The cryptocurrency market is experiencing a surge of optimism as the BTCUSD Santa Rally phenomenon captures the attention of traders and investors worldwide. December 26 has historically been a pivotal day for digital assets, and this year appears no different as Bitcoin maintains its position above critical support levels while altcoins begin showing signs of awakening. The traditional Santa rally concept, borrowed from equity markets, has found a new home in the crypto space, where holiday-season trading patterns create unique opportunities for savvy market participants. As institutional money flows into Bitcoin and retail traders eye alternative cryptocurrencies, the stage is set for what could be one of the most memorable year-end rallies in recent memory.

Understanding the dynamics behind the BTCUSD Santa Rally requires examining both technical indicators and broader market sentiment. Bitcoin’s resilience throughout December has provided the foundation for what many analysts believe could be an extended bullish phase that carries into the new year. With reduced trading volumes typical of the holiday season creating lower liquidity conditions, even modest buying pressure can result in significant price movements across the cryptocurrency spectrum.

The BTCUSD Santa Rally Phenomenon

The Santa rally in cryptocurrency markets refers to the tendency for digital assets to experience upward price momentum during the final weeks of December and early January. This pattern mirrors similar behavior observed in traditional stock markets but carries unique characteristics specific to the 24/7 nature of cryptocurrency trading. Unlike equity markets that close for holidays, Bitcoin trading continues uninterrupted, creating distinct opportunities and risks during holiday periods.

This December, the crypto Santa rally appears particularly robust as Bitcoin holds steady despite broader macroeconomic uncertainties. The cryptocurrency has maintained support above key psychological levels, building a foundation that historically precedes breakout movements. Technical analysts point to improving chart patterns and momentum indicators that suggest the current consolidation phase may be reaching its conclusion.

Bitcoin Price Action Drives Market Sentiment

Bitcoin price performance serves as the primary catalyst for broader cryptocurrency market movements, and the current BTCUSD dynamics exemplify this relationship perfectly. As the dominant cryptocurrency by market capitalization, Bitcoin’s ability to hold critical support levels provides confidence to traders considering positions in alternative digital assets. The current price action suggests accumulation by long-term holders, a pattern that often precedes sustained upward trends.

Institutional participation continues expanding, with regulated investment vehicles seeing steady inflows throughout December. This institutional adoption provides a stabilizing force that previous Santa rallies lacked, potentially making the current move more sustainable than purely retail-driven pumps of earlier years. Exchange-traded products tracking Bitcoin performance have attracted billions in new capital, demonstrating that cryptocurrency investment has firmly entered mainstream financial portfolios.

Altcoins Awakening as Bitcoin Stabilizes

The relationship between Bitcoin dominance and altcoin performance represents one of the most important dynamics in cryptocurrency markets. When Bitcoin stabilizes after a significant move, capital often rotates into alternative cryptocurrencies seeking higher-risk, higher-reward opportunities. The current market phase appears to be entering precisely this rotation period, with numerous altcoins showing early signs of relative strength against Bitcoin.

Leading altcoins across various sectors have begun outperforming BTCUSD on a percentage basis, signaling the potential beginning of a broader altcoin rally. Decentralized finance tokens, layer-one blockchain projects, and gaming-focused cryptocurrencies all show improving relative strength. This sector rotation suggests that the crypto market is entering a risk-on phase where speculative appetite increases and investors seek diversification beyond Bitcoin.

