Stablecoins to Hit $4tn? Three Forces Fueling the Next Boom the question of whether stablecoins can hit $4tn in market value is no longer a fringe speculation limited to crypto enthusiasts. It has become a serious discussion among policymakers, financial institutions, fintech innovators, and global investors. Stablecoins, once viewed simply as a utility for traders moving funds between exchanges, have evolved into a core pillar of the digital asset ecosystem. As adoption accelerates and infrastructure matures, many analysts now believe the stablecoin market could expand several fold over the coming years.

Today, stablecoins already process trillions of dollars in transaction volume annually, rivaling traditional payment networks. Their appeal lies in price stability, instant settlement, and global accessibility. In a world where cross-border payments remain slow and expensive, stablecoins offer a compelling alternative. The idea that stablecoins to hit $4tn may sound ambitious, but when viewed through the lens of structural financial change, it becomes increasingly plausible.

We explores the three major forces widely seen as fueling the next stablecoin boom. From regulatory clarity and institutional adoption to real-world payment use cases and emerging market demand, these drivers collectively explain why stablecoins are moving from the margins to the mainstream. By examining each force in detail, this analysis aims to provide a clear, balanced, and forward-looking perspective on the future of stablecoins.

Stablecoins to Hit $4tn Three Forces

Stablecoins are digital assets designed to maintain a stable value, typically pegged to fiat currencies such as the US dollar. Unlike volatile cryptocurrencies, stablecoins offer predictability, making them suitable for payments, savings, and settlement. Over time, they have become essential infrastructure within the crypto economy, serving as bridges between traditional finance and decentralized systems.

The stablecoin market has expanded rapidly due to its practical utility. Traders rely on stablecoins for liquidity, while decentralized finance platforms use them as building blocks for lending, borrowing, and yield generation. More recently, businesses and individuals have begun using stablecoins for remittances and everyday transactions. This expanding role explains why discussions about stablecoins to hit $4tn are gaining traction.

As adoption grows, stablecoins are no longer just tools for crypto-native users. They are increasingly viewed as digital cash for the internet age, capable of reshaping how money moves globally.

Force One: Regulatory Clarity Unlocking Confidence

Why Regulation Matters for Stablecoins

One of the most significant barriers to stablecoin growth has been regulatory uncertainty. Governments and financial authorities have long debated how stablecoins should be classified, supervised, and integrated into existing financial systems. This uncertainty has limited participation from large institutions and conservative investors.

However, momentum is building toward clearer regulatory frameworks. When stablecoins operate within defined legal boundaries, trust increases. Clear rules around reserves, audits, and consumer protection reduce systemic risk and encourage broader adoption. This is a key reason many analysts believe stablecoins to hit $4tn is achievable once regulation aligns with innovation.

Global Regulatory Developments

Across multiple regions, policymakers are working toward comprehensive stablecoin legislation. These efforts aim to balance innovation with financial stability. As rules become clearer, compliant stablecoin issuers gain legitimacy, while users gain confidence in the safety of their digital assets.

Regulatory clarity also opens the door for banks, payment providers, and corporations to integrate stablecoins into their operations. This institutional participation represents a massive potential inflow of capital and usage, significantly expanding the stablecoin market.

Force Two: Institutional and Enterprise Adoption

Stablecoins Enter Traditional Finance

Institutional adoption is perhaps the most powerful force driving the stablecoin boom. Major financial institutions are exploring stablecoins for settlement, liquidity management, and cross-border transfers. Unlike traditional systems that rely on multiple intermediaries, stablecoins enable near-instant settlement with reduced costs.

As institutions recognize these efficiencies, stablecoins are increasingly viewed as strategic tools rather than experimental technologies. This shift in perception is central to the idea of stablecoins to hit $4tn, as institutional use cases scale far beyond retail adoption.

Corporate Use Cases and Treasury Management

Corporations operating globally face challenges related to currency conversion, payment delays, and high fees. Stablecoins offer a solution by providing a unified digital medium for international transactions. Companies can move value across borders without relying on correspondent banking networks.

Additionally, stablecoins are emerging as treasury management tools. Firms can hold stablecoins as digital cash equivalents, enabling faster deployment of capital. As more enterprises adopt these practices, demand for stablecoins is likely to rise substantially.

