The introduction of Bitcoin in 2009 by the anonymous Satoshi Nakamoto caused a seismic shift in the global financial system. It began as a minor, unrecognized digital currency but has now expanded into a worldwide financial asset that impacts economies worldwide. Many people are curious about Bitcoin’s future and how it will develop. Discover the most important developments, threats, and possibilities influencing the future of Bitcoin in this in-depth study.

Adoption and Mainstream Integration

Institutional Involvement

As an asset class, Bitcoin has attracted institutional investors in the last decade, moving it from the realm of computer enthusiasts. Big banks, including Fidelity, JP Morgan, and Goldman Sachs, are buying Bitcoin. Along with direct cryptocurrency investments, Bitcoin exchange-traded funds (ETFs) and custodial services are among the products institutions offer.

Institutional backing establishes Bitcoin’s credibility as a medium of exchange and keeps its price stable by attracting institutional investors. Incorporating Bitcoin futures and options on more conventional exchanges solidifies Bitcoin’s place as a leading global financial asset.

Nevertheless, there are pros and cons to the way Bitcoin interacts with traditional financial institutions. With institutional adoption, Bitcoin has become more visible and liquid but more tied to conventional financial markets. This might make it less effective as a hedge against the traditional banking system and more correlated with other asset types.

Corporate Adoption

The interest of corporations in Bitcoin has also increased dramatically. A change in perspective on cryptocurrency among companies was signaled in 2021 when Tesla bought $1.5 billion worth of Bitcoin, making headlines at the time. To protect itself against potential currency devaluations and inflation, MicroStrategy, headed by CEO Michael Saylor, has been steadily adding Bitcoin to its treasury portfolio.

The number of companies holding Bitcoin may increase in the future, particularly if worries about inflation and the stability of fiat currencies continue to rise. A wider range of merchants may start accepting Bitcoin as a payment option. Many businesses already accept Bitcoin, like Square and PayPal, and more may join soon.

Retail and Global Adoption

Consumers’ use of Bitcoin is rising, especially in nations experiencing currency or economic turmoil. Bitcoin has become a shelter and a store of value in countries like Venezuela and Argentina, where hyperinflation has ravaged the local economy.

El Salvador became the first government to recognize Bitcoin as legal cash in 2021, a significant step forward that may inspire other countries to consider doing the same. Although Bitcoin’s widespread acceptance as a medium of exchange remains in its infancy, millions of individuals worldwide may soon be able to buy Bitcoin through decentralized finance (DeFi) and mobile payment services.

Technological Advancements and Scalability Solutions

Lightning Network

Slow transaction delays and hefty fees under congestion have long raised concerns about Bitcoin’s scalability. To address this issue and facilitate quicker and cheaper transactions, the Lightning Network was developed as a second-layer solution built on the Bitcoin network.

The Lightning Network enables users to execute many transactions without overloading the Bitcoin network, enabling them to construct off-chain payment channels. The blockchain alone records channel openings and closings, increasing transaction speed and reducing costs significantly.

Bitcoin has the potential to become more mainstream and compete with established payment systems like Visa and Mastercard as Lightning Network use increases. In addition, it may open up new applications for Bitcoin, especially in industries like gaming, streaming services, and microtransactions, where users often make small payments.

Taproot and Schnorr Signatures

Taproot, an important upgrade to the Bitcoin protocol that was released in 2021, improves privacy, scalability, and the capabilities of smart contracts. It uses Schnorr signatures to reduce the amount of data recorded on the blockchain. These signatures allow many transactions to be consolidated into one single signature.

Although Bitcoin’s capabilities are still inferior to Ethereum’s, this improvement paves the way for more sophisticated smart contracts. With the growing popularity of decentralized apps (dApps), adding Taproot and Schnorr signatures is a crucial step in improving Bitcoin’s efficiency and adaptability.

Smart Contracts and Interoperability

While smart contracts were never Bitcoin’s primary goal, developments like Taproot have made even the most fundamental of them more practical. Other initiatives, such as Stacks and RSK, are working on layer-2 solutions and sidechains to add innovative contract capabilities to Bitcoin. These initiatives have the potential to transform Bitcoin into a decentralized application platform, putting it in competition with other blockchain ecosystems like Ethereum.

There is also an effort to make Bitcoin and other blockchains work together. Polkadot, Cosmos, and other bridge projects are working toward facilitating frictionless interaction between different blockchain networks. As a result, Bitcoin’s potential uses would be significantly increased by being able to communicate with decentralized finance (DeFi) systems and other decentralized protocols.

Regulatory Landscape and Governmental Involvement

Regulation A Double-Edged Sword

The Bitcoin regulatory environment is changing rapidly. Governments worldwide started to notice Bitcoin as it became popular after being mostly uncontrolled in the beginning. Various countries have taken different methods, with some completely banning it (like China) and others encouraging innovation (like the US and Europe).