Technical Analysis of Current BTCUSD Patterns

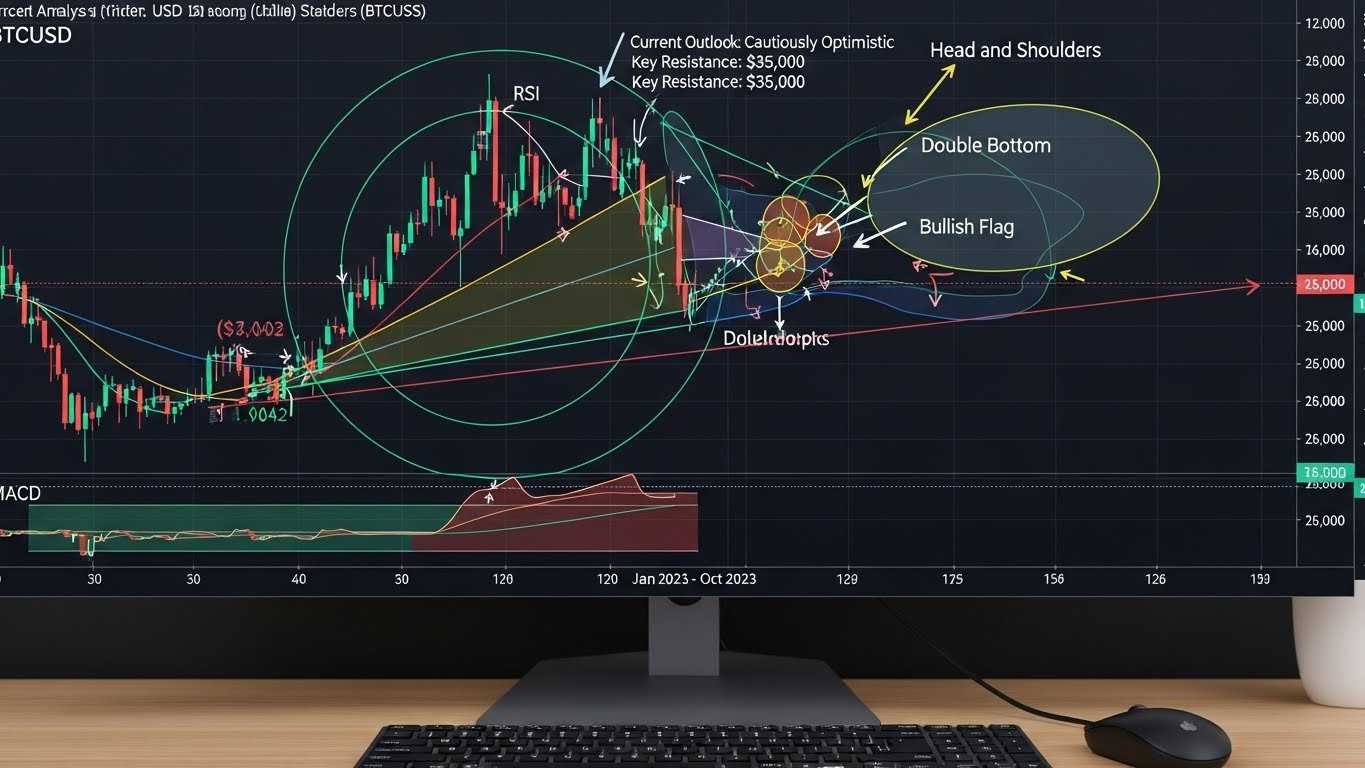

Examining Bitcoin technical analysis reveals multiple confluent factors supporting the bullish case for continued upside. The daily chart displays a series of higher lows forming over the past several weeks, indicating that buyers are becoming more aggressive at progressively higher price levels. This accumulation pattern typically precedes breakout movements, particularly when combined with contracting volatility and tightening Bollinger Bands.

On-chain metrics complement the technical picture, with wallet distribution data showing continued accumulation by both retail and institutional addresses. Exchange reserves have declined throughout December, indicating that holders are moving Bitcoin into cold storage rather than preparing to sell. This removal of supply from readily available exchange inventories creates conditions favorable for upward price pressure when demand increases.

Global Macroeconomic Factors Supporting Crypto

The cryptocurrency market operates within the broader context of global financial conditions, and current macroeconomic trends provide a supportive backdrop for digital asset appreciation. Central bank policies, inflation expectations, and currency devaluation concerns all factor into investment decisions regarding Bitcoin and alternative cryptocurrencies. The late-year positioning by institutional investors often reflects expectations for the year ahead, making December price action particularly meaningful.

Currency weakness in several major economies has renewed interest in Bitcoin as a store of value alternative. The narrative positioning Bitcoin as digital gold gains credibility during periods of fiat currency uncertainty, attracting capital from investors seeking inflation hedges and portfolio diversification. This fundamental demand source provides underlying support that complements technical and sentiment-driven price movements.

Altcoin Opportunities During the Santa Rally Period

Identifying promising altcoin investments during the Santa rally requires analyzing both fundamental project qualities and technical positioning. The most successful altcoin trades typically combine strong underlying technology or utility with favorable chart patterns and improving relative strength against Bitcoin. December often presents attractive entry points as year-end tax considerations create temporary selling pressure that dissipates in early January.

Decentralized finance protocols represent another category attracting attention during the current altcoin momentum phase. These projects enable financial services without traditional intermediaries, offering lending, borrowing, trading, and yield generation opportunities. As total value locked in DeFi protocols continues growing, the tokens governing these protocols benefit from increased usage and network effects.

