Initially a fringe idea, Bitcoin has become somewhat well-known in the financial industry as a digital currency and asset. Bitcoin has created waves, with price swings, legal discussions, and growing institutional interest taking the stage.

Looking ahead to the next ten years, it is obvious that changes in technology, laws, and market dynamics will define the path this coin travels. In this paper, we investigate the possible direction of Bitcoin over the next ten years.

Bitcoin as Hedge

Bitcoin was considered a speculative asset, with traders looking for significant gains depending on its volatility. As Bitcoin developed, though, it started to be seen as a store of value—akin to gold in the conventional financial system. With its finite quantity, capped at 21 million coins, and distributed character, Bitcoin appeals to some as a substitute for fiat money, which central banks might devalue by mismanagement or inflation.

Bitcoin should confirm this position much more over the next ten years, which has been seen for ages. Given the continuous global economic uncertainty, Bitcoin Holdings might act as a hedge against inflation. In this sense, Bitcoin could become more firmly ingrained in the portfolios of those seeking strategies to diversify and safeguard their fortune from the volatility of conventional financial markets.

Bitcoin Institutional Adoption

Rising institutional acceptance of Bitcoin is a primary determinant of its future. Large-scale investors such as MicroStrategy, Tesla, and even publicly traded firms have included Bitcoin in their balance sheets in the last few years. Furthermore, financial companies such as Goldman Sachs and Fidelity have started offerings to let consumers be exposed to Bitcoin.

This trend should become more pronounced during the following ten years. More businesses and financial institutions that see Bitcoin as a fundamental economic asset rather than a speculative investment will probably keep including it in their offerings. This might involve starting their digital currencies, ETFs (exchange-traded funds), or even providing loans secured by Bitcoin.

Bitcoin’s Global Rise

As Bitcoin’s profile rises, so will its acceptance worldwide. Bitcoin presents a good substitute in areas experiencing restricted access to conventional banking systems, hyperinflation, or economic uncertainty. Adopting Bitcoin as legal cash, countries like El Salvador have already taken important action; during the next 10 years, additional countries could do the same.

Furthermore, as Bitcoin’s technology develops, it will become more user-friendly, resulting in greater acceptance. Bitcoin’s use as a medium of exchange will rise as more wallets and exchanges open themselves to individuals all around, particularly in underdeveloped countries with restricted access to conventional banking.

Bitcoin’s Future Challenges

The technological developments around Bitcoin will be significant in the future. One of Bitcoin’s primary difficulties right now is its scalability—that is, its capacity to manage a high transaction volume. Solutions like the Lightning Network, which allows cheaper and faster transactions off the main Bitcoin blockchain, could solve this problem and make Bitcoin more sensible for daily use.

Bitcoin’s energy use is still a source of controversy. The significant computational capacity needed to mine Bitcoin creates a huge carbon footprint. The environmental effects of Bitcoin mining will probably receive more attention as the globe shifts toward sustainability.

Bitcoin Price Forecasts

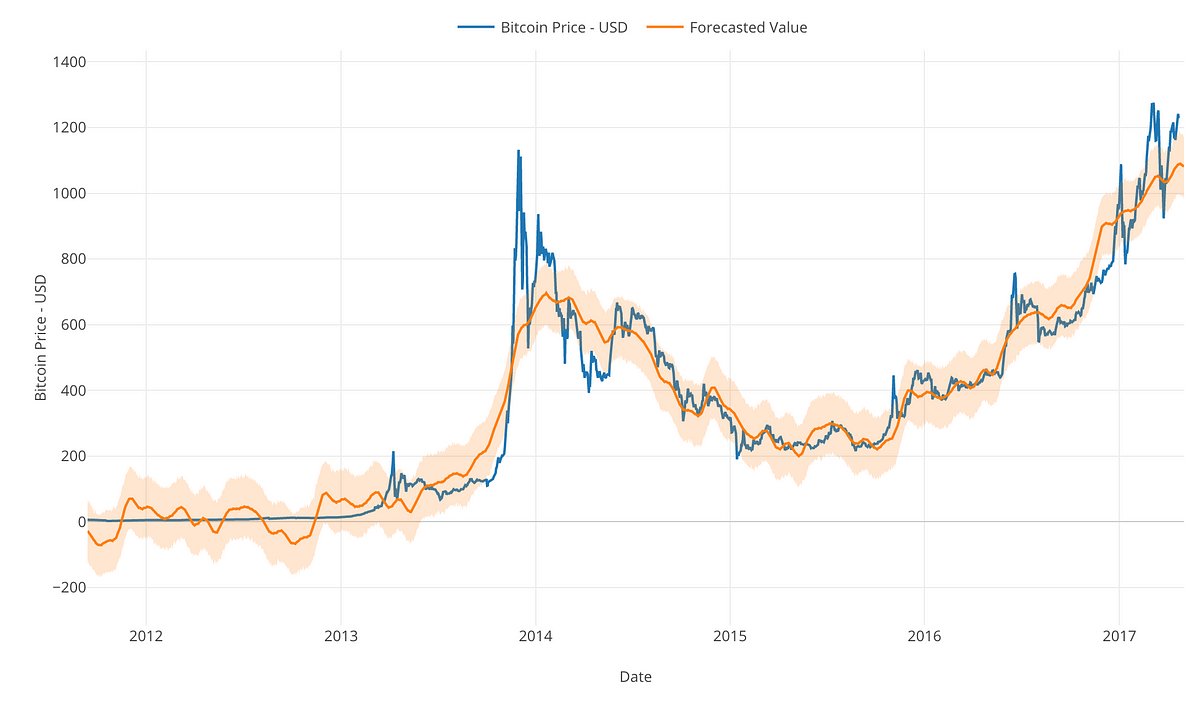

Due mainly to the speculative character of the bitcoin market, price forecasts over the next decade vary greatly. Although some analysts believe that Bitcoin’s value will keep rising and that it could reach values much over $100,000 or even $1 million, others warn that its erratic character could cause notable declines.

Price swings still exist, particularly in light of events surrounding Bitcoin halving—events that happen typically every four years. These occurrences slow down the generation of fresh bitcoins, therefore affecting supply. Price rises have historically accompanied halvings. Depending on the world’s economy, the next halving in 2028 could set off another price surge.

Final thoughts

Over the next ten years, bitcoin’s future presents both possibility and uncertainty. Its potential as a store of value and growing institutional interest might become a regular feature in world banking. Still, the continuous difficulties with market volatility, environmental issues, and control must be properly negotiated.

Bitcoin could keep rising as a transforming agent in finance if governments adopt a balanced approach to control and if technological developments keep enhancing scalability and sustainability. Whether Bitcoin can live up to its promise as the future of money will depend mainly on the next ten years.