Force Three: Payments, Remittances, and Emerging Markets

Reinventing Global Payments

Payments are at the heart of the stablecoin value proposition. Traditional payment systems often involve delays, high fees, and limited accessibility. Stablecoins address these issues by enabling peer-to-peer transfers that settle in minutes or seconds, regardless of geography.

This efficiency makes stablecoins particularly attractive for cross-border payments. Migrant workers sending remittances can bypass costly intermediaries, retaining more value for recipients. As this use case expands, transaction volumes grow, supporting the narrative of stablecoins to hit $4tn.

Adoption in Emerging Economies

Emerging markets represent a significant growth opportunity for stablecoins. In regions with volatile currencies or limited access to banking, stablecoins offer a reliable store of value and medium of exchange. Users can protect purchasing power while participating in global commerce.

Mobile technology further accelerates adoption. With smartphones and internet access, individuals can use stablecoins without traditional bank accounts. This financial inclusion aspect is a powerful driver of long-term growth, positioning stablecoins as tools for economic empowerment.

The Role of Technology and Infrastructure

Blockchain Scalability and Efficiency

The underlying technology supporting stablecoins has improved significantly. Faster blockchains, lower transaction costs, and better scalability make stablecoins more practical for everyday use. These advancements reduce friction and enhance user experience, encouraging adoption beyond niche markets.

As infrastructure continues to evolve, stablecoins become more competitive with traditional payment rails. This technological progress supports the idea that stablecoins to hit $4tn is not merely speculative but grounded in measurable improvements.

Interoperability and Ecosystem Growth

Interoperability between blockchains and financial systems further strengthens the stablecoin ecosystem. Users can move stablecoins across platforms, wallets, and applications seamlessly. This flexibility increases utility and reduces dependency on any single network.

A growing ecosystem of wallets, payment apps, and financial services amplifies network effects. As more participants join, the value of stablecoins increases, reinforcing adoption and market expansion.

Economic and Macroeconomic Factors

Inflation and Demand for Digital Dollars

Global inflation concerns have heightened interest in assets that preserve value. Stablecoins pegged to strong fiat currencies offer a digital alternative to holding physical cash or bank deposits. This trend is especially pronounced in regions experiencing economic instability.

As demand for digital dollars grows, stablecoins become vehicles for capital preservation. This macroeconomic backdrop adds another layer of support to projections that stablecoins to hit $4tn could materialize over time.