Risk Management in Volatile Holiday Markets

While the BTCUSD Santa Rally creates exciting opportunities, prudent risk management remains essential given cryptocurrency market volatility. Holiday trading periods feature reduced liquidity that can amplify price swings in both directions. Stop-loss orders and position sizing become even more critical during these periods, as unexpected moves can occur with less warning than during normal trading conditions.

Diversification across multiple cryptocurrencies can help mitigate individual project risks while maintaining exposure to the broader crypto bull run thesis. Rather than concentrating capital in a single altcoin bet, spreading investments across several quality projects with different risk profiles often produces more consistent results. This approach allows participation in the Santa rally upside while limiting downside from any single project disappointment.

Institutional Investment Trends Shaping the Market

The BTCUSD Santa Rally maturation of cryptocurrency markets has brought significant institutional participation that fundamentally alters market dynamics compared to earlier cycles. Major financial institutions now offer Bitcoin exposure through various investment vehicles, from spot exchange-traded funds to futures contracts and custody solutions. This institutional infrastructure provides legitimacy and stability that previous Santa rallies lacked.

BTCUSD Santa Rally Regulatory clarity continues improving in major jurisdictions, removing uncertainty that previously hindered institutional adoption. As regulatory frameworks become more defined, compliance-focused institutions feel increasingly comfortable allocating capital to cryptocurrency markets. This ongoing professionalization represents a multi-year trend that should support sustained growth beyond any single Santa rally period.

Trading Strategies for the Current Market Phase

Successful navigation of the BTCUSD Santa Rally requires adapting strategies to current market conditions and personal risk tolerance. Swing trading approaches that capture multi-day trends work particularly well during trending holiday markets when momentum can persist longer than during normal conditions. Identifying strong support and resistance levels provides entry and exit points for these intermediate-term trades.

Dollar-cost averaging strategies offer a lower-stress approach for investors focused on long-term accumulation rather than short-term trading. By making regular purchases regardless of short-term price action, this method removes the pressure of timing entries perfectly while building positions during consolidation phases. The crypto Santa rally often rewards patient accumulators who maintain conviction through volatility.

Future Outlook for Bitcoin and Cryptocurrency Markets

Looking beyond the immediate BTCUSD Santa Rally period, the fundamental case for BTCUSD Santa Rally and select altcoins remains compelling based on multiple long-term trends. The ongoing digitalization of finance, growing distrust of centralized institutions, and search for inflation-resistant assets all support continued crypto adoption. While short-term volatility will inevitably continue, the multi-year trajectory appears increasingly positive.

The integration of blockchain technology into traditional finance represents perhaps the most significant long-term trend supporting Bitcoin and cryptocurrency valuations. BTCUSD Santa Rally Major banks now explore blockchain settlement systems, stablecoin infrastructure, and tokenized securities. This convergence of traditional and decentralized finance validates the underlying technology while creating new use cases and demand sources for digital assets.

Conclusion

The BTCUSD Santa Rally represents more than just a seasonal trading pattern; it reflects the growing maturation and mainstream acceptance of cryptocurrency markets. As Bitcoin holds critical support levels and altcoins begin showing relative strength, the setup for a meaningful year-end rally appears increasingly credible. Investors who understand both the technical patterns and fundamental drivers positioning the market can identify opportunities while managing risks appropriately.Whether you’re a seasoned cryptocurrency trader or someone exploring digital assets for the first time, the current market phase offers multiple entry points across the risk spectrum. From Bitcoin’s relative stability to altcoin speculation, strategies exist for various investment approaches and time horizons. The key lies in understanding your own risk tolerance, conducting thorough research, and maintaining discipline through the inevitable volatility that characterizes crypto markets.

As we close out the year and look toward new opportunities in the coming months, the Bitcoin Santa rally serves as a reminder that cryptocurrency markets operate with patterns and rhythms worth understanding. Take time to analyze the current BTCUSD dynamics, identify promising altcoin opportunities, and position your portfolio to capture potential upside while protecting against downside risks. The convergence of technical, fundamental, and seasonal factors makes this an particularly interesting moment in cryptocurrency market history.Ready to participate in the crypto Santa rally? Begin by securing your accounts with proper security measures, conducting thorough research on projects that interest you, and starting with position sizes appropriate to your financial situation. The cryptocurrency market rewards preparation, patience, and continuous learning as much as it does timely execution.