verification, it aims to reduce counterparty risk and enhance user trust. This is particularly important as stablecoins increasingly serve as the backbone of trading, lending, and payments within the crypto economy.

The Stablecoin Framework Aligns With Polygon’s Vision

Polygon’s long-term vision revolves around creating an internet of blockchains where value flows seamlessly. The stablecoin framework fits naturally into this narrative by addressing one of the most critical components of digital finance: price stability. Without reliable stablecoins, decentralized applications struggle to achieve mainstream usability.

By enabling customizable stablecoins, Polygon empowers developers to design solutions for diverse markets, from remittances and micropayments to institutional settlements. This flexibility aligns with Polygon’s goal of becoming a hub for Web3 infrastructure that supports both consumer-facing apps and enterprise-grade solutions.

As Polygon rises 13% on the back of this announcement, it reflects growing recognition that the network is moving beyond incremental improvements toward foundational innovation.

Decentralized Finance on Polygon

Decentralized finance relies heavily on stablecoins for liquidity and risk mitigation. Lending protocols, decentralized exchanges, and derivatives platforms all depend on stable assets to function efficiently. The new framework could significantly enhance DeFi on Polygon by increasing the diversity and reliability of stablecoins available.

With a standardized framework, developers can focus on building sophisticated financial products rather than worrying about stablecoin mechanics. This could lead to an explosion of new DeFi applications optimized for specific regions or regulatory environments. Over time, this diversity could attract more users and capital to the Polygon ecosystem.

The announcement also strengthens Polygon’s competitive position against other layer-two solutions. While many networks offer scalability, few provide a comprehensive approach to stablecoin issuance that balances decentralization, compliance, and usability.

Regulatory Considerations and Institutional Appeal

Stablecoins sit at the intersection of innovation and regulation. Governments and financial institutions are increasingly scrutinizing how stablecoins are issued and managed. Polygon’s framework acknowledges this reality by allowing issuers to embed compliance mechanisms directly into smart contracts.

This feature makes Polygon particularly attractive to institutional players who require transparency and regulatory alignment. Banks, fintech companies, and payment providers can experiment with blockchain-based stablecoins without exposing themselves to unnecessary risk. As institutions explore tokenized assets and on-chain settlements, Polygon’s infrastructure could serve as a trusted foundation.

The 13% rise in Polygon’s price suggests that investors see institutional adoption as a key driver of future growth. By addressing regulatory concerns proactively, Polygon positions itself as a bridge between traditional finance and the decentralized world.

The Broader Impact on the Blockchain Industry

The unveiling of Polygon’s stablecoin framework has implications that extend beyond its own ecosystem. It sets a precedent for how blockchains can approach stablecoin design in a more open and collaborative manner. Rather than competing for dominance, frameworks like this encourage interoperability and shared standards.

This shift could accelerate the maturation of the blockchain ecosystem as a whole. When stablecoins become easier to issue and integrate, developers can focus on user experience and real-world utility. This, in turn, brings blockchain technology closer to mainstream adoption.

As Polygon rises 13%, it sends a signal to the market that innovation focused on fundamentals can still drive meaningful value, even in a crowded and volatile industry.

