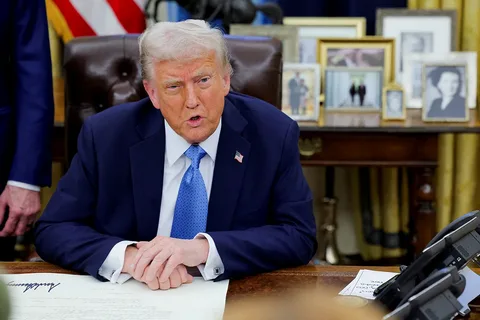

There has been much upheaval in the financial world recently, particularly in the bitcoin industry. Many factors contribute to this volatility, but one of the most notable is the effect of the Trump’s Tariffs and Crypto former President Trump levied on China on XRP and Dogecoin. This essay explores the implications of tariffs for the future of digital assets and how they decreased the value of these cryptocurrencies.

Trump’s Tariffs and Crypto Volatility

President Trump embarked on a tariff war with China in 2018 to lower the trade deficit and promote American manufacturing to lower the trade deficit and promote American manufacturing by targeting a broad variety of Chinese goods. A 25% tax on $50 billion worth of products was imposed, and additional levies on billions of dollars worth of items were added. Preventing foreign competition for American jobs and industry was the fundamental motive.

But the uncertainty and impact on investor sentiment caused by these tariffs have repercussioworld’sthroughout the world’s markets. Whenever there is a perception of economic policy volatility, especially concerning China’s and the United States’ economies, the financial markets tend to experience instability. Known for their vulnerability to market mood and global economic forces, cryptocurrencies were caught in this storm.

Trump’s Tariffs and Crypto Price Drop

Notable cryptocurrency prices fell simultaneously after Trump’s Tariffs and Crypto went into effect, including XRPLabs’Dogecoin. Ripple Labs’ XRP mostly relies on banks and other financial institutions for its cross-border payment capabilities. On the other hand, Dogecoin has grown from its meme roots into a widely used digital currency that has inspired many to donate to Goodbrand and enjoy the brand’s quirky humor.

Investor sentiment took a nosedive as reports of tariff increases surfaced. Due to the uncertainty surrounding international trade agreements, investors tend to be cautious when people sell their cryptocurrency holdings in a panic or move their money into safer assets; the value of the cryptocurrency drops.

XRP and Dogecoin Affected by Tariffs

The value of XRP is directly related to the stability of the international monetary system of the tariffs’ impact on the economy; many investors are re-evaluating their exposure to potentially volatile assets, such as cryptocurrency. The market price of XRP plummeted as a result, mirroring the general economic anxiety.

Like Bitcoin, Dogecoin has a dedicated user base but is nevertheless susceptible to market fluctuations caused by macroeconomic issues. Even a community drive couldn’t evade the larger economic pressures, as the dwindling crypto market capitalization caused bbbyhetariffsto loloweredheir values.

Tariffs Impact XRP and Dogecoin

The announcement of tariffs caused shockwaves in conventional markets and across the cryptocurrency industry. As a result, investors started to avoid riskier investments and put their money into more stable assets, such as gold and U.S. Treasury bonds. The withdrawal of investor interest substantially affected the valuations of XRP and Dogecoin because of their dependence on speculative investment for price support.

Community attitude and social media activity are another factor that significantly affects cryptocurrency pricing. Throughout this unstable period, debates about the future and associated consequences of trade policy shaped public opinion and investment patterns. Concern over the long-term effects of trade tensions on cryptocurrency stability became more apparent on online forums such as Reddit and Twitter as panic spread among individual investors.

Tariffs Fuel Crypto Volatility

Trends, community-driven excitement, and speculation fuel cryptocurrencies. For example, social media endorsements and viral contributed to Dogecoin’s skyrocketing rise. But speculative bubbles can pop quickly when things like tariffs make people nervous about the economy.

The scenario is already difficult for XRP due to trade war-related economic uncertainty, continuing regulatory scrutiny, and legal disputes. In a perfect storm of government meddling, trade barriers, and market psychology, cryptocurrency prices have the potential to plummet in an instant.

Crypto Investors Watch Trade Policies

Crypto investors should always keep the effects of trade policies in mind, especially as the economy is always changing. Understanding macroeconomic issues is crucial when investing in digital assets, as learned fromrlearnedncomplementedtthose ed under Trump’s administration.

Although the tariffs hit XRP and Dogecoin hards, the ripple effects showed where the cryptocurrency sector was vulnerable. Investors need to keep a close eye on the market and how global political and economic policies affect it, assets to the atmosphere.

Final Thought

Finally, Trump’s Tariffs and Crypto on Chinese imports were a sobering reminder of how interdependent global economies and digital currencies are, rather than just affecting conventional markets. The trajectory of digital currencies such as Dogecoin and XRP is closely tied to global issues such as escalating trade tensions and shifting regulations. Investors need to be educated about the broader economic backdrop supporting their investments and be prepared for continued volatility in the sector.

[sp_easyaccordion id=”4621″]