The future of Bitcoin regulation can influence its price and level of acceptance. On the one hand, institutions and investors would benefit from explicit legislation as it would legitimize Bitcoin. In contrast, stringent rules limiting innovation and access can obstruct Bitcoin’s widespread acceptance.

Central Bank Digital Currencies (CBDCs)

One threat and one opportunity that Bitcoin faces is the proliferation of CBDCs. The European Union and China are among the nations working on CBDCs, digital representations of national currencies.

Although CBDCs may threaten Bitcoin in the daily transaction market, they can potentially bring digital currencies to a whole new audience of millions. In a roundabout way, Bitcoin may gain from this increased interest in decentralized alternatives brought about by a generalized understanding of digital money.

CBDCs are not the same as Bitcoin in any significant way. On the other hand, Bitcoin is decentralized and thus not subject to the authority of any government or other body. Given the growing concern for privacy and financial independence, Bitcoin’s decentralized character may entice those apprehensive about digital currencies controlled by states.

Taxation and Financial Oversight

The importance of taxes and financial control is expected to rise with the adoption of Bitcoin. Some governments are already mandated to report Bitcoin transactions for tax purposes. According to the Internal Revenue Service (IRS), Bitcoin is considered property in the United States, and every Bitcoin transaction isregarded asd a taxable event.

Stronger systems to tax Bitcoin and other cryptocurrencies could emerge in the future. One possible solution is to include tax reporting capabilities in exchanges and wallets automatically. This would alleviate a significant load for users. However, governments must find a middle ground between making people pay taxes and fostering innovation in the bitcoin industry.

Environmental Concerns and Sustainable Solutions

The Energy Debate

Concerns about Bitcoin’s effect on the environment rank high among its critics. Bitcoin mining uses a lot of power since it creates new currencies and verifies transactions. The proof-of-work (PoW) consensus mechanism of Bitcoin, which relies on miners solving complex mathematical puzzles, has its detractors who believe it cannot be maintained in the long run.

Consequently, Bitcoin miners are rushing to secure sustainable power sources. Renewable energy sources already provide enough electricity to fuel a sizable fraction of Bitcoin mining. Hydroelectric power in certain sections of China (before the 2021 ban) and geothermal power in Iceland are examples of plentiful and affordable renewable energy locations. This trend indicates the industry’s drive toward sustainability.

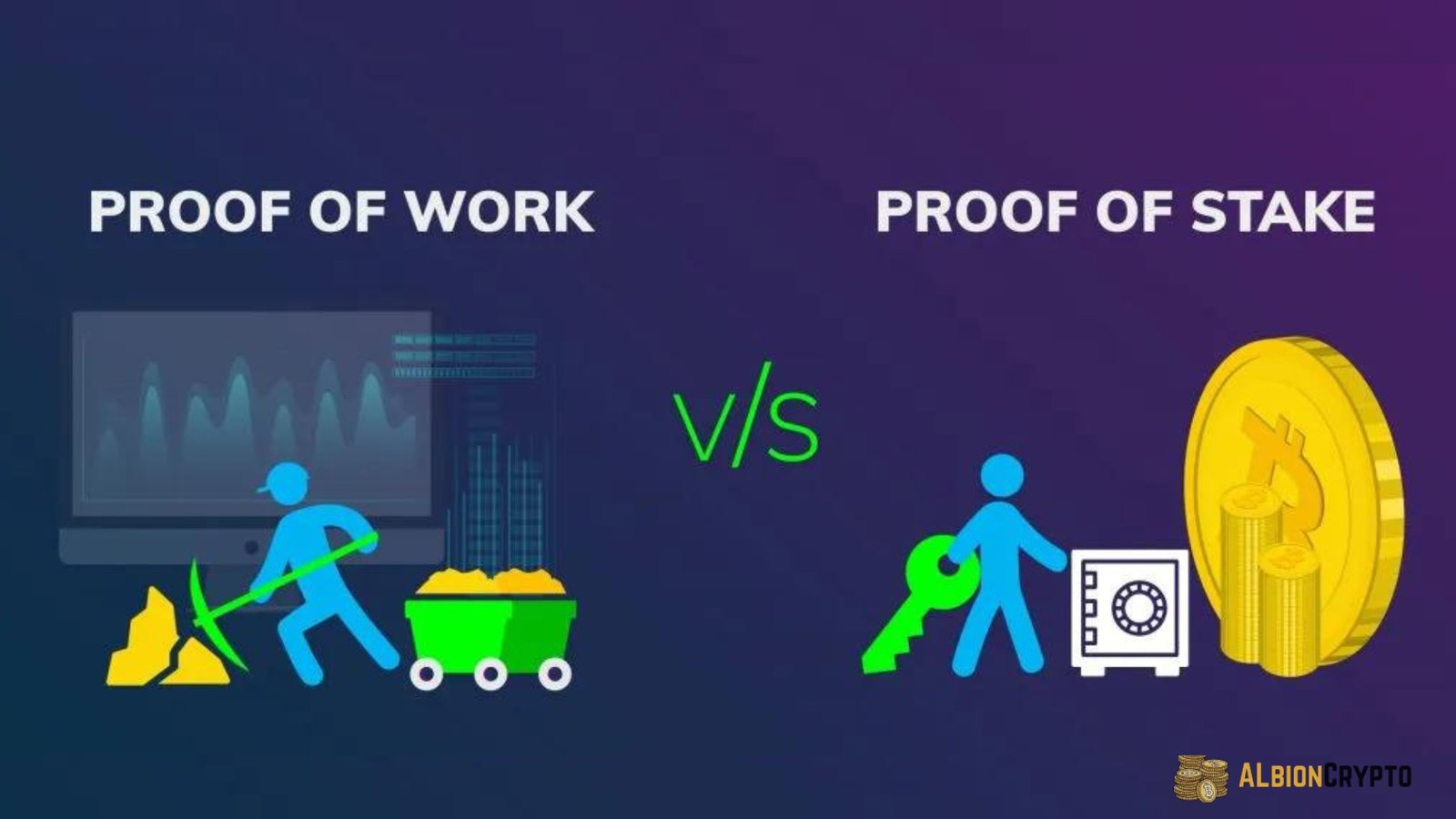

Proof of Stake vs. Proof of Work

The second-most valuable cryptocurrency, Ethereum, is switching to a more energy-efficient consensus method called proof-of-stake (PoS) from proof-of-work (PoW). As a result, many are demanding that Bitcoin undergo a comparable transformation. Still, not everyone in the Bitcoin world thinks this is the way to go.

The decentralized architecture of Bitcoin makes it challenging to execute such basic adjustments, even while proof-of-stake promises substantial energy savings. Those who support proof-of-work for Bitcoin say it is more secure and fits the cryptocurrency’s decentralized and anti-censorship principles.

Improving proof-of-work rather than modifying Bitcoin’s consensus process could reduce the cryptocurrency’s environmental impact. Current and future efforts are to put renewable energy’s surplus power or oil fields’ flare gas to good use.

Price Volatility and Market Maturity

Bitcoin as a Store of Value

Being a hedge against inflation and one of the most scarce commodities in the world, Bitcoin has earned the nickname “digital gold” due to its 21 million total supply. Concerns about inflation have intensified due to central banks’ increased printing of money worldwide to support their economies. Investors looking to protect their capital from currency depreciation may find Bitcoin appealing due to its fixed supply.

The price of Bitcoin may eventually level out as more people start to see it for what it is: a store of wealth, not a speculative asset. However, given the growing link between it and conventional financial assets, Bitcoin may not resist more significant market movements.

Market Volatility and Speculation

Bitcoin is still quite unpredictable, even though it’s becoming increasingly popular. Factors such as regulatory developments, macroeconomic news, and speculative trading may cause prices to fluctuate sharply. This high-risk environment may be ideal for confident investors but may discourage wider adoption, especially from risk-averse organizations.

As the Bitcoin market develops and more institutional investors pour in, the price may become less volatile. Increased liquidity, the introduction of more advanced financial instruments, and clarifying regulations might achieve a more stable pricing environment.

Bitcoin’s Role in a Decentralized Future

Decentralized Finance (DeFi)

One of the most fascinating trends in cryptocurrencies is the emergence of decentralized finance, or DeFi. Wrapped Bitcoin (WBTC) and related solutions bring Bitcoin into the DeFi ecosystem, even though most DeFi apps are built on Ethereum. Due to Bitcoin’s incorporation into DeFi protocols, new lending, borrowing, and yield production possibilities arise.

Given Bitcoin’s ongoing involvement in the DeFi domain, its potential uses might go beyond just storing currency. This could position it as an essential component of a decentralized financial system that eliminates the need for intermediaries and traditional institutions.

Bitcoin’s Role in the Global Economy

Given the current global economic climate, Bitcoin’s decentralized structure presents an intriguing possibility for addressing issues such as currency depreciation, financial inequity, and economic instability. Bitcoin offers an alternate way to store and transfer wealth in nations with limited banking institutions.

Developing nations, in particular, may find Bitcoin a powerful instrument for economic emancipation in the future. Thanks to its permissionless and borderless character, anybody with an internet connection may join the global economy, allowing billions of people to be financially independent.

Conclusion

Uncertainty and promise characterize Bitcoin’s future. Its function as an inflation hedge and store of wealth appears to be well-established, and developments in technology like Taproot and the Lightning Network may increase its worth even more. However, many obstacles must be overcome, including environmental worries, market volatility, and governmental scrutiny.

With more and more businesses and organizations starting to accept Bitcoin, it will undoubtedly play an increasingly important role in the international monetary system. Its decentralized and censorship-resistant nature guarantees it will remain essential to the changing digital banking scene, even if it might never totally replace conventional currencies. If Bitcoin is going to live up to its hype as “digital gold” or become something even better, the next ten years will be pivotal.