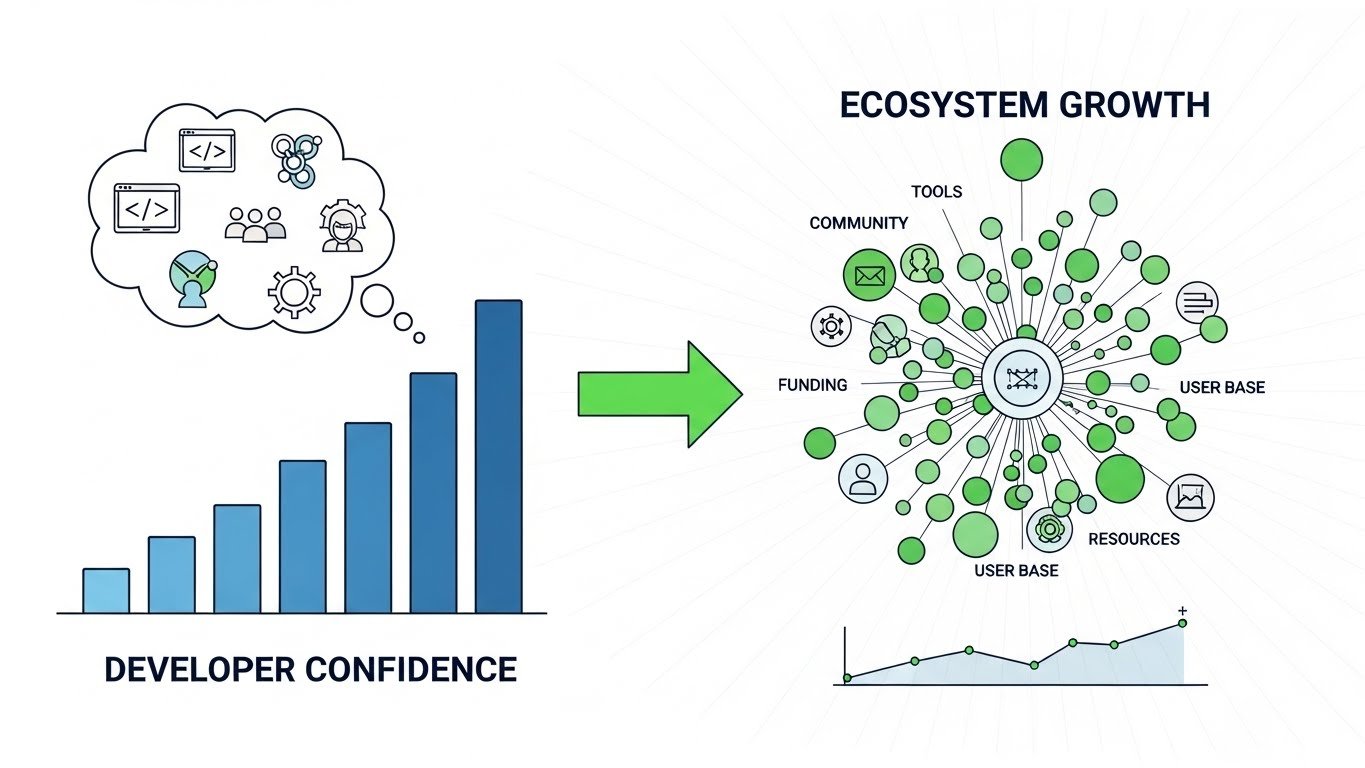

Developer Confidence and Ecosystem Growth

One of Polygon’s greatest strengths has always been its developer community. By providing tools, documentation, and incentives, Polygon has cultivated an environment where innovation thrives. The stablecoin framework further reinforces this culture by addressing a common pain point for developers.

When developers feel supported, ecosystems grow organically. New applications attract users, which in turn attract more developers. This virtuous cycle is essential for sustaining long-term growth in the crypto space. Polygon’s announcement demonstrates a deep understanding of this dynamic.

The positive market reaction reflects confidence that the framework will translate into tangible ecosystem growth rather than remaining a conceptual initiative.

Economic Implications of Expanded Stablecoin Usage

Stablecoins play a crucial role in bridging the gap between volatile cryptocurrencies and real-world economic activity. By facilitating predictable value transfer, they enable use cases such as payroll, remittances, and everyday payments. Polygon’s framework could significantly expand these applications by lowering costs and improving scalability.

As stablecoin usage increases, demand for the underlying network also grows. More transactions mean more activity, which can positively impact network economics. This creates a feedback loop where utility drives value, reinforcing Polygon’s market position.

The 13% rise in Polygon’s price can be seen as an early reflection of these anticipated economic benefits.

Challenges and Risks Ahead

Despite the optimism surrounding the announcement, challenges remain. Stablecoins are complex instruments that require careful management of reserves, governance, and security. Any vulnerabilities could undermine trust and adoption. Polygon’s success will depend on how effectively the framework is implemented and adopted by issuers.

Competition is another factor. Other blockchains are also developing stablecoin solutions, and the race to establish standards is far from over. Polygon must continue to innovate and collaborate to maintain its edge.

Nonetheless, the market’s response suggests that investors believe Polygon is well-equipped to navigate these challenges.

Long-Term Outlook for Polygon

Looking ahead, the stablecoin framework could serve as a cornerstone for Polygon’s evolution into a full-fledged financial infrastructure. As more applications and institutions build on the network, Polygon’s relevance in the global crypto economy is likely to grow.

The 13% price increase may be just the beginning if the framework delivers on its promise. Sustainable growth will depend on continued developer engagement, regulatory alignment, and real-world adoption. Polygon’s proactive approach positions it favorably in an industry that is increasingly focused on utility and trust.

Conclusion

Polygon rises 13% as blockchain’s developer unveils a new stablecoin framework, marking a pivotal moment in the network’s evolution. The announcement highlights Polygon’s commitment to addressing fundamental challenges in decentralized finance and digital payments. By providing a flexible, compliant, and scalable foundation for stablecoin issuance, Polygon strengthens its position as a leading blockchain platform.

The market’s positive reaction reflects confidence in Polygon’s vision and execution. While challenges remain, the stablecoin framework represents a meaningful step toward mainstream adoption and institutional integration. As the blockchain industry continues to mature, innovations like this will play a crucial role in shaping its future.

FAQs

Q: Why did Polygon rise 13% after the stablecoin framework announcement?

Polygon rose 13% because the new stablecoin framework signaled meaningful innovation that addresses real needs in the crypto ecosystem. Investors interpreted the announcement as a sign of long-term utility, institutional appeal, and stronger fundamentals rather than short-term speculation.

Q: How does Polygon’s stablecoin framework differ from existing stablecoin models?

The framework is modular and flexible, allowing multiple issuers to create customized stablecoins with built-in compliance and interoperability. This contrasts with traditional models that rely on centralized issuers and rigid structures, making Polygon’s approach more adaptable and scalable.

Q: What impact could this framework have on decentralized finance?

The framework could significantly enhance decentralized finance by increasing the availability and reliability of stablecoins on Polygon. This would support more efficient lending, trading, and payments while encouraging developers to build advanced financial products.

Q: Is Polygon’s stablecoin framework attractive to institutions?

Yes, the framework is designed with compliance and transparency in mind, making it appealing to institutions that require regulatory alignment. This could accelerate institutional adoption of blockchain-based stablecoins and financial services on Polygon.

Q: What does this mean for Polygon’s long-term growth?

In the long term, the stablecoin framework could position Polygon as a core financial infrastructure for Web3 and traditional finance integration. If widely adopted, it may drive sustained network activity, ecosystem growth, and continued market confidence.