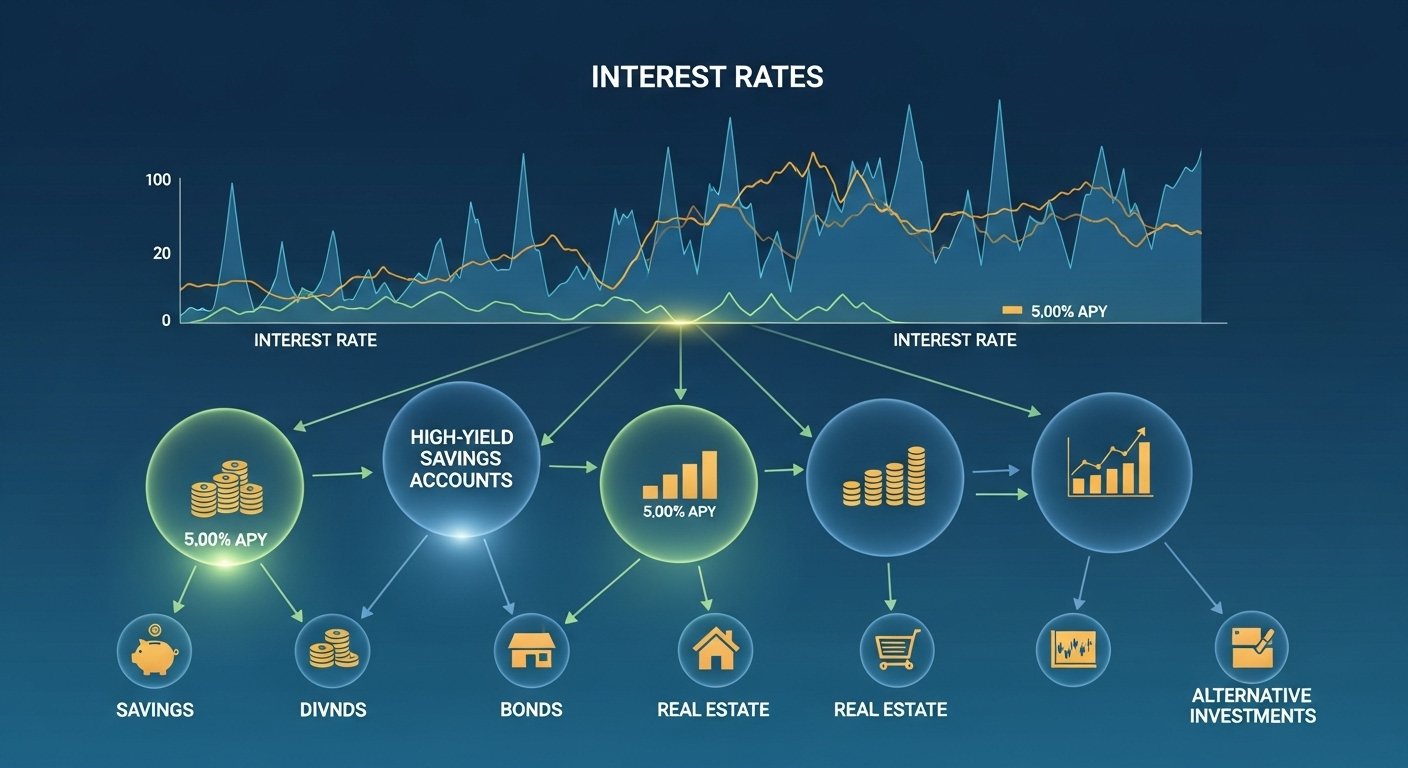

Interest Rates and Yield Opportunities

In certain environments, stablecoins can be integrated into yield-generating strategies. While maintaining price stability, users can earn returns through various financial mechanisms. This combination of stability and yield attracts both retail and institutional investors.

As financial products built around stablecoins mature, they contribute to deeper liquidity and higher market capitalization.

Risks and Challenges to the $4tn Vision

Despite strong tailwinds, challenges remain. Regulatory missteps, technological failures, or loss of confidence in reserves could undermine growth. Stablecoins must maintain transparency and reliability to sustain trust.

Competition is another factor. Multiple issuers vie for dominance, and only those meeting high standards of compliance and usability are likely to thrive. Addressing these risks is essential for stablecoins to reach their full potential.

Long-Term Outlook for Stablecoins

Looking ahead, stablecoins appear poised to play a central role in the future of finance. Their ability to bridge traditional systems with digital innovation positions them uniquely. As adoption spreads across sectors and regions, the stablecoin market could expand dramatically.

While the timeline may vary, the convergence of regulation, institutional adoption, and global payment demand supports the argument that stablecoins to hit $4tn is within the realm of possibility rather than hype.

Conclusion

The idea of stablecoins to hit $4tn reflects more than optimism; it reflects structural changes underway in global finance. Regulatory clarity is building confidence, institutions are integrating stablecoins into core operations, and real-world use cases in payments and emerging markets continue to expand. Together, these three forces create a powerful foundation for sustained growth.

Although challenges remain, the trajectory of stablecoins suggests they are becoming essential financial infrastructure. As trust, technology, and adoption align, stablecoins may well redefine how value moves in the digital economy, making the $4tn milestone a realistic long-term outcome rather than an outlier prediction.

FAQs

Q: Why do analysts believe stablecoins to hit $4tn is realistic?

Analysts point to regulatory progress, institutional adoption, and expanding payment use cases as structural drivers. These factors collectively support long-term growth beyond speculative cycles.

Q: How does regulation influence the future of stablecoins?

Clear regulation builds trust by ensuring transparency, proper reserves, and consumer protection. This clarity encourages institutions and enterprises to adopt stablecoins at scale.

Q: What role do emerging markets play in stablecoin growth?

Emerging markets drive adoption by using stablecoins as alternatives to unstable local currencies and limited banking systems, significantly increasing global demand.

Q: Are stablecoins only useful within the crypto ecosystem?

No, stablecoins are increasingly used for real-world payments, remittances, and corporate treasury management, extending their relevance beyond crypto trading.

Q: What risks could prevent stablecoins from reaching $4tn?

Key risks include regulatory setbacks, loss of confidence in reserves, technological vulnerabilities, and intense competition among issuers, all of which must be managed